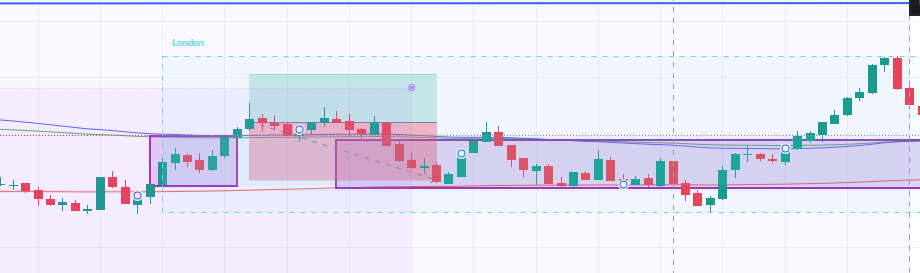

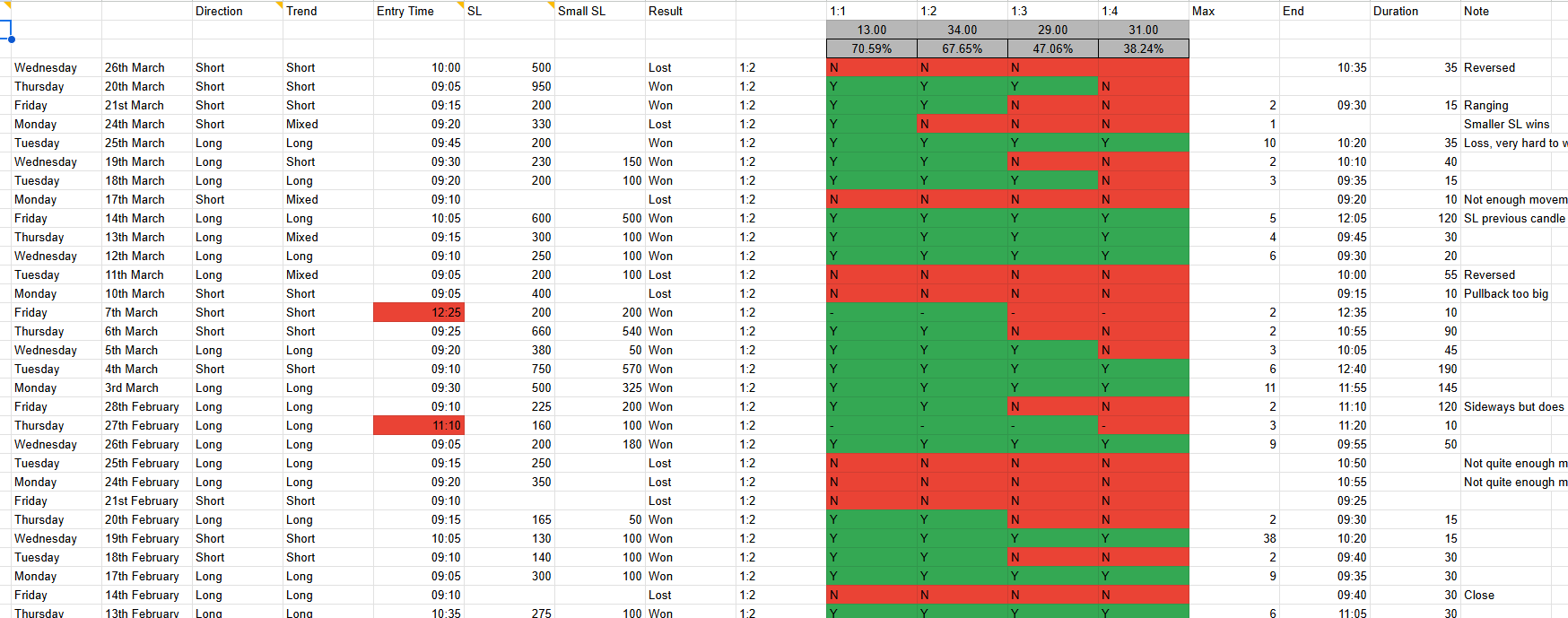

Rule number 1, don’t trade a ranging market, so I did 4 trades. :

To be fair it usually ranges just before 8am but it had really been ranging from about 7am so I should have left well alone but I am dumb.

