Hi All,

I trust you are all well.

I have created a few topics on this forum (London Breakout 1H Strategy & What Timeframe Do You Trade) and a few people have asked for my daily trading routine/system, so I finally today have had the time to sit down and write it all out.

Now, this is probably going to be lengthy, so I do apologize for that, but I’d like to cover as much as I can and if you have any questions, feel free to shoot me a message or comment below and I’ll be more than happy to help where I can.

The Timeframe

Before I go into the strategy, let me put it out there that I trade the daily chart exclusively. I don’t even look at the 4H timeframe or anything lower than that. Sometimes I do it for the fun of it, but not for my serious trading. I have already written a length topic on this so please feel free to search that one up, but to recap, here are few main points as to why I do this:

- More often than not, price actions are correct and market structures are respected compared to other lower timeframes (the lower you go, the more noise there will be)

- You don’t have to spend hours on end in front of the computer each day waiting and waiting and waiting for trades opportunities just to lose or miss it which leads to frustration

- You only need to check the charts daily before the daily candle closes (about 20-30 minutes before), maintain your existing trade and/or enter new trades and go about your day

- Teaches you patience (very important in trading)

- News no longer affect your trades as much

- Bigger profits potential (bo looking at the bigger picture)

- Less stress = clearer mind = better trading decision

- More freedom to do whatever I want

The Strategy

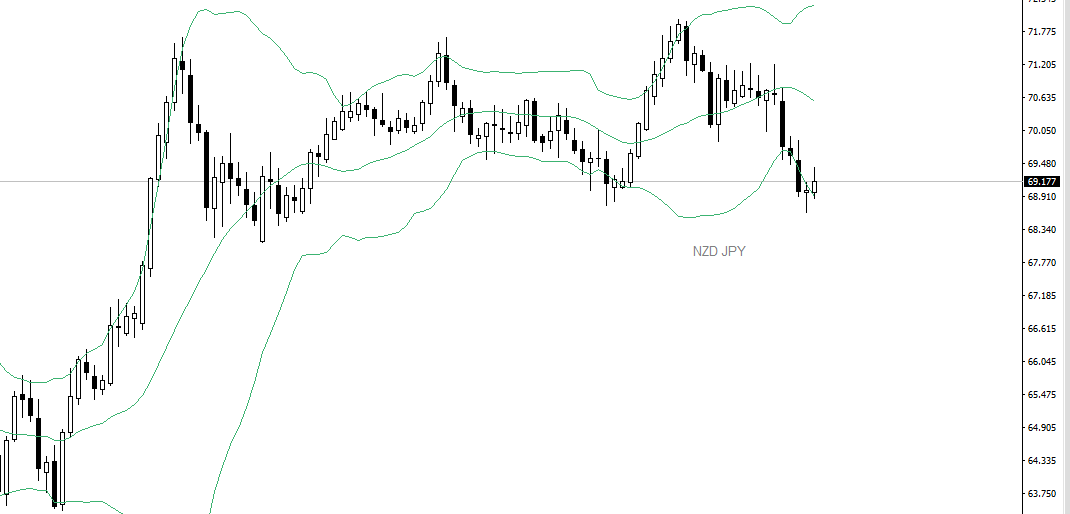

It’s very simple, the way I trade is I look for market structures, price action in combination with the only indicator that I use which are the bollinger bands. These are more than enough to give me powerful signals that will give me a very good idea of where the market will be going the following day. Check out the image below and see for yourself.

You may wonder, if I trade the daily chart, does that mean I am swing trading or position trading and that my trades can last for days, weeks, or months? Yes, when I see the opportunity to do so but not necessarily all the time, in fact, 70-80% of the time, I am still a day trader.

For every trade that I open, I open 2 positions, 1 for 80% of the full lot size and the other for 20%. The 80% position is my 1:1 RR and the 20% position I call it a “runner” - meaning I will maintain and let it run for as long as the trend can go for maximum profits. I move the SL of my “runner” to breakeven once I have achieved my 1:1 RR with the 80% position.

It would also be helpful for you to learn the basics of the following first:

- Candlesticks (anatomy, various patterns such as double top/bottom and especially focus on signs of reversal, continuation, and consolidation)

- Bollinger bands (how to trade trend, reversal, and squeeze with it)

- Market structures (how to identify key levels)

You want proof that even though I trade the daily timeframe, my trades only last for within 24-48 hours? Here:

Trade 1 - Price broke out of the top of the bollinger band and showing signs of weakness (long upper wick). The next candle is a strong bearish engulfing candle. I entered short and got my 1:1 RR day after next.

Trade 2 - Price went up and tested the top of the bollinger band again. When it does, the market shows indecision. When the bearish engulfing candle show itself again, I entered short the next day and got my 1:1 RR the following day.

Trade 3 - Price tested and broke out of the lower bollinger band and a bullish engulfing candle appeared. I entered long the next day and got my 1:1 RR the same day.

Trade 4 - After the price has broken through the middle of the bollinger band, it came back down to retest it and failed to go further down. Once I have confirmation of the continuation up (after 2 continuous strong bullish candles with lower wicks rejecting the bears), I entered long and got my 1:1 RR the next day.

Now for the above trades, I did not talk about my “runners” as these are quite subjective and it’s up to the trader him/herself to decide how to move the SL up to secure profits on the go. But the point is, and you can also tell based on the photo for this one currency pair during the period, all the trades I took can certainly come out with profits with minimal to almost no loss.

Currency Pairs

As I trade the daily chart, I cannot just watch one single currency pair as otherwise, I’d have to wait for a long time for a trade opportunity. I trade 23 currency pairs and gold. If you’d like to know what they are, shoot me a message. Listing it here would make it too long.

If anyone tells you that you should only focus on certain pairs only, I call that b*llshit. Yes, certain currency pairs move differently compare to others however, price action and market structures don’t change, they are exactly the same on any currency pairs.

It could be true, that you should only focus on certain currency pairs only, but that’s if you trade the much lower timeframe. But if you let it sink it, this is just circumstantial, you trade the lower timeframe, you don’t have the attention span to use it across different pairs. I trade the daily timeframe, I have plenty of time and more pairs = more trading opportunities.

Disclaimer’

There is no holy grail of trading strategies out there. I am a firm believer that the best strategy is one that you find suits you the most both in your trading style as well as your lifestyle.

If you like the strategy that I have presented here, please feel free to backtest it, anyone can do it, you just need to learn the basics, add the bollinger bands indicator on to your chart, scroll back in time, and check it out. Don’t put your real hard-earned money on the line until you are 100% sure and are confident you can come out profitable. Feel free to add other indicators if you want and twitch the strategy as you please.

I did not make this strategy and I am not laying claim to it. I learned to trade on price action and I found tutorials on bollinger bands and I decided to put them together. I am sure there are many others out there who already are doing the same.

There are many different ways you can trade this to come out profitable. If you come through any situations where you are unsure, feel free to ask me and I’d be more than happy to provide my insight/opinion.