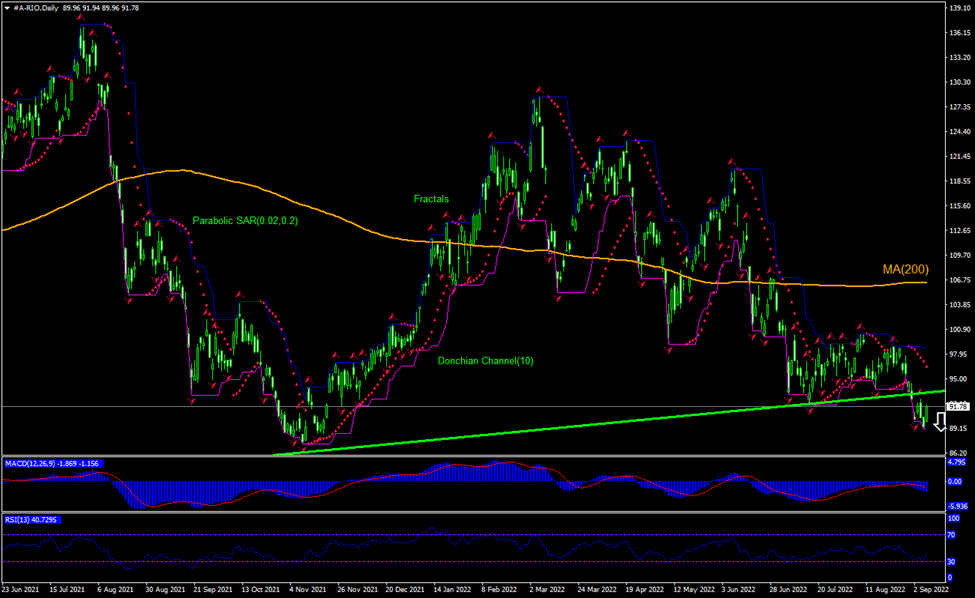

Rio Tinto Ltd Technical Analysis Summary

Below 89.06

Sell Stop

Above 92.6

Stop Loss

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Neutral |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

Rio Tinto Ltd Chart Analysis

Rio Tinto Ltd Technical Analysis

The technical analysis of the RIO TINTO stock price chart in daily timeframe shows #A-RIO, Daily is retracing down under the 200-day moving average MA(200) after rebounding to two-month high four weeks ago. We believe the bearish momentum will continue after the price breaches below the lower bound of Donchian Channel at 89.06. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the fractal high at 92.60. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (92.60) without reaching the order (89.06), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Rio Tinto Ltd

RIO TINTO stock dipped after a report the miner faces lawsuit in US over Mongolian mine cost overruns. Will the RIO TINTO stock price continue retreating?

Rio Tinto Plc is a publicly traded Anglo-Australian multinational mining company with headquarters in London, the United Kingdom. Company’s market capitalization is at A$133.41 billion. Rio stock is trading at P/E Ratio (Trailing Twelve Months) of 5.96. The company earned $60.19 billion revenue (ttm), a Return on Assets (ttm) of 14.46% and a Return on Equity (ttm) of 32.83%. A US court ruled Rio Tinto Plc must face a lawsuit accusing the mining giant of concealing delays and huge cost overruns at a Mongolian copper and gold mine owned by Turquoise Hill Resources in which Rio Tinto has a majority stake. Pentwater Capital Management LP, Turquoise’s largest minority shareholder with about a 10% stake, accuse Rio Tinto and Turquoise of fraudulently assuring that the $5.3 billion Oyu Tolgoi mine was “on plan” and “on budget,” even as it was falling up to 2-1/2 years behind schedule and coming in as much as $1.9 billion over budget. Shareholders of Turquoise, who are seeking damages from Rio, said their investments lost close to three-quarters of their value as the truth became known. Rio Tinto said Pentwater’s claims were unfounded and said it had consistently complied with its disclosure obligations. Earlier this month, Rio Tinto agreed to pay about $3.3 billion for the 49% of Turquoise it does not already own. RIO TINTO stock retreated 1.1% on the day after the lawsuit news was made public. Possibility of big legal liability is bearish for a company stock price.