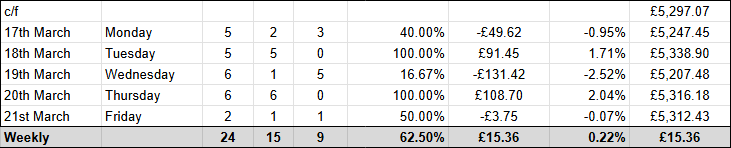

Overall it’s a 1 win 1 loss and 3 break even today which I will explain below in the trade details:

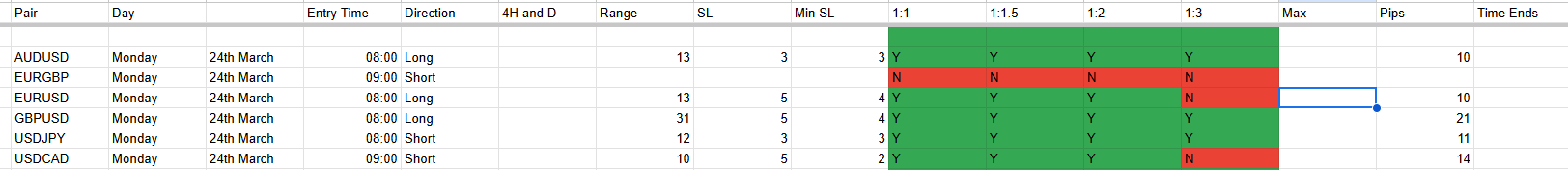

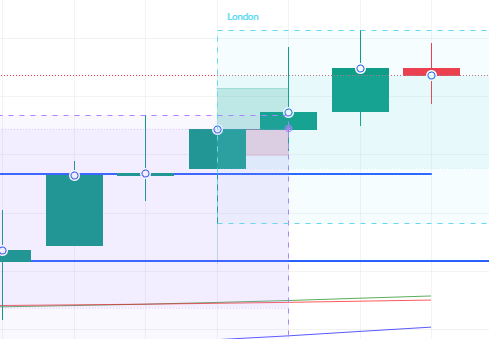

USDJPY lost, quite clearly it’s ranging but in my defence it looked like it tried to breakout of the Tokyo session range a bit earlier so I felt this would be bullish and as you see later on it did hit my TP although the pull back was too big.

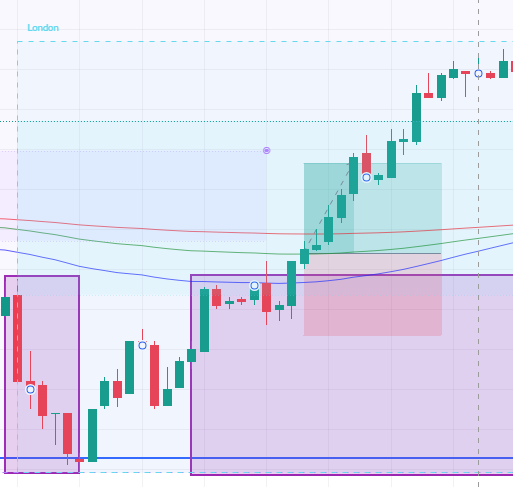

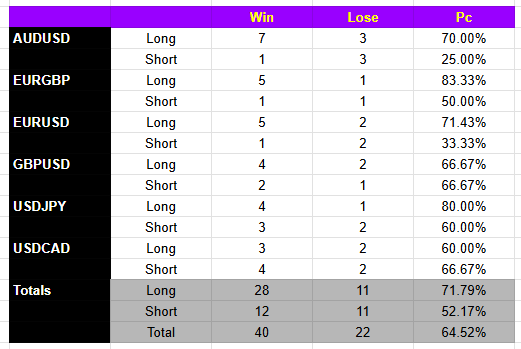

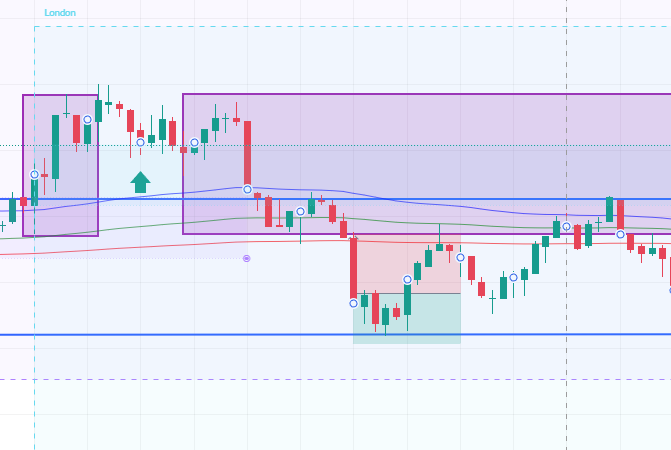

Nice quick win for USCAD, now you’ll notice I didn’t set the SL to the other side of the range but this was deliberate as the range was huge, had I set the SL there then this might not quite have hit TP so I think I did OK here. I have increased my TP to a risk to reward of 1/0.9 now as the last 50 trades that I have won would all still have won at that level.

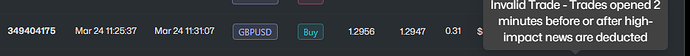

Around this time I realised the market was ranging and so all three of the remaining trades were closed early for around break even - I had to do the school run and left them all running while I was out but as they were still running when I got back I decided to close them early as in my experience trades that go for more than 20 minutes or so tend to lose.

