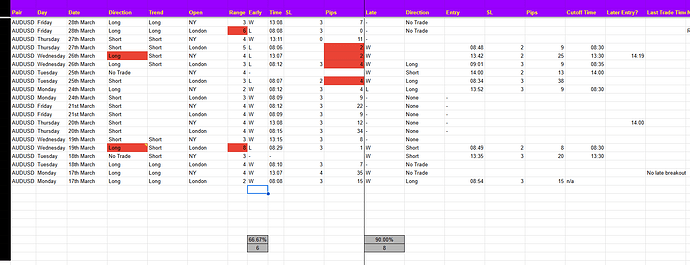

So, some analysis and backtesting on AUDUSD.

I am doing this for a few reasons:

- To better understand how this pair reacts around London and NY openings.

- To see if late entries are more successful, I have a sneaky feeling they are

3 To see if the range makes a difference

So as you can see:

- Yes, later trades are more successful, but I will only get about half as many.

- The range DOES seem to matter, so don’t trade this pair if it is >4 or 5 (to be decided)

- Try to avoid going against the trend, this isn’t as clear cut I will do more research (Only really applies to early trades)

- To be honest if I follow the trend and don’t enter when the range is >4 the win rate is pretty similar to the late trades so I might do that, will have a think

- I will stick to 1/1 risk to return for now

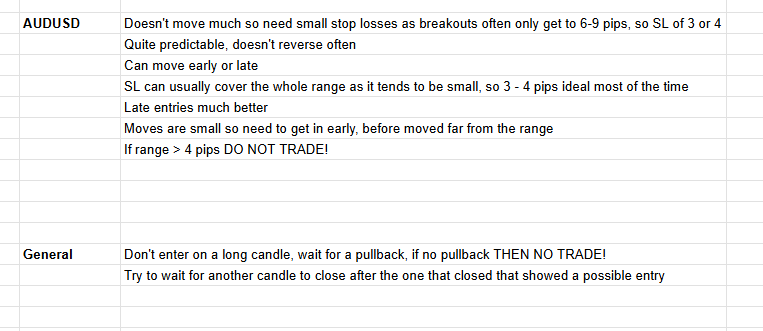

Learnings for this pair:

This is all based on a very small amount of data so needs to be treated with caution, I would welcome feedback as I am still a noob!

I’ll do this for all the pairs I trade as this does seem helpful, let’s see if I can put it into practise.

I’ll be logging this info for all pairs going forwards so I can amass more data.

1 Like

I spent the weekend backtesting and did over 200 trades - today was good, 4 wins from 5 trades, made up some of the losses from last Thursday and Friday.

I was more patient than normal today and you can see as my first trade wasn’t until 8:13 - nice quick win on USDCAD.

Now I was a bit hesitant on AUDUSD as I know if often doesn’t move far and I probably was a bit late getting into this one but another fairly quick win with no dramas.

I was too late on USDJPY as you can see, although the initial move was so quick that there probably wasn’t a winning trade in this today.

EURUSD was a bit of a close call, only just hitting TP but another win.

Now I was confident here with GBPUSD as I know from the backtesting I did that later entries have a higher success rate and sure enough a nice quick win.

All these were at 1/1 risk to reward.

I did some more trades using smaller risk levels 0.1% on the 1H strategy will report back later with those.

1 Like

So, testing the 1H breakout, I’ve done around 200 test trades for this, basically pretty much all the pairs I trade going back to January and it has a higher success rate if you enter at 9am.

However, it’s not really profitable at 1:1 RRR but it is at 1:1.5 and above, so for now I am testing with that risk to reward (it looks like 1:3 is best but I will leave that for now)

So today I was distracted and entered all these a bit later than I should, around 10 minutes, here’s the results;

Nice quick win on USDCAD, the only real question for this strategy is where to set the SL, I am still working on that.

Ditto for GPBUSD.

