How’s it going, now? What’s the “score”?

I might complete stage one if I have a good end to the week, need another 2% or so.

Five trades, two wins, 40% win rate. Not the best, I didn’t do anything wrong, here’s the trades.

Nice quick win on EURGBP, SL was exactly where I intended, 1:0.7 risk to reward all good, done in 2-3 minutes.

USDCAD, similar story, this took around 10 minutes, there was a bit of a pull back earlier but not dramas.

AUDUSD, perhaps there wasn’t enough movement here, it was kind of sideways but then there was like a news item or something that strengthened USD and hit my SL out of the blue. No news was due at that time though, the trend was generally up and it recovered to going up again afterwards.

EURUSD, I don’t think I need to say anything here ![]()

USDJPY was possibly a mistake, there was a pretty strong push down which had a quick retest and then continued but as soon as I placed the trade it reversed.

Overall a loss of around $40 which is about 0.8% so rather frustrating but I will go again tomorrow, I do feel this was just a bad luck day and otherwise a 4 wins from 5 day which would have been profitable. I didn’t make any obvious mistakes, all SL etc were where I wanted, I waited for candles to close before making the trades etc.

I’ve just been trading price action/market structure on US30 and DAX40 since the above to get some confidence back and made 10% using my small personal account. So not all bad today.

A nice day today where everything didn’t happen all at once and I did 6 trades with 5 of those winning, here’s the details:

Nice easy win on EURUSD, action wasn’t very exciting but a win is a win.

And another quick win with no dramas for AUDUSD.

Almost identical for USDJPY, if only every trade was like this!

USDCAD also nice and easy.

EURGBP teased me a bit but got there in the end.

GBPUSD looked good early on but then drifted down for my only loss. Now, I am recording how long trades are taking and I might close them down if they run over 20 minutes as no winning trade has ever taken that long and it would allow me to cut losses, but I will get some more data before making a decision on that.

So overall a nice day, almost 1% up, back to the $300 profit mark so 75% of the way to finishing stage 1, let’s hope for a good week next week so I can finish this/

Here’s the trades for today in MT5 out of interest:

So, based on the last 27 trades (I know, very small sample) the optimum RRR is actually 1:1 which would give almost 50% higher returns vs 1:0.5 RRR

I will keep recording this info as I need a much bigger sample size to change the strategy just yet.

Good post ^^^ - and good thinking. (And good luck!). ![]()

This is the type of thing I am recording now for the trades, these are the winners:

So I record the day of the week so I can see if some days are better than others, potentially I might not trade on certain days.

Also the currency pair, again if some have a poor win rate I might stop trading those.

Also the direction of the trade and the current trend, is it worth avoiding going against the trend etc?

I then record the SL I used and what the minimum SL could have been to still win the trade, if I can reduce the SL in general this would see my win rate increase, or I could look for higher risk to reward.

I’ve then got a column for every RR from 1:0.5 up to 1:5 and at the top is the total of how much I would have profited for each scenario - 1:1 and 1:2 currently tied for 21% gains - this is only winning trades so no losers in there but I don’t think that affects this total in any material way.

Max win is the biggest RR that I could have got for each trade.

Finally I’ve started recording the time I placed the trade and how long it took for the trade to hit TP, again might help decide on when to trade, when to close a trade early etc.

And this for the losing trades:

Not quite so sure with these what to record so it’s work in progress, you can tell I’m a Data Analyst for my day job!

![]()

Feedback welcome.

I didn’t know - but I was wondering, and certainly guessing something like that! ![]()

And the summary for last week:

A fairly reasonable week given the small mistakes I made, over 1% in the right direction, another two weeks like this I and will complete phase 1, in fact another couple of good days and I can hit that target.

Market wasn’t very nice today. Didn’t spot it until too late, only 2 winning trades from 5, here’s the gory details;

USDJPY did it’s usual thing, looked to be heading down and reversed as soon as I placed the trade, hitting SL in a couple of minutes.

Very nice quick win on GBPUSD.

Need to wake up here as once again I didn’t set the SL quite far enough away, another pip and this would have won despite the early reversal. Stop rushing!

Probably shouldn’t have taken this one as it had been in a slight downtrend, USDCAD.

Finally EURUSD, took its time and I thought I’d lost this but it did come round in the end, this is the longest time a winning trade has ever taken for me I think, 55 minutes.

