Had one of the worst weeks ever. really devastated. I am going to have to conduct a thorough review before i even consider getting back in the game. This could take a while.

USD/SGD Long

Price: 1.25472 SL 1.2508 TP: 1.2628 closed at SL

net - .61%

USD/JPY Long

Price: 79.691 SL 79.384 TP 79.991 closed at 79.98

In this trade my platform was messing up as i was trying to squeeze, ended up having to close at market which cost me 1.1 pips not much but still annoying.

Net +.46%

GBP/USD Long

entry 1: Price 1.56861 SL 1.5656 TP 1.5716 Closed at SL

entry 2: Price 1.56627 SL 1.5633 TP 1.5716 Closed at TP

Another compound entry turning the 1st trade into a net winner. getting better at these.

Net: +.25%

EUR/JPY Short

Price 106.41 SL 106.81 TP 105.776 closed at SL

Net - .51%

Eur/Usd short

entry 1: 1.3347 SL 1.3387 TP 1.3307 closed at SL

entry 2: 1.33851 SL 1.3425 TP 1.3307 Closed at SL

entry 3: 1.3424 SL 1.3464 TP 1.3307 Closed at SL

compound entries dont always work hahhahaha

net -.75%

CAD/CHF Long

Price: .9028 SL .8982 TP .9078 closed at SL

net -1.037%

Weekly results

Total Trades 6

Total wins 2

33% winrate ( yeah that realy sucks doesnt it)

net - 3.37%

Meihua, do you remember your emotions and thoughts during the entries of EUR/USD 2nd and 3rd, plus the CAD/CHF long?

all of those trades were preplanned at least 1 day in advance. so there was no emotion or psych involved. I use all limit orders as it was. But yes i do keep a psych journal just in case.

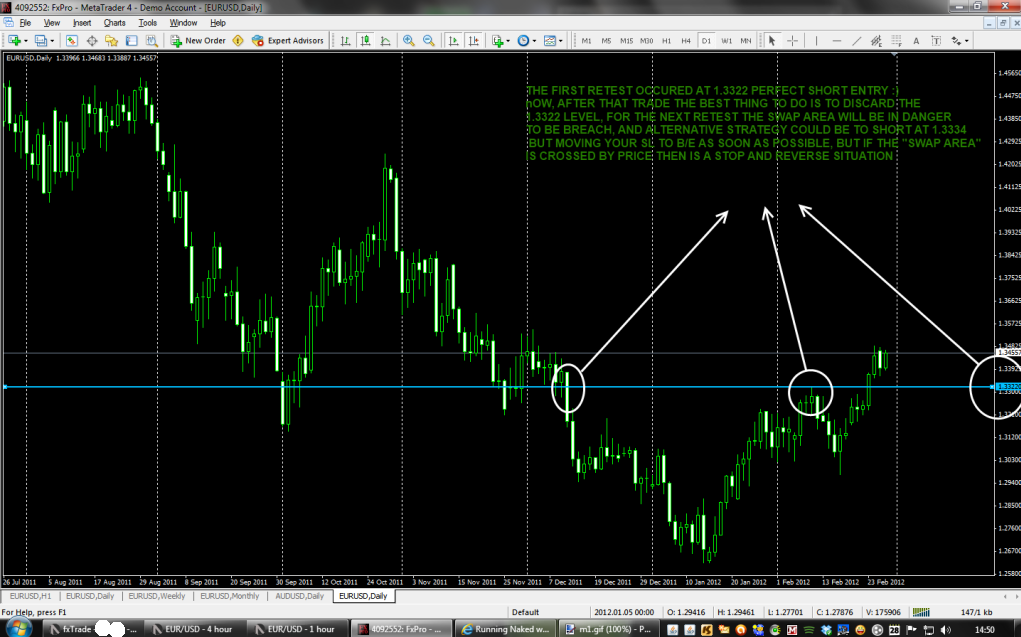

MeiHua, Why did you take these trades? other than 1.3334 resistance level, there was nothing that could stop price to go up.

So heres a break down of my analysis on the EUR/USD short. I hope it explains my thought process.

Daily level breakdown:

SO here is the pic of the daily level, I have a Level on Level situation. The Red lines and the orange box represent the Virgin daily level and the pink link and box represent the daily level above. This has been touched once as marked by the X but was not penetrated deeply. The next level below was the origin of a precipitous drop in price. The first leg was measured at 398 pips with the daily swing low measured at 715.

Internal Analysis:

So the entire khaki colored box is the daily levels as shown in the chart above. We are now looking internally at a 1H chart. Here we can see multiple internal supply levels inside a larger time frame supply level. giving us multiple points of Supply/demand confirmation.

Now we can see how price reacted.

So we see here in the baby blue area which was the origin of the move down we see i miss getting filled and price moved down 75 pips without me by 4.7 pips. But the order was still valid so i left it on. Price swings up and gets into my 4H zone and stops dead for 10 hours. Creating a lot of pin bars and inside bars. No dice. And now as you can see price poked out of the top of my entire zone and has swung down 117 pips so far making lower highs and lower lows on a 1H.

I hope that this shows my thought process. I dont know if i will regret giving away my secret sauce really. But this is the type of analysis i do to see if i made any errors or if there is something i can tighten up. But really these are the kinds of movements I am looking for with SnD and I have no idea how it fits in with any other system. For me this was a good trade that followed my system so losing doesn’t matter.

I dont think you should have any regrets on revealing your though process or so called ‘secret sauce’.

in fact i think it gives you a clearer reality of your though process and perharps allow others to see and improve on what you have just laid out.

still i think its a good plan, just that drawdowns are inevitable.

good luck!