I won’t post the other images but in total I had 3 winners and 2 losers, which at 1:1.5 risk to reward is a nice profit - I’m only using 0.1% risk on these as I am still in a “testing” phase but will start using the same lot size as the others soon.

What I really like about this is it’s so simple, very little “interpretation” just the stop loss and you can be done for the day in about 5 minutes. Just logon at about 8:55, draw some lines, place some trades and finish by about 9:05! Even I can do that!

And finally I also have been testing the NY breakout with my 5 minute range strategy and it’s been looking good, so again I did some live test trades (0.1% risk) and both of them won. I only had a chance to do this after the market had opened so only took the 2 late trades which both won, everything else had already broken out.

Looking at the charts, today was one of those days when the market just behaved itself and everything would have won using this method.

So, when to go live with all of these?

Oh, the GER40 would have won as well but again I got distracted by work so missed it, really need to give up this day job!

1 Like

Couldn’t trade London open due to work so did NY open and all was looking good until about half an hour in when everything reversed on me, so 2 wins from 6 today.

London open looked to be good, NY, not so much.

I’ll do a proper update tomorrow.

I decided to try taking late trades today as the win rate looks to be better, so all trades were taken after 8:30am or half an hour after London open.

Another roller coaster, at first it looked like all 6 trades would lose, then it looked like they would all win and eventually I got 3 wins and 3 losses! I did manage to close one trade early for a smaller loss so overall a very slight profit on the day. And for once I got it right, USDCAD would have hit my SL for a $25 loss but I closed it for only a $10 loss, a small “win”!

It was probably a day to not do any trading as everything was pretty sideways but quite volatile, if you know what I mean!

In the event leaving it until later didn’t gain me anything and if I had done my usual strategy I might have had 4 or 5 wins, it’s hard to know for sure as the moves on some of the pairs were not very big.

Another incredibly frustrating day, 3 wins from 6 but another 1 pip on the SL and it would have been 5/6

So, I’ve gone through a load of trade history and worked out my optimum SL, which I used today, but the ranges for the 3 losing trades were bigger than normal so I should have made the SL bigger or not traded them.

The trades were all at 1/1 so on paper a break even day but with spread and charges it’s a small loss.

I’ve amended my notes so I will have everything setup in future so I don’t repeat this mistake.

When I draw my boxes I will put a Long/Short position onto the range so I can see exactly how big the range is before taking any trades.

I have made notes so I know what the “normal” range is and if it’s bigger than that I need a bigger SL.

I need to be better prepared, I will focus on this in future.

4 Likes

The 1H breakout would have been good today, I missed it - 3 wins from 4 at 1.5 RRR

Had to do the school run as my wife was poorly, too much to drink on her birthday!

1 Like

We’ve all been there.

(The alcohol, I mean; not necessarily the school runs!).

I was very well prepared today, did everything right, SL all set properly, entry was all good and 5 losses from 5 trades. The USD just strengthened about 5 minutes into the trades when they were all just starting to show profit and wiped me out.

I am now going to only go for late trades after 8:30, my backtesting shows a better win rate for this although there will be fewer trades.

Another week like the last two and I will probably call it a day for this strategy as I will be showing a loss, currently just about 1% in profit and I am now back to where I was in early February, feels like I wasted two months.

I do feel like I’ve learned a lot but the results don’t show it.

Had I waited until 8:30 today then it would have likely been 3 or 4 wins from 4.

1 Like

That’s most important!

I know it doesn’t always feel like it, but at this stage that’s actually less important. They will!

3 Likes

Just had a look at the NY open and it was scarily similar to London, everything reversed quite early and late trades would have been almost 100% successful.

So I will definitely be taking only late trades from next week.

Did more backtesting on the GER40 breakout and that is looking good to trade as well, will keep using my personal Pepperstone account for that, just minimum lot sizes, today I made 9% profit on just that one trade.

The 1HR breakout also looked good today with 3/5 wins at 1/1.5 and finally I am looking at trading the US30 using price action and some rules for entry/SL to try to make a system.

