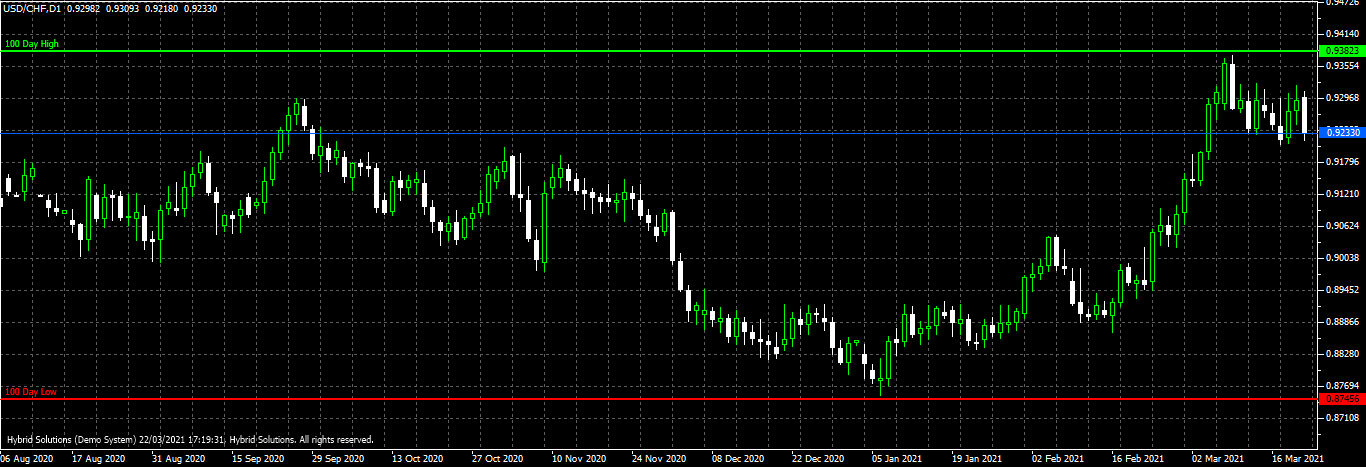

The Reversal Trend following Autotrader is an always in the market trend following strategy. This is a 100 bar high low breakout strategy. Trend following systems uses different strategies like breakout, moving averages. Usually, trend-following systems are applied to a portfolio containing different asset classes. The aim is to capture some big trends and profit from them. The downside is it makes small losing trades many times and profits from big trends. It is important to use such systems in a diversified portfolio.

This system is run on daily charts. The system exits sell positions and open buy position when price break above 100 days high and exit buy position and open a sell position when price break below 100 days low. Positions are opened after a breakout is confirmed. For a buy, First bar close above last 100 day high, then next bar close above the high of the breakout bar. At the next bar open the Autotrader buys. Money management is an important factor in using trend following systems because they remain in drawdown for longer periods. Use this system on multiple symbols at the same time and divide a small part of the capital for a symbol. Never use full capital among all symbols. The portfolio might contain noncorrelated assets including index futures, bullion, currency pairs, etc.

Reversal Trend Following.zip (2.4 KB)