MeiHua, your method is almost identical to the one I use, there are some flaws (in my view) in how you picked out your levels to trade. Today I am kind of short of time but tomorrow I will post my analysis here.

MeiHua, this is my view. Not saying is the correct way to trade. These levels were studied only with supply and demand theory.

URLs in case you can not see the text in the images

http://i1086.photobucket.com/albums/j449/yunny11/m1.gif

http://i1086.photobucket.com/albums/j449/yunny11/m2.gif

http://i1086.photobucket.com/albums/j449/yunny11/M4-1.png

http://i1086.photobucket.com/albums/j449/yunny11/m3.gif

When you entered these three trades you were trading against supply/demand and the trend, therefore a low probability trade considering that you were aiming for 1.3307

Hope I made sense, spanish is my first language…

Actually I have been working on psych and going over some stuff from mark douglas has been great. His interview Mind over Markets and “Learning Flawless Execution” have really come at a time of need for me and hit the nail right on the head. Now lets see if I can continue to bring that type of thinking into my trading for the rest of the week.

I haven’t been doing this thread much anymore. But I thought I would give an update. I dont trade spot forex much anymore, except for the occasional longer term swing trade. I have moved to futures trading, which includes currencies but also been trading stock index futures on an intraday basis. Also I have dedicated myself to going full time and have taken the leap of faith. I started a few weeks ago not quite a full month yet.

It has come with a huge slew of psychological problems and pressures. ones i could have never imagined when i was trading as a hobby, when your rent, your food and real money that may mean something at the end of the month. Its a whole new frame of mind, as demo is to live, live as a hobby is to live as a full timer. But I have found solid planning, journals, reviewing, creating routines, Tech analysis, fundi analysis, sentiment analysis… Every tool in the toolbox that i collected here on baby pips coming together in a way that is more fluid. To be perfectly honest this thread has actually documented 90% of my development. I want continue to journal personally because it was my beginning, the true start of this entire endeavor. its just what I have to say isn’t about my system development most of the time. My trading development for this entire year has had little to do with systems or entries and exits.

But for all those preparing to take the leap to full time, I can tell you it is completely possible. For those who have taken the leap, gosh I hope I can be as strong as you. Admittedly i still come to this forum for friends and the support network it provides. While trying to give back to that same community. I really wish I could continue this thread the way I imagined it. But my trading has taken a new form. I don’t want this thread to die, so i may post random thoughts and things that have helped me in my continued trading development but its not going to be as system development and refinement focused. The system is documented quite clearly here. I would love to thank all the readers both lurking and posters for their support to my development. I can whole heartily say without this thread, the baby pips community, i would not have accomplished so much so fast.

I created this video to kind of synthesize the basics of Supply/demand trading system that I use. I am in no way claiming that I created Supply/Demand nor am an expert trader/mentor. I just was asked to create a video and thought it might be helpful to others as well as myself. I hope you guys enjoy. Also if anyone has any feedback i would love to hear it.

Hi MeiHua

Great video, thanks for putting it together.

Any update on your performance, I know you are full time now, how’s that going?

Are you still using this system, or have you changed it?

Cheers

Yes, I am 100% full time trader now. Its going pretty well, i have to say that i am getting much much more consistent than I ever was as a part time trader/ hobbiest. I have to admit I dont trade this system as is currently. This is just straight up Supply Demand and multiple time frame analysis. I do use supply demand levels on a daily basis though. I trade futures now, mostly stock index and some commodity futures. So i use my levels 1H 15M 5M levels as well as some internals and volume analysis to find confluence or support my trading ideas. I would say that basic price action and supply demand are still very fundimental building blocks of my trading system. But as I have evolved and changed instruments I have found tools that work well with what I am doing. I do believe in the system I showed and the steps I took in this thread is the journey everyone should take when they are starting out, find the tool they like, document their analysis and trades, and make it public not only to keep them honest to themselves but also to get outside opinions. i am still sharing trades and working with other full time futures traders and continuing this circle of progression. It is just not in the scope of babypips. I can tell you this, the development i showed here can take you to full time. Its not the system, its the work. Copious note taking, journaling and screenshot, constant review of past trades, and being open and humble to criticism. This system may or may not be enough to take someone over the edge to profitability. But if you put in the work it will come.

Thanks for your response.

I have been through a lot of systems this year, and this one seems to gel most with the way I see myself trading.

For the first time I’m starting to actually create my own rules, and guidelines based on my own analysis as opposed to listening to what people say, but there’s a lot of work to be done. This thread is a good example of what can be achieved with the right amount of work, and the right mindset, so congrats to you.

I’ll put some thought into my own thread, it never occurred to me before, I guess I’m not comfortable with putting myself out there-something to think about.

You mentioned that you use volume, but I see a lot of controversy around the subject, especially since the Spot market is so unregulated, the volume feed I get from my broker may not reflect the entire market accurately. So are you using volume in commodities only, or does it work because you are trading currency futures?

Thanks for your time.

I guess I could google it, but I know you are dying to give me the answer

So basically we are looking at the number of ticks (price changes) that occurred in a single bar per timeframe?

Then why is it called volume? And how can it actually be better or have any meaning at all in futures?

The price could dart between two prices for an interval but that means nothing.

Then I guess in Spot forex we could estimate the volume based on the price change versus the amount of ticks.

So low tick volume accompanied by large price movement in a single bar means price made a big change due to one or two large institutions making an order. And high tick volume with a small price change either means lots of small orders or big orders cancelling each other out. Seems a bit like voodoo. I’d like to hear from Meihua how he uses it in Futures.