In the last years, the renminbi made a pause in his attempt to get stronger against USD dollar. In February 2014, renminbi found support at 6.0153 and from there it made a perfect zig – zag correction structure to equal legs at 7.1964 in June 2020. After that, the USDCNH continue with the downtrend.

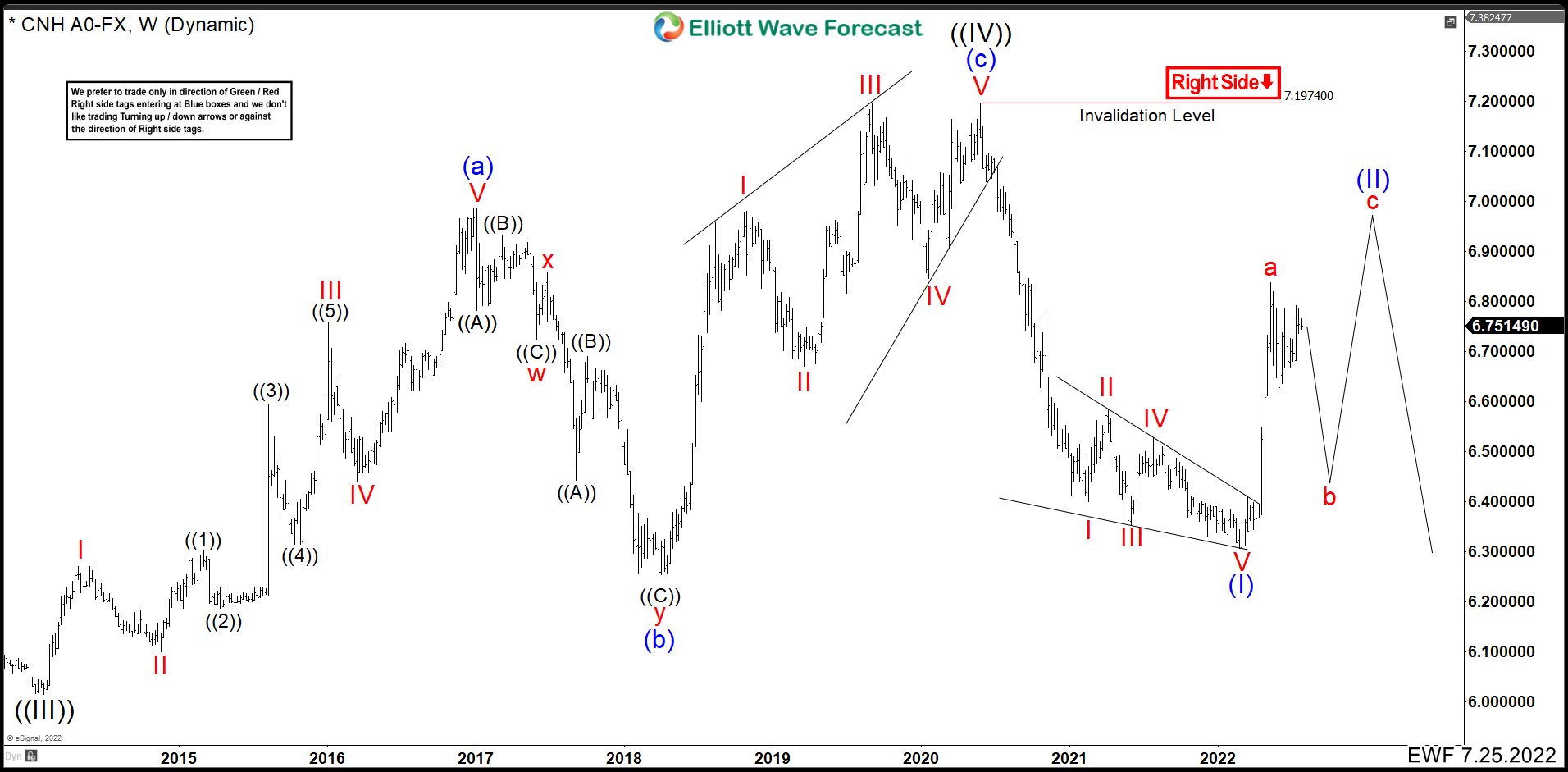

Renminbi July 2022 Weekly Chart

This zig zag structure took place as wave ((IV)), telling us that the renminbi should appreciate against the USD in long term. In June 2020, the pair dropped again possibly making a leading diagonal, that was the pattern we drew in the chart. If that structure played out we should see a bounce before continue with downtrend. Only a break lower of 6.3052 level will confirm that wave (II) is completed and the bearish trend will continue. After a year, the structure did not play out and the market broke above June 2020 high beginning a double correction structure.

