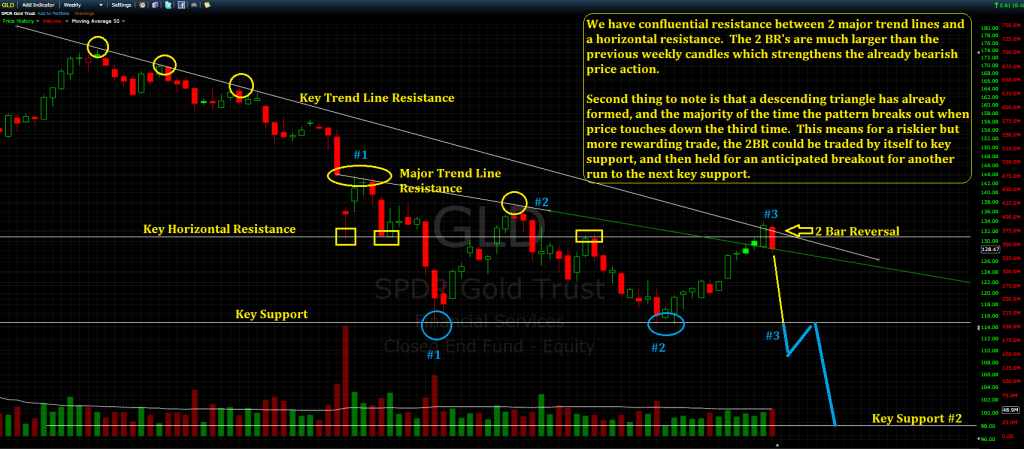

Just play it as you see it guys, by speculation I mean this, say you think gold has to hit 1000, well then that gives you a bias meaning you want to keep shorting it, even though the trend may be up. I am waiting for a clear direction this week, I will be looking to sell based on the weekly, but looking to try and get an entry on H4 for a nice tight stop so I can get a big position loaded up.

I bought this setup on the H4 and have closed out in profit for the weekend. Waiting to see what shows on Monday, could continue up a little more before finding trouble.

We will soon find out. I trade the charts, but as santions are being imposed on crimea and the situation could escalate giving GOLD some upthrust… We will see

Thanks krungman, but any chance to upload a full resolution image some where else please? I can’t read.

Ok, that is WAY better. From now on I will upload to photobucket and then embed the image. If you want to see it in higher res, just click on it.

Hi folks

A question just crossed my mind, as follows:

We know the price quoted & displayed for a fx pair is always the [B]bid price[/B], let’s call it “[B]B[/B]”. Associated with it is the [B]ask price[/B], let’s call it “[B]A[/B]”, which is always higher than B. The difference between A & B is the spread, which may or may not vary according to the time of the day depending on the broker we use.

I further understand that we always [B]sell at B[/B] & [B]buy at A[/B].

My question is: when we place a [B]buy stop[/B] order at price [B]P[/B] when is the order triggered & done? When [B]B=P[/B] or when [B]A=P[/B]?

Similarly for [B]buy limit[/B] order at [B]P[/B], when is it triggered & done? When [B]B=P[/B] or when [B]A=P[/B]?

Henry

This is another way Gold could play out, anything could happen, it’s the market! Play what you see on your chart, don’t speculate.

On further thought I think I found the answer to my question. Buy stop or buy limit order is triggered & done when A=P. That is how brokers hunt stops by momentarily widening the spread. Any disagreement?

Bets on which side it will break?

EURJPY H4

Right click image, copy image location and paste into URL bar to see larger image…

Good catch on the H&S. I did want to point out a few things though, one is that to identify the location of the right shoulder you should always use the angle from the neckline(armpit to armpit), you never just use an arbitrary horizontal line. The second thing to note is that when your neckline is angled upwards the pattern has a higher chance of failure. There are other H&S subtleties that you consider when identifying a a H&S pattern that I won’t get into right now. This again is one of the reasons I prefer to keep H&S patterns out of this thread, at least until I can write up a full article explaining proper pattern rules and things to look for regarding pattern quality.

You pointed out a something else though that I want to comment on, that is patterns inside of other patterns. When this happens I will either just simply trade from support to support, using only candlestick price action patterns, or I will always prefer the pattern that is more completed and is in direction of previous momentum. In this case the medium term trend is neutral with the long term trend being down. So not much to go off of there, but we do have enough peaks and valleys for a complete descending triangle, with the next step just being a break where as the H&S at this point is speculative.

