I also price action trader, I use channels, triangles and other patterns and it works great for me

That’s great. There are several strategies for trading with price action.

I created this thread half as a journal and the other half to share my experience and learn from others.

I hope you will stop by once in a while to share experiences.

sure, would love to share

Uncertainty rules the forex markets as well as all other markets.

Try to embrace the uncertainty while trading. Do not try to be perfect. Do not assume that your trade will be a winner. Make sure that your trade has a high probability of hitting your take profit point rather than being certain it will hit your TP. Try to think in probabilities. High probability trades make you a consistent trader than perfect trades. The moment you place your trade, you should leave the charting platform and go do something else. The market, which is neutral, will determine the direction of your trade. You have done your best.

When traders lose, many of them don’t realize that it has to do not with their strategy but with the way they think and react to trading. The market offers every trader unlimited opportunities and individuals have unlimited freedom to explore those opportunities. The two concepts presents the trader with unique psychological challenges which they are unable to deal with. For example, how do they reconcile the fact that they are losing trades with the fact that there are opportunities at the same time to win those trades if they have taken the opposite direction.

Therefore, traders need to question how they think about trading in order to succeed. Many traders believe that their strategy is key. So, they go on a cycle of looking for the holy grail. Yet, they fail to realise that their perception about trading, their believe that they can control and dictate to the market, is contrary to the realities of trading that no one can control the markets in forex. Hence why so many lose out in trading.

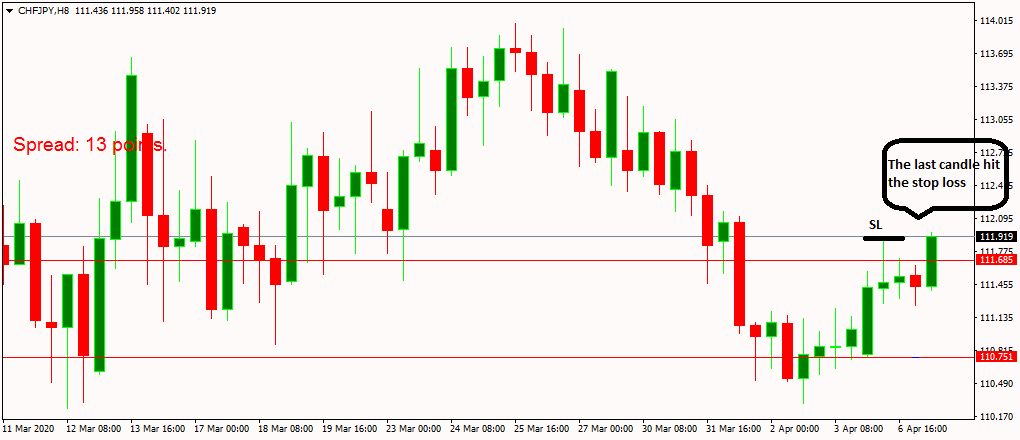

This is the journal of a trade I took yesterday and was stopped out today.

Reasons for trade entry: I was well relaxed before taking this trade. I had my mental preparedness to take the opportunities that present themselves. When I saw on the Daily chart that price had reached support, I started looking for PA signals. The first signal I saw was on the H4 chart, a pinbar, but the pinbar was not significant. So, I decided to ignore it. After the candle close, I looked again and saw that the H4 chart was showing a 2 bar reversal signal. I then looked at the H8 chart and saw a large and obvious pinbar. So, I decided to look at the market structure. This was a trend although the bars have lots of spikes showing high volatility. The trend direction was downwards but the pinbar was at a pullback. Then I saw that the pinbar was a a significant swing high. Therefore, there was every sign that the price might reverse. I looked at the direction I wanted to take the trade, a sell and decided I wouldn’t have traffic in that direction. And since the pinbar was large and significant, I decided to place a pending order. Unfortunately, it took 12 hours for the pending order to be triggered.

Trade management: When I woke up this mornig, I saw that I was at a loss of 20 pips but there was no significant sign that the price was changing direction significant but just sluggish so have to wait this out. One mistake I made was that I did not note the RR for the trade this was because I did not understand how to handle the position sizing indicator. Will have to learn it thoroughly.

Trade result remarks: The stop loss was hit. This trade I believe satisfies the requirements of the signal for a pinbar. The requirements are: 1. Must open and close within the previous bar. 2. Candle wick minimum 3 times the length of the candle body. 3. Long nose protruding from all other bars or must be sticking out obviously. On retrospect, I think this loss underscores the fact that lossing is part of trading. When you place a trade, the markets take over because the outcomes are probable. What is more significant is that you are consistent, stick to your rules, and trade with an edge. Every trade is unique and is independent of all other trades. So, the market went against me this time. No problem. I can win another time.

Thirty minutes later:

Second look: After wondering why I was wrong, I took a second look at the chart on H8 and realised that I did not analyse it very well. There was traffic on the left that I did not see. I have to be more careful next time.