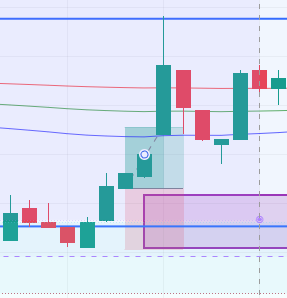

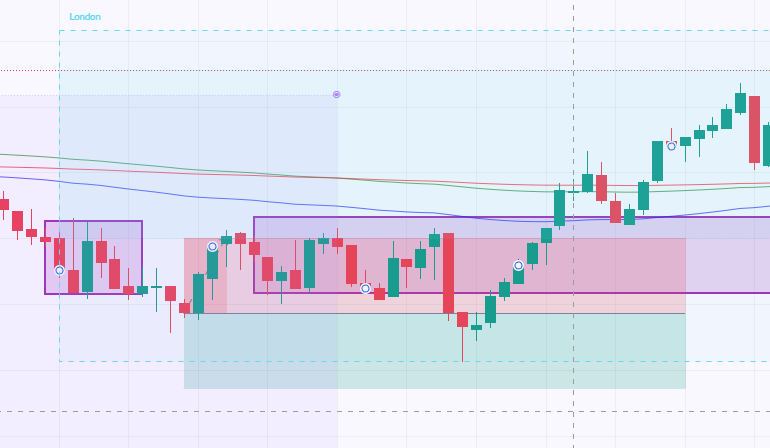

AUDUSD so nearly hit the TP it’s not funny, closed this for a small profit as it just seemed to be ranging - if I’d kept the TP at 0.8 then it probably would have hit that - equally a smaller SL results in a win here.

EURUSD, again fractionally short of the TP, hits it with either a smaller SL or a the old risk to reward ratio, closed early as it looked to be ranging.

Bit of a mess on EURGBP, closed early for a break even but it now looks like it might have hit my TP if I left it!

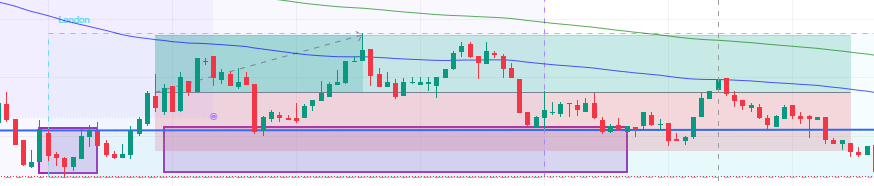

So learning points, avoid trading in a ranging market (need to work out how to identify that reliably) and set a smaller SL for all pairs apart from USDJPY.

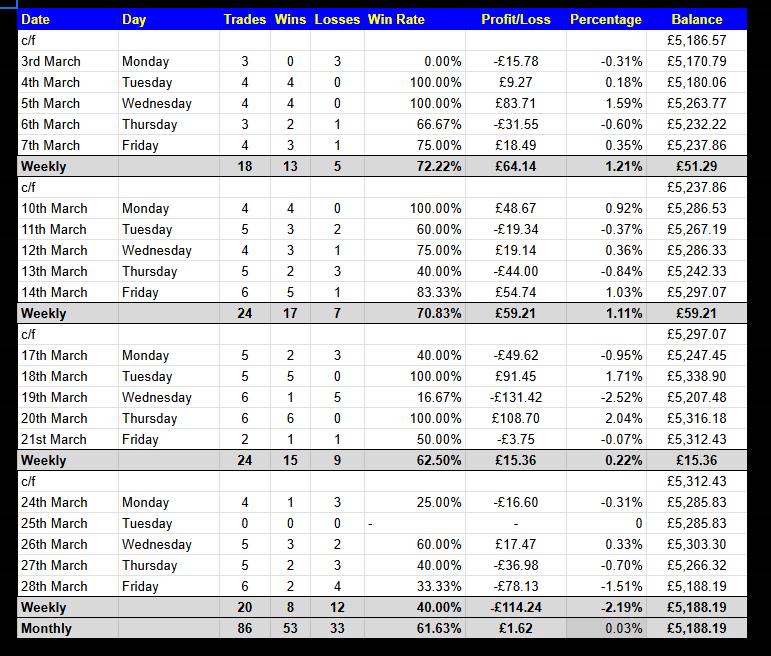

Another losing day after a winning day but it’s only a tiny loss of around $3 so no big deal, those two trades that nearly hit TP would have been nice but it is a small profit overall for the week.

I am going to analyse my trades now as I think going forward I am best doing smaller SL for most of the pairs but maybe leave USDJPY with a big stop loss, this should see my win rate improve a little.

The Tokyo open was a complete waste today as everything pretty much is ranging and has been for about 3 hours.