US equity indices already reeling from a big drop in shares of Amazon post its earnings, dropped further thanks to the weak jobs report (and the ISM survey that was released later) at the time of writing on Friday afternoon, just before the London close.

By :Fawad Razaqzada, Market Analyst

US equity indices already reeling from a big drop in shares of Amazon post its earnings, dropped further thanks to the weak jobs report (and the ISM survey that was released later) at the time of writing on Friday afternoon, just before the London close. The key question is whether rising rate cut expectations will outweigh concerns about growth for equity investors. Tech earnings have been decent, Amazon aside. Other economic indicators outside of employment haven’t been too bad given the higher tariffs. Yes, valuation concerns are likely to come under the spotlight, but with the markets being so strong in recent times, shrugging off one bearish news after another, can we see dip buyers step back in? in the week ahead, there is not much in the way of data except the ISM services PMI to guide sentiment. But we do have more earnings, and should we see continued strength the results, this could keep the bull market running for a while longer. It may be far to early to declare an end to the bullish S&P 500 forecast.

Weak jobs data boosts September rate cut probability

It was all about whether the probability of a September cut would change dramatically in reaction to this data release. Well, it certainly has – rising to 75% after today’s data. That’s mostly thanks to the weak headline jobs data for this month and, notably, the big downward revision to the prior month. The report was, in no uncertain terms, a wake-up call. July’s non-farm payrolls came in at just 73,000—well below the 104,000 forecast—but it’s the massive downward revisions to previous months that truly rattle the cage. June’s figure was chopped from 147,000 to 14,000. May? Slashed from 144,000 to just 19,000. That’s 258,000 vanished jobs. Not a wobble—an outright stumble.

All eyes now turn to the Federal Reserve. Despite inflation still running warm, the Fed’s dual mandate includes employment—and this data screams weakness. The doves are circling. Fed Governors Waller and Bowman, who both backed cuts this week, warned the central bank may already be lagging behind the curve. After today’s numbers, more officials may agree. And if the next jobs data on 5 September also disappoints, then a cut becomes almost a certainty, with follow-ups likely in October and December, even if tariffs push inflation temporarily higher.

The takeaway is that the US labour market is losing steam fast. And unless the data surprises on the upside soon, the Fed may have no choice but to cut—and cut again. Against this backdrop, bond yields should now remain under a bit of pressure which may help support expensive tech stocks.

Did the labour market weaken because of tariffs?

It is difficult not to link the bad US data to the impact of tariffs. Indeed, it certainly looks that way, especially given that the slowdown in jobs started in early Q2 when reciprocal tariffs were announced. Companies expecting margins to be squeezed by higher duties probably thought twice about hiring workers in order to keep costs down. So, the US labour market has been losing steam fast, undoubtedly due to tariff concerns. Unless the data surprises on the upside soon, the Fed may have no choice but to cut sooner rather than later. Against this backdrop, the recovery in the dollar is going to be a long bumpy road, but the impact on stock markets

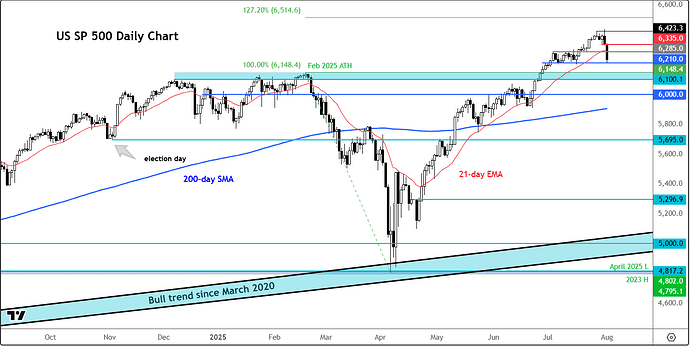

S&P 500 forecast: Technical analysis and levels to watch

Source: TradingView.com

The S&P 500 forecast from a technical standpoint remains bullish despite the big drop post NFP. More bearish price action is needed before we turn tactically negative on the US markets. At the time of writing on Friday, the S&P 500 was testing support at just north of the 6210 area, where it had previous rallied from. It did however break two important support levels including 6285 and 6335. These levels may now act as short-term resistance. Bullish if we can reclaim these levels relatively quickly. Meanwhile, if the selling continues then the next key support is between 6,100 and 6,148, marking the previous all-time highs that were eventually taken out in June. So, the technical bias is still bullish despite the sizeable two-day drop.

– Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.