- i look at daily candles and enter on hourly since i day trade.

In my opinion it is ok to look at daily and trade open according to 1HR candle signal.

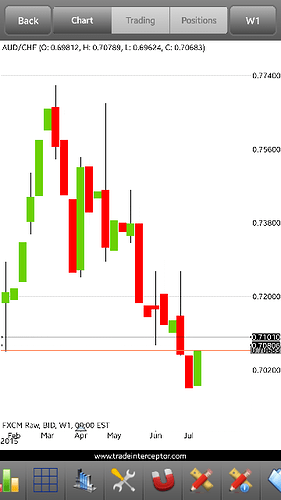

- SR lines are colour-coded, drawn for weekly (most resistant / support), daily (resistance / support) and 4 hourly (see the candles in perspective). too many lines?

It best to stick with higher TF SnR like weekly and daily.

- the reason why close depends on whether i am buying or selling and the interest for keeping the position open. say i sell audusd, but trade going against me, the stoploss if hit plus the interest is really a dampener. Please correct me if that’s not the thing to do. Maybe to sleep better also…

If you open a position and you can’t sleep that means you are taking more risk on individual trade, need to work on position size and risk management.

4.like yesterday there were big news from 4.30pm, 5.00pm, 5.15pm, 7.45pm, and 8.30pm GMT+8. the windows for a trade is practically from 9.00pm GMT+8 when US market opens.

Leave the news in your check list but don’t follow it religiously now, once you know the concept you can use the news as another tools for profitable trade. But try not to open a position before the major news realease.

“Candle don’t confirm bias.” was your reply to my last question. Is my understanding correct to say that when yesterday candle is down, today will be a sell, so we wait for one of the 6 candle patterns NikitaFx looks at to open a trade. does this also mean the the candle has to form when the 1-hour chart closes, or we look at higher TF for these candle patterns to open a position?

As you are trading on daily candle, look previous day candle if bearish then today is sell and vise versa. But we wait for the lower TF to give us signal around SnR area by forming thise 6 types of candle like doji, engulfing, etc, pin bar type is more effective.

on a sidenote, how many pairs do you look at since it is a full time commitment for you?

I look for almost every single pair at the moment, because I am very much selective about my position.

and what are these pairs? do you scan for pairs at the opening of a new candle based on weekly (look at it once a week or based on daily (look at it once everyday) but uses weekly as a guide to the more dominant bias?

I am looking at weekly and daily candle but mostly weekly which give more profitable trade. I look at every sunday to get an idea which pair I will need to monitor for the week and then check every 1HR or 4HR.