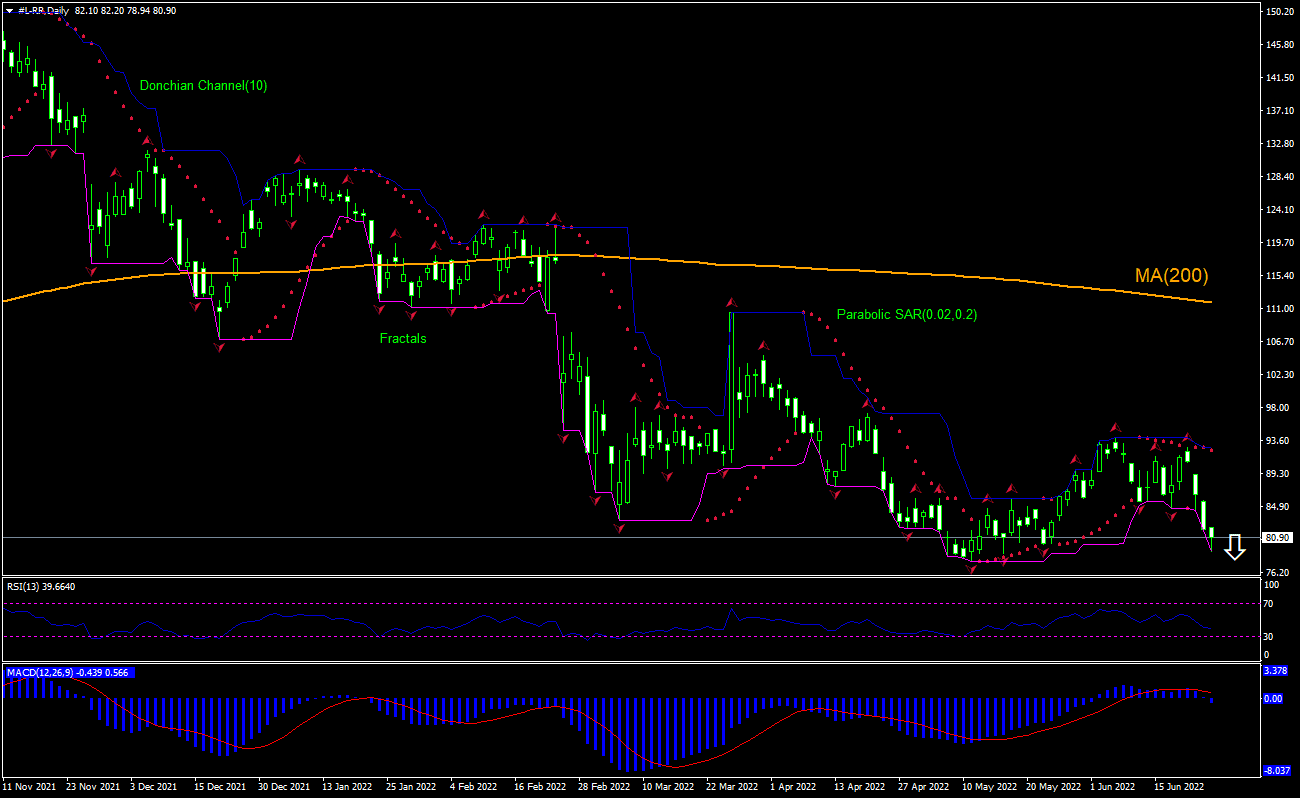

Rolls-Royce Holdings PLC Technical Analysis Summary

Sell Stop: Below 78.94

Stop Loss: Above 92.70

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Neutral |

| Parabolic SAR | Sell |

Rolls-Royce Holdings PLC Chart Analysis

Rolls-Royce Holdings PLC Technical Analysis

The technical analysis of the Rolls Royce stock price chart on daily timeframe shows #L-RR,Daily is retreating after hitting twenty-month high eight months ago and has fallen below the 200-day moving average MA(200) which is falling too. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 78.94. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the fractal high at 92.70. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (92.70) without reaching the order (78.94), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Rolls-Royce Holdings PLC

Rolls Royce stock ended down after the workers’ union rejected company’s offer on inflation compensation. Will the Rolls Royce stock price rebound?

Rolls Royce Corporation is a British industrial corporation. The company manufactures and sells engines for aircrafts and ships as well as power generators globally. Company’s market capitalization is $8.87 billion. Rolls Royce’s stock trades at price-to-earnings (P/E) ratio of 58.8 for trailing twelve months (ttm). Over the past 12 months, it has generated revenue of $11.22 billion and Return on Assets (ttm) of 1.00%. Last Wednesday a union representing Rolls Royce Holdings workers in the UK rejected the company’s offer of a £2,000 single payment to compensate for inflation. The union known as Unite argued that the offer “falls far short of the real cost of living challenges which our members are experiencing.” Rolls-Royce CEO Warren East, who made the offer, said that a “simple wage increase” was "just not affordable”” as it would damage the company’s “future competitiveness in the UK, by adding too much cost into the long-term wage bill at times of such high uncertainty.” Stock price closed 4.6% down on the day after the news.