I did increase my TP from 0.7 to 0.75 which I don’t think made any difference today.

Just that SL on AUD made the difference between a winning day and a losing day, but overall quite a small loss - I have noticed I often seem to have a winning day then a losing day, need to get some consistency.

Learnings for today, don’t go against the trend (USDCAD) and SET THE STOP LOSS TO THE OTHER SIDE OF THE RANGE!

Also patience! ![]()

Not a bad day, 5 trades and just 5 wins. ![]()

So yeah, I went back over yesterdays trades and noticed that I tend to win if I go with the trend and lose if I go against. It’s only taken me 2 months to realise this ![]()

So today I marked the trend on the chart just before 8am and looks like it has helped, here’s the trades;

Nice quick win with no dramas for EURUSD.

Ditto for GBPUSD.

And EURGBP

USDCAD took a bit longer but no dramas.

And AUDUSD, this took a bit longer and did make me nervous it was reversing but I held on for the win.

Now I DIDN’T take USDJPY shown above, the trend was UP at 8am but it did reverse so I need to be aware of this, but very happy with 5/5, the mark I’ve put on there is where I would likely have taken the trade so it would have been a win but I am not too unhappy about missing it.

So this is my best day ever trading this strategy and now I am very close to hitting the target for phase 1, need another $50 or so, about 1%

I need to be consistent and have another winning day tomorrow as I always seem to have a profitable day followed by a losing day, fingers crossed for tomorrow!

I suppose with hindsight maybe today the markets just behaved themselves a bit better than normal.

I will be increasing my RRR to 1/0.8 tomorrow as looking back at the results every trade that hit my TP would have hit it at 0.8 so might as well grab a fraction more profit.

The market was tricky today as a lot of the pairs I trade look to have reversed around 7:45am so I didn’t have time to spot this right away.

Shouldn’t have traded, I knew the market looked a bit off and today has been my worst day ever, after probably my best day ever, this is a recurring theme, a winning day, then a losing day.

So overall 6 trades and 1 win, lost all of yesterday’s gains plus last week’s and some of the week before, really frustrating, here’s the trades;

GBPUSD was first, now I was wondering if this had reversed as I marked the big wick at the bottom around 7:40 and though that might be a reversal from a downtrend. But the market structure wasn’t very clear and it actually looked like a pull back when I entered this trade.

It then reversed again almost immediately forming a higher low and just hitting my SL. The SL is exactly where I intended and this pair has now gone back to a very slow downtrend but it’s not doing enough to really trade successfully.

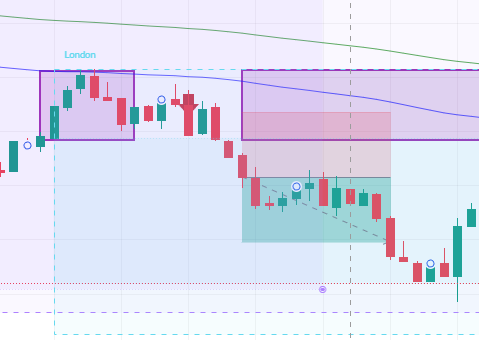

EURUSD next, thought I’d done well here as there’s kind of a head and shoulders pattern indicating a reversal just before 8am and higher highs, higher lows confirming an uptrend.

Then it reversed immediately I placed the trade again!

I messed this up totally as I got the risk level and the SL mixed up so my risk was 0.8% (instead of 0.5%) and my SL was 5 instead of 8 so that’s a new one.

The only good news there is the trade would still have lost anyway but I have made about 50% more of a loss than I should have. Again this is now ranging and there was never really a trade there that would have been profitable.

AUDUSD now, again looked to have reversed and then went against me as soon as I placed the trade. I felt I had been fairly patient here as well.

USDJPY and a winner at last, this one had reversed, I spotted it and it kept on going and didn’t immediately go against me, everything worked as expected for a change.

USDCAD, a double top and the 10 and 21 SMA crossed over, this looks like a definite reversal to the downside which I probably entered a bit late.

EURGBP, just going sideways really.

So overall I need to probably not trade on days like today, or be very patient with it, but the good news is I did think it looked off before I even traded so that’s an improvement as I probably wouldn’t have noticed that a few days ago even.