Will post more about that next week.

1 Like

Market was a basket case this morning, so no trades using my standard strategy, I left well alone. The range for AUDUSD for example was 4 times the normal range, in that case I did right as it didn’t move far from the original range and there was no winning trade in it.

I am doing a couple of new things, will report back later.

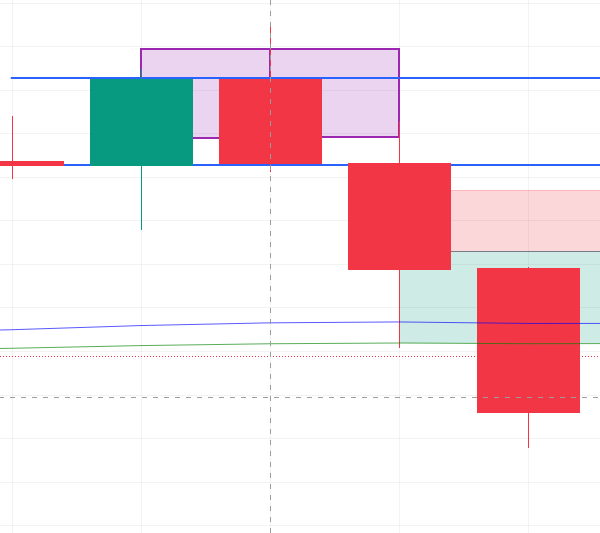

Here’s last weeks tale of woe, worst week to date:

1 Like

My pension has lost £20k since Trump announced his tariffs, I know it will recover but jeez, that’s nearly 20%

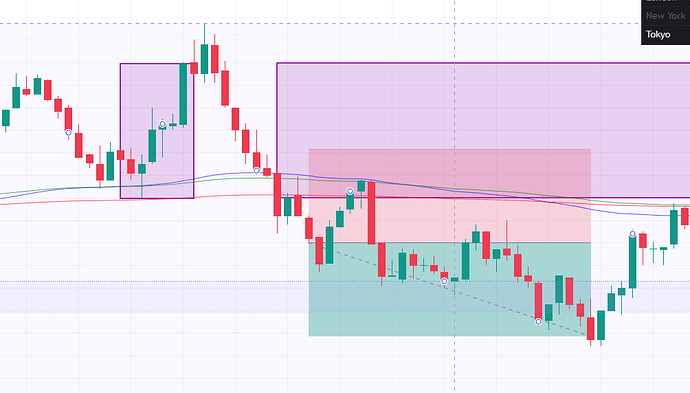

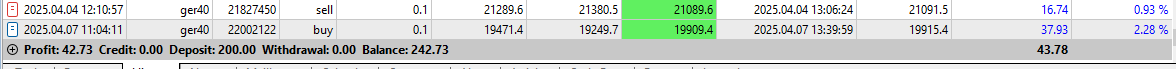

Anyway, that explains the markets being so screwed up this morning, I did take a trade on GER30 again and this was another winner for my Pepperstone account, just minimum lot sizes here for now:

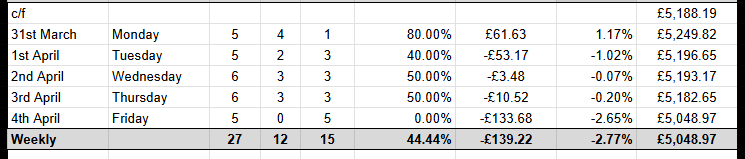

So my new ideas, first one isn’t really a system it’s more price action. This is on the US30 Index, using 30min timeframe and Heikin Ashi candles, this was today’s trade:

The idea is to trade during London/NY market times, more of a bias towards NY as the moves are bigger - this index has very long trends versus most Forex pairs so I am not yet 100% on the TP yet but the entry is simple.

If there are two consecutive candles (bullish or bearish) with no trailing wick (or a very small one) then enter the position, as I did today.