Obviously the H&S could form and play out, but I want to lean towards patterns that are completed with confluent indications vs. patterns that have not yet been completed. If price does find support at the potential shoulder area or even false breaks through, then it would be time to give it considering to move to BE or take partial profits.

Doesn’t look like much of an edge either way. You have a nice descending triangle and a strong impulsive move down, but at the same time you have a huge H8 bullish pinbar off of key support. I would naturally say long is the better bet since it is with medium/long term trend strength and has a nice large H8 pin support the bullish outlook. I think a bullish breakout upwards has the slightly higher edge here in the short term.

Haha, no confrontation here, just good open discussion.

I agree, downward momentum has slowed down but for me this doesn’t seem unusual given such strong selling over the past year. You have to have a re-accumulation of positions before any further selling can occur. What I am looking for is any obvious, high quality reversal patterns showing a true reversal is in store, otherwise I am inclined to believe we are in a correction period for further declines. Adam mentioned a H&S pattern which at this point would be my only concern, but without the right shoulder it is speculative as there is already completed 2BR and descending price action in play. As far as world events are concerned, we don’t speculate or price that into our trades here in this thread. We do certainly consider the volatility implications but at the time frame I am trading(weekly), it’s not much of a concern. You will find that world events affects on gold(and the stock markets) are very short. Crimea was only 3 days before gold erased it’s gains from that scare. Even looking at 9/11 which was the most deadly attack since Pearl Harbor, and focused more at the heart of our financial system than Pearl Harbor, still only affected the markets for less than 30 days. 30 days after the attack markets had broken the 9/10 market high, and was back to “normal”. There may be ways to play short term safe-haven driven price spikes in gold, but it’s outside of the scope of this thread.

Overall I am still bearish on gold until I see a completed and broken out bullish reversal pattern. Otherwise this just looks like an old support has become new resistance scenario.

Very professional, it’s good to have another bias well fundamented.

I’ve being scalping longs gold the past week on every hard dip collecting 3-5 point and have already covered my stop loss on my swing long positions.

So I guess if this does not play out the way I want to I will have to hold my slices of gold a little longer than expected.

Thanks again and good luck everyone!

I’m already swing long in EURJPY - GBPJPY - USDJPY.

TGT +100 pips up.

Oh and willing to add if I can get a better price during the week. :22:

I somewhat agree, but looking at the weekly and monthly, it is looking bearish to me, with a lower high, reversal IB and descending wedge… this will be interesting for sure as if you are on the right side of this trade, bank will be made for sure!

Full Size - http://i.imgur.com/xH51gvQ.png

Full Size - http://i.imgur.com/qzK5LQP.png

Full Size - http://i.imgur.com/1oa4YHX.png

Monthly

Full Size - http://i.imgur.com/xFiqRnZ.png

Yep, You can post most things Price action based here and Aaron has no issue with it

We trade all kinda of things in this thread, after all, it is called price action that matters…

There are 2 things that could happen with Gold, it will either go up, or down LOL, but on a serious note, on H1, that is an inverse H&S, I played it from an H4 IB and my target was hit, so I am waiting for another entry now if I see something I like, preferable long to catch the retrace of the weekly 2 bar as price will not fall off right away IMO.

One note about moving averages, I used to use an 89 EMA, 20 MA, 8 EMA and 50 EMA, now I only use the 20 MA, problem I found was that all the moving averages make it very confusing and every time price hits an MA you kinda get confused as to what is going to happen, not saying it isn’t possible to trade with them all, but it just makes it a mess IMO.

Also, Aaron, speaking of a breakout, I think it has already broken out from the wedge to the upside.

NOTE: I have no idea why last weeks candle has gone from my chart lol.

The popular MAs used amongst the technical trading community are 50 for medium term trend and 200 for long term. I’ve heard everything in between the two but 90% of the MAs quoted in articles and analysis are those 2, especially 50. Short term is more personal preference but I like to use 20. I don’t myself give much heed to MAs, except for 21, and only when price is strong trending and I want to find good pullback opportunities. Although I only consider the daily MAs, any other time frame they are garbage.

I agree there was a breakout, but the TP of a wedge pattern is the start of the pattern, which we hit last week so I would say that pattern played out as expected and people should have banked on it already. Time to move onto new and fresh price action movement

Strange that my FXPro platform showed slightly different charts. Which broker do you use? Not NY close?

So, a different perspective based on my charts:

Price is below 21 EMA on daily. The pin bar was rejected by TL, resistance line & 21EMA

On H4 chart, price is also below 21 EMA, closed below your neck line. Your red mother bar did not show up on my chart