I’ve basically lost all the profit I made over the past 10 days now, but still over half way to the first stage target and I haven’t come close to blowing the account so that’s nice ![]()

What a crazy amount of data! This is awesome! I bit much for my brain, but I’m thinking I need more data!

Another light-bulb moment, I need to use the 5M timeframe to view the trend, it’s clear as day then and I would have still been on a losing day but probably only half as bad as it actually was, may even a bit better than that.

Just paper traded the US opening using my strategy and got 5/5 winners, bloody typical!

I will keep a record of these and might start trading as part of this challenge if I get some more good results.

Pah. ![]()

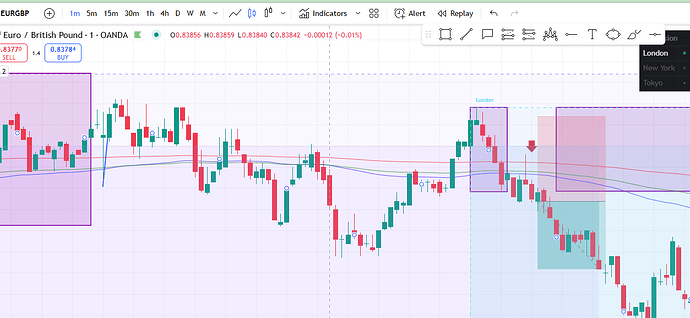

Just sharing a couple of images of the NY open:

This was AUDUSD and almost textbook break and retest, where I’ve circled, the pull back doesn’t quite hit the edge of the 5 minute range but it’s very close and this gives good confidence to take the trade.

And this is what I mean about the trend:

There was an uptrend on the M1 timescale, then that big drop into the NY open.

But more like a downtrend on the M5, which I traded with and was successful, on paper.

Good day, 6 wins from 6 for a nice profit, was expecting a winning day as I always seem to alternate between winning and losing.

I’ve been doing more research into the London Breakout strategy and it seems there are more versions than I thought and mine is quite odd, so I am going to see if I can use the other versions to improve the win rate. You will see this on the trades below:

USDJPY first, I actually went against the trend here but on the M5 it is really pretty much sideways and the price action looked fairly clear and got the win quickly but as you can see there wasn’t much room to spare.

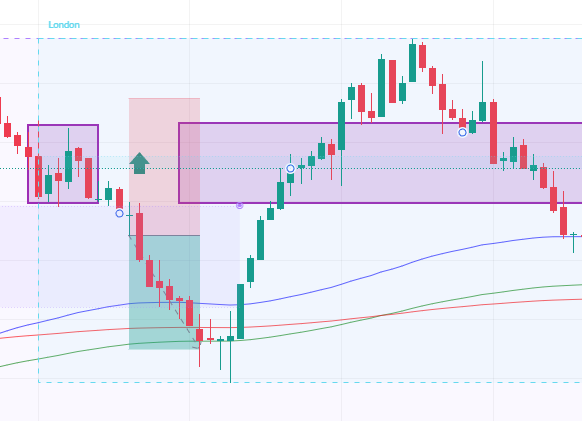

EURGBP here, you can see I’ve drawn another box to the left, this is the more usual London Breakout strategy which is based on a breakout from the Tokyo range from (GMT) Midnight to 7:00am - this gave me another confluence that this was heading down, both M1 and M5 trends were also Bearish so I was quite confident entering this trade and it hit TP quite quickly.

Similar for the EURUSD.

So overall arguably my best day ever after my worst day ever, but due to the spread and my risk to reward of 0.8 I am still down overall, need another win tomorrow but as I seem to alternate good days vs bad days not too confident. Maybe my new confluences might help me.

Back over the $300 profit mark though which is nice, another day like today and I will complete phase 1 of the challenge, I have been saying that for a while now!

USDCAD took a bit longer but again all playing nicely.

Now confession time, I closed GPBUSD a little early as it had reached 9am and I know things can get a bit random around here, so the profit was a fraction smaller than it should have been, but overall happy.

I’ve almost recovered what I lost yesterday, I will keep tabs on the new breakout strategy to see how it compares to my current one and also paper trade the NY open again today.

Just need to string two good days together now!

Doing a bit of back-testing and this other breakout strategy looks to have a very high win rate.

My paper trading on the NY open also had a 6/6 win rate today.