Wall Street futures remain choppy despite fresh highs, while ASX 200 slips towards support as bulls prepare for a potential swing low.

By :Matt Simpson, Market Analyst

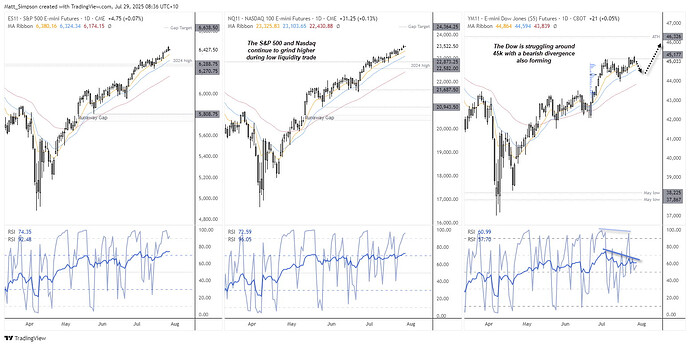

S&P 500 and Nasdaq 100 futures reached new record highs on Monday, although trading conditions remain choppy and both indices gave back much of their early-week gains. Wall Street futures gapped higher at the open following news of a US-EU trade deal, but sentiment around the agreement is mixed. France criticised the 15% tariffs as a “submission,” while other member states view the deal as better than no deal—albeit far from ideal.

View related analysis:

- ASX 200 Eyes 9,000 as Bulls Defend Dips Ahead, RBA Mins In Focus

- AUD/USD Slumps, ASX Hits Record as RBA Rate Cut Bets Rise After Soft Jobs Data

- ASX 200 Rally Stalls Below Key Resistance as Seasonal Tailwinds Fade

Wall Street Futures Mixed After Highs, ASX 200 Nearing Key Support

- S&P 500 futures are holding above 6400, though a 2-bar bearish reversal pattern (dark cloud cover) has formed on the daily chart.

- Nasdaq 100 futures printed a small shooting star candle, and with prices extended above the 10-day EMA, a minor pullback could be due.

- Dow Jones futures are struggling to gain traction above the July high and show the potential to dip back below 45,000 in the near term. Bearish divergence has also formed on the daily RSI (14).

Chart analysis by Matt Simpson, Source: TradingView, CME Futures, S&P 500 E-mini Futures, NASDAQ 100 E-mini Futures, Dow Jones E-mini Futures

Click the website link below to read our exclusive Guide to index trading in Q2 2025

https://www.cityindex.com/en-au/market-outlooks-2025/q2-indices-outlook/

ASX 200 Futures (SPI 200) Technical Analysis

Last week I outlined my bias for the ASX 200 to retreat lower before continuing its move towards 9,000. Prices have indeed been grinding lower and may well move towards the high-volume node (HVN) at 8,537 before a low is found. For now, the ASX 200 is holding above the December high, so we should also be on guard for a swing low to form soon, given its bullish trend structure on the daily chart.

A double bottom has formed on the 1-hour chart around the December high, leaving the potential for a bounce in todays session. Though Monday’s relatively long, bearish inside day suggest bears remain in control and a move towards the HVN (8535) remain on the cards. At which point, ASX bulls could reconsider its potential for a swing low to form on the daily chart.

Chart analysis by Matt Simpson - Source: TradingView, ASX SPI 200 Index Futures, S&P/ASX 200 Index

Key Economic Events for Traders (AEST / GMT+10)

13:35 JPY 2-Year JGB Auction (USD/JPY, EUR/JPY, AUD/JPY, Nikkei 225)

16:00 SEK GDP (Jun/Q2) (EUR/SEK, USD/SEK, GBP/SEK)

16:00 NOK Core Retail Sales (Jun) (EUR/NOK, USD/NOK, NOK/SEK)

17:00 EUR Spanish GDP (Q2), Retail Sales (YoY) (Jun) (EUR/USD, EUR/JPY, EUR/GBP, IBEX)

18:00 EUR Italian Trade Balance Non-EU (Jun) (EUR/USD, EUR/JPY, EUR/CHF)

18:30 GBP BoE Consumer Credit, M3, M4, Mortgage Lending, Approvals, Net Lending to Individuals (Jun) (GBP/USD, EUR/GBP, GBP/JPY, FTSE 100)

19:30 EUR German 5-Year Bobl Auction (EUR/USD, EUR/GBP, EUR/JPY)

20:00 EUR France Jobseekers Total (Jun) (EUR/USD, EUR/JPY, EUR/GBP)

22:00 EUR Spanish Consumer Confidence (Jun) (EUR/USD, EUR/JPY, EUR/CHF)

**22:30 USD Goods Trade Balance, Retail Inventories ex Auto, Wholesale Inventories(**Jun) (EUR/USD, USD/JPY, GBP/USD, S&P 500)

22:55 USD Redbook (EUR/USD, USD/JPY, AUD/USD, S&P 500)

23:00 USD House Price Index, S&P/CS HPI Composite 20 s.a./n.s.a. (May) (USD/JPY, GBP/USD, EUR/USD, S&P 500)

00:00 USD CB Consumer Confidence (Jul), JOLTS Job Openings (Jun) (USD/JPY, EUR/USD, USD/CAD, S&P 500)

00:30 USD Dallas Fed Services Revenues, Texas Services Sector Outlook (Jul) (USD/JPY, USD/CAD, EUR/USD, S&P 500)

01:30 USD Atlanta Fed GDPNow (USD/JPY, EUR/USD, AUD/USD, S&P 500)

02:00 USD 7-Year Note Auction (USD/JPY, EUR/USD, GBP/USD, Treasury Markets)

View the full economic calendar

– Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.