I was reflecting on my loss yesterday and it came to me that the loss affected me personally so I started working on my psychology. Yes, it’s painful to loss money while trading. It could lead to self-harm or loss of self esteem. This is why when a loss happens one has to find succor in having a good mental attitude and belief system. And this can only come about when a trader is disciplined and has in place the ability to guide his or her behavior before carrying out any trade.

One way we can inculcate that discipline and behavior guidance system is to have a risk management plan in place. This is very essential.

Remember, the markets cannot do this for you. The markets only present opportunities for buying and selling. The market is always neutral. You have to put in this structure yourself. This will prevent you from having the pain of a lost trade.

Do you trade without a trading plan? Some persons believe that the moment one understands a strategy, that is all they need to make money on the foreign exchange market. They are in a hurry to express themselves in the trading environment as they see the unlimited opportunities that it presents. But when everything turns awry and contrary to their expectations, they blame the market. It is either the fault of the charting platform, the broker, or the big banks and hedge funds who are market makers. They do not realize that the problem is because they fail to take responsibility for the outcome of their trade. They do not know that taking responsibility would result in consistent trading. One of the steps towards taking responsibility is to prepare and follow a trading plan as a guide in trading.

I have a trade that has been running for two days now. The pair seems to be in perpetual rut. Reflecting on my expectations for that trade helped me to change my thoughts. If you consider the fact that many have learned to control or manipulate their environment in life, you will see why trading presents psychological challenges. In trading you cannot control or dictate to the market. It will do whatever it wishes. Reflecting on that fact, I have resolved rather to control myself and my expectations. I will wait on the market to carry out it’s wishes about the trade. I am resigned to the outcome. I cannot control it.

That gives peace.

Low volatility, less opportunities.

This April, I have noticed lesser volatility in prices compared to March. March madness was due to the scare from the coronavirus but now it is beginning to wane out.

Less volatility means less opportunities. I wonder if that is how the month will be defined.

Notice the two bullish pin bars that occurred between 23rd and 24th March. This double rejection of low prices caused price to rise more than 1000 pips over 24 bars. Very volatile and very good opportunity for anyone who had gone long at that time.

Take two new traders for example: Trader L and Trader W. Trader L has lost his last four trades but Trader W has won his last 4. You must agree with me that Trader W will tend to be more confident of his system than Trader L. But what if Trader L is losing not because his strategy is not high probability but because he has lost confidence in it and begins to think of jumping to another strategy or system. Trader L doesn’t know that his losing comes with his state of mind.

Your state of mind is a by-product of your beliefs and attitude. It is useful to examine one’s state of mind before taking a trade. Quite important that it is part of the trading plan.

If one is not confident about a good strategy there is no way he can use it to take a good trade.

2 Bar reversals patterns. Some examples.

These notes are for some of the candlestick patterns I have curated. Mind you, the support and resistance levels are not shown because it was not possible to draw them. But they were significant because they were at important swing highs and swing lows. As I forward test, I would show more examples of the reversal candlestick patterns with support and resistance.

This two bar reversal was not a valid high probability 2 bar reversal. It should have closed lower so that we would know that the momentum is strong, particularly since it wants to go counter trend. Also, notice the traffic on the left.

This 2 bar reversal was a strong bullish 2 bar reversal because it started a new trend. That is a trend reversal took place. See how it formed at a swing low. This is a good spot to buy. The bullish bar also closes strong and the bearish bar has small upper and lower wicks. It shows a very good 2 bar reversal pattern.

This 2 bar reversals are two consecutive patterns that reinforce each other. They show how 2 bar reversals can initiate trend reversals. The strength of the rejection of low prices was very strong on the part of the buyers as it was rejected twice. The pattern occurs at a swing low which is a key area. See how the bars are significantly large which show strong momentum. The pressures during the sessions were evenly balanced as shown by the large upper and lower wicks.

Taking trader L for instance who has been having a string of losses. If he is not careful it would affect him emotionally and make him commit errors in his trading. Why? Because these losses might make him to have contradictory beliefs. One of them is the belief that the market is always offering opportunities for him to make money and that fuels his greed. But this knowledge is contradictory to the fact that he is afraid to put on the next trade because he believes the fifth trade would also turn out to be a loser. So fear restrains him from acting. This contradiction between knowledge from greed and action from fear makes him to over trade, trade outside the rules of his trading plan, or even miss out on trading opportunities because the market is out to get him. If he does not resolve this contradiction, trader L will never be a good trader. He has to examine his beliefs system critically and resolve the contradiction.

Journal review for the trading week of April 6-10, 2020.

During the week, I opened three trades with one pending order not triggered. Of the three trades opened, one closed and it was a loser. I lost $17.74 when my stop loss was hit. Not too bad. The remaining two trades are still running. You can find the details of the trade that was a loss for the week here.