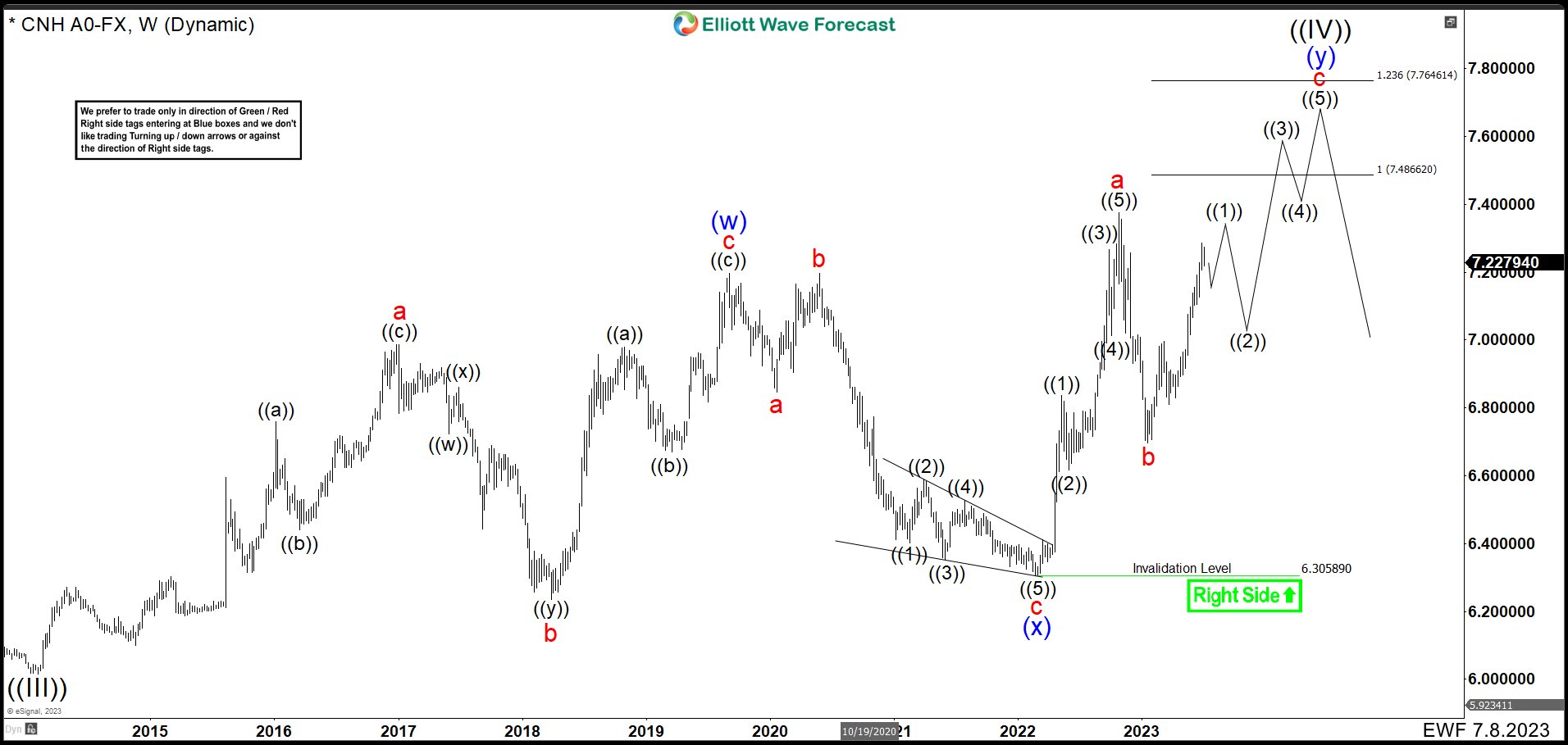

Renminbi July 2023 Weekly Chart

The wave “a” began at 6.0153 (2014 low) and moved high in 3 waves structure almost hit 7.00 dollars ending at 6.9854. After this zig zag correction, we have a huge drop to 6.2359 developing a double correction structure to end wave “b”. The volatility did not leave things like that an enormous rally took place in the beginning of wave “c”. This movement developed again 3 waves higher completing wave “c” at 7.1974 and also wave (w) reaching the equal leg extension.

After that, we could see that an expended flat correction took place as wave (x) completing as an ending diagonal bouncing hard from 6.3058. This move higher looks like an impulse and we labeled as wave “a” ended at 7.3748 above wave (w) confirming the bullish sequence. Then USDCHN made a wave “b” ended at 6.6883 and bounced in the last leg higher. Currently, we are looking to develop an impulse higher to 7.4866 - 7.7646 area to fisnish wave “c”, the double correction wave (y), and the wave ((IV)) before renminbi continues with the downtrend.