Now I used a TP of 1/2 here and it hit pretty quickly but I am thinking a trailing SL might be best as there are very large potential gains on this. Sure, you will probably only get a 30% or so win rate but I think you could conceivably see 10/1 wins or better. I will keep an eye on that and try to refine the technique.

I’m trading this as well as the 1H London open breakout strategy using a new qualifying account, this is a 10k account with Maven. I find my backtesting is not very accurate so I am trading using a real account, it was only ~£30 to buy the account so I am comfortable doing this. So far only using minimum lot sizes for this account.

That’s a 0.15% profit so far then

And this is my Pepperstone account, I traded the GER40 again today and now two wins in a row, again minimum lot sizes as I am still refining this strategy.

I read the markets this morning the exact same way. Nothing I do would have made any sense.

1 Like

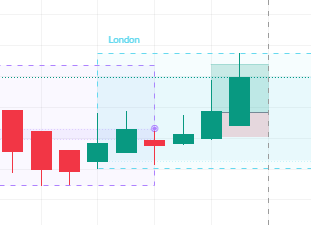

First day trading using the later breakout variation, markets looked back to fairly normal so I was OK to go ahead.

I set the time limit at 30 minutes after the London open to start looking for trades, 4 wins from 4! (I did cash one out a bit early so not quite the full profit on that one, details below.)

It’s too early to tell if my usual strategy would have resulted in, but I will do that comparison a bit later.

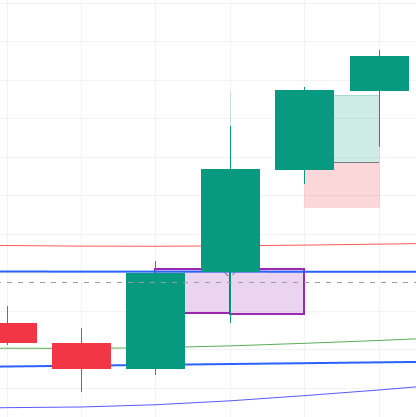

All the trades hit TP fairly quickly (1/1), the only one that was a bit of a pain was USDJPY:

So this is the one I cashed out early, it kept hitting the 147.00 level and bouncing off it, my TP was just below, look how close it got!

So I took a $17.32 profit rather than ~$25 but happy with that, in the end I made the right decision for once!

Nearly 2% profit on the day, just need to keep some consistency now.

2 Likes

Mixed bag for the rest of today, all the 1H London breakout trades lost, not seen that before, the market just went against me at 9am and none really showed any profit at any stage.

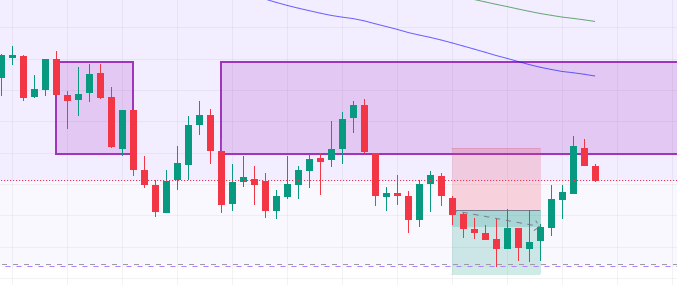

The GER30 trade won at 2/1, that’s three days in a row now. I might have to start using proper lot sizes now as I’ve just been using minimum lots for testing which is why the results look a bit weird.

I was a bit unsure with this one as the range wasn’t broken until four hours after London opened, but it turned out to be a good trade. I could have used a smaller SL here, note the resistance/support levels I marked out, this isn’t usual for this index.

What’s proper for you? Like a full 1 lot?

I use a calculator to calculate lot sizes based on my account balance and my risk amount per trade, currently 0.5%

Not sure what that would be for my Pepperstone account as it only has £260 in it, might be too small a balance to work, I will have a go tomorrow.