Yeah. I also saw it. I put a pending order for it and at this minute the order hasn’t triggered. I will cancel the order now because of NFP. I don’t like trading USD when NFP is around the corner.

good job not trading during NFP ,because He used that news to stopp out those like 1odi

@coolBuTcute.01. From your trade descriptions, I think you are emotionally fighting the markets. Stop fighting the markets. If you think the market should do what you want, then you will end up losing in this business. The markets are neutral and are obedient to no one. They will not do what you want. You will not always be right. Get that into you. Just take only high probability trades and let the market decide what side it will go.

Aha,sure

Wasnt ,in the pictures i gave you higher , high probability trade/

And yes because i open alot of trades,when market goes against me ,and give profit to majority i lose alot

. But i never risk more than 30-40percent in 1 trade

. But i never risk more than 30-40percent in 1 trade

hahahahhahahahahahahah hilarious lol, i just pointed out a possible setup, i actually sold UJ after NFP. but again, hilarious

quick scalp 3to1 RR, stop above the upthrust.  u thought: hey, this is an oportunity to stand out , well no, the way u trade it s ridiculous, when u buy i ussually sell, and viceversa, like last time on UJ, cheers

u thought: hey, this is an oportunity to stand out , well no, the way u trade it s ridiculous, when u buy i ussually sell, and viceversa, like last time on UJ, cheers

Dont get mad on me ,it was just an opinion

I just believe that competition leads to improvements,for both of us of course

i m not mad, just smiling lol, hope 1 of these days ur gonna try t actually learn how to trade without betting the house

betting gives you better reward,wayyy better

And losses are also wayy better

ofc, if when u win u win more then u lose, but seeing how u trade, i doubt that s possible. u have that gamblers falacy attached, and u gonna realize that when u ll be left without money to trade or… ur gonna get bored of blowing demo after demo

ofc, if when u win u win more then u lose, but seeing how u trade, i doubt that s possible. u have that gamblers falacy attached, and u gonna realize that when u ll be left without money to trade or… ur gonna get bored of blowing demo after demo

ur makin threats now huh?

MUAHAHAHAHA

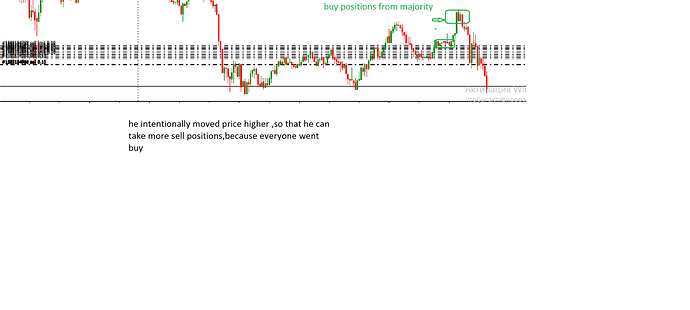

Once again gambler coolBuTcute.01 knew their tricks wayyy before

1odi do you envy me?  . I know we can entertain each other,thats why we are here

. I know we can entertain each other,thats why we are here  , I know you love me guys

, I know you love me guys

i sure hope ur a woman since ur kissin on every post  and no, i do not envy no1, as for the entertainment part, people come here to learn or to land a hand, not to entertain hahah

and no, i do not envy no1, as for the entertainment part, people come here to learn or to land a hand, not to entertain hahah

and ofc i ain t got nothing against u, told u it s nothing personal, my comments are based on ur posts about the way u trade, simple as that. i ain t trying in no way shape of form to offend you, just the way u trade

and ofc i ain t got nothing against u, told u it s nothing personal, my comments are based on ur posts about the way u trade, simple as that. i ain t trying in no way shape of form to offend you, just the way u trade

You dont like boys?

By the way show some of your trades,make some analysis i want to see how you do this.

P.S - I have a strong feeling that you are wayy older than me(23)

i love women, sorry…

i use volume, 3ema s for tests and confluence and that s it. u can trade without ema s, i just keep them cos of habit i guess.

VSA(volume spread analisys) it s the name of the market aproach i use, basically i measure volume(that represents activity) with the spread of the candles and also looking at the hole picture(background), support and resistance, strenght and weakness etc. a very good example of that was today on USDJPY.

This is too deep for me,i have no idea what is all about  ,i dont see where are his sell or buy limit orders,where are majority and so on.

,i dont see where are his sell or buy limit orders,where are majority and so on.

By the way,why admins from that forum,always delete my messages when i post some proves that I am right?

Some1 asked to provide proves of what i say and how i trade,i tried two times,but i got this message from admins two times in a row…

They will probably will delete this too…

Or rather this time i will get banned

I have no idea why they do this,or why they are after me

Done for today.Whole day spent in front of monitor,need some love,to hell this market.

See you guys on monday

Happy weekend

My expectancy after 15 trades using these strategies.

I started trading one month ago and I have had 15 positions traded. Although the sample size is very small to calculate expectancy with, it is good to keep this figures in mind. The calculation shows that I am losing $6 for every trade but I have a win rate of 46%. I have to work on my average losses because they are on the high side, about $18. That is it. Now, I know what to work on. Risk management and exit strategies. That is the next step on the journey. I have to always thinks of cutting short my losses and letting my winners run.

Well, the journey is getting better as the days go by. I think I am getting into the flow somewhat.

Lessons learned this week.

I took three trades this week. Two winners and one loser. These are some of the lessons I learned this week while trading.

-

I learned never to act on the fear of missing out, (FOMO). All the trades I take are based on pending orders. But I have seen several trades that look like good setups but the price has gone past the point where I would have placed a pending order. There is a strong temptation to take those trades. But I would say to my account that I have consistently resisted that temptation. I have done so consistently. I never chase trades. Never. Every trade is taken based on pending orders or it is not taken at all.

-

One rule that I broke this week is that I should always remember that I am trading patterns, not the news or sessions. But patterns. I broke that rule this week and paid dearly for it. Recalling it so that I would keep it in my memory.

-

Another rule that I broke this week is that for one of the trades I took because I was excited I did not follow the trading plan. I felt bad about it. I know that consistently profitable traders always stick to the trading plan. I want to be a consistently profitable trader.