These are some of the things I learned during the week that I will be working on:

-

- Don’t be hasty, especially when dealing with H8 and H12 charts. I found an indicator that could create H6, H8, and H12 charts. In fact, any chart of your liking. It expands what is obtained by default on MT4. I found that because these charts do not align with the support and resistance levels I have already drawn on the daily, I could be a little careless and be hasty in using the charts. That was the error I found in my first trade. So, this reminder is what I will have at the back of my mind for the coming week.

-

- Follow the trading plan faithfully and do analysis carefully before deciding upon how to trade. I just started using a trading plan and have to stick to it. I have given myself the rule to be rigid in my rules but flexible in my expectations. I can stick to this and will stick to this reminder.

-

- Patience is a virtue. Yes, that is the truth. In forex trading, patience is a virtue. The two trades that are still running have been in a low volatility and low momentum mood that it seems as if price is going nowhere and is stuck in a tight range. That can be emotionally draining. I am learning to be patient.

Yes, those are the lessons I learned for this week. We all learn daily on the forex market.

Some chart examples of engulfing bars.

These are some engulfing bars I found during my backtesting of the price action reversal strategies. Because I was doing backtesting, it was not possible to insert support and resistance to get a clean chart, so I decided to stick to swing points in order to understand better the strategies. Here are some engulfing bars that I found.

1.Gold. Daily. Bullish engulfing bar. The conditions that it satisfies are that it engulfs the preceding bar and creates a higher high and lower low. It completely engulfs it. Also, the signal is large which shows high momentum but it did not really close at the highs that much but the size of the signal makes up for this. Notice that taking a long trade would be in the direction of the trend. The rally that followed this pattern was huge. About 2000 pips.

2.EURGBP. H4. Bearish engulfing bars that used two candles to fulfill the condition. From my research, I discovered that sometimes the conditions for engulfing bars can be fulfilled by two candles. This is acceptable because it shows that the momentum has shifted; that is the essence. This bearish multiple engulfing bars started a sell off that went through many pips. Very good trade.

Our noob Trader L who has been having a string of losses suddenly discovers he can win. After two huge wins, he starts getting excited. His expectations of fame and fortune increases. Therefore he reasons that if he can make two wins, he has found the secret to trading. He could make hundreds. He throws all restraint to the wind and forgets to trade according to his plan. He increases his leverage by opening large position sizes because now he is overcome by euphoria and overconfidence. I guess you know what would happen to trader L. He’ll blow his account sooner than later.

Trader W though is a professional trader. He understands that losing is part and parcel of trading and that the market offers several opportunities to counteract his losses if only he is disciplined and applies appropriate risk management to his trading. So, when he has a string of wins, he restrains himself. He still trades according to his trade plan and gives no way to greed. Eventually, he takes the opportunities the market has to offer and smiles to the bank.

What kind of indicator is this, may I ask?

Used for calculating lot size, RR etc.

See the instruction Here on how to use: Metatrader Position Size Indicator

Success. EURJPY. H12. Short.

Reason for trade: The trend is downtrend in long term and range in short term. Price is right now at a significant resistance level and I see this as a pullback towards the downtrend. It also has confluence with the 50% Fibonacci level. I foresee that there will be traffic at the 117.706 level and my mind tells me to leave the trade but I want to take it for just some pips and exit the trade at that level rather than allowing it to run. What made me take this position is because the pinbar is large and obvious. Very large indeed. My mind is positive and I have a high probability that this trade will work out. So, I just set a sell stop and will check to see whether the sell stop will trigger.

Trade management: I have a feeling that the traffic is very strong. Price has been lingering around the entry point for a long time. Even after 5 hours it is still lingering there. I was not happy when I then opened my mobile app this morning and realized that price had moved against me. In order not to feel bad about this fact, I had to tell myself that the markets are going the way that they interprete the price movement and I have to be patient. Also, that price doesn’t go in a straight line but zigzag formation. I then analysed the chart and came to the conclusion that it was not yet to be called a losing trade but just something I didn’t like. So, I had to wait a little. Price has gone against me by 62 pips today. 9/4/2020. I noticed that there was a chart pattern that is forming. It is a head and should chart pattern. Maybe this is the right shoulder forming, and if this is true, then price would form the shoulder and go down to hit my TP. I will be patient much longer rather than close it now. In retrospect, the stop loss might get hit. 10/4/2020. Pips still in negative territory. Sell pressure is high though and it might go my way. Patience. The bull bars though were big at the start of the retracement and begin to get smaller, showing that momentum for the bulls is waning. I think this is just a retracement or pullback. Until Monday. 13/4/2020. Right!

Trade Result Remarks: 10/4/2020. I noticed that I was slipping into the bad habit of not taking responsibility and blaming the platform. Have to stop that and take responsibility for my trades. 13/4/2020. At the start of the week, the trade is in my favor during the Asian session. Have nothing to do but to watch it. The trade finally went as expected. It got to the region I predicted it would and hit my TP. Made $10.19 from this trade.