S&P 500 hints at swing high following Powell’s hawkish speech: The Week Ahead

Hawkish comments from Jerome Powell with the threat of further hikes snapped Wall Street’s 8-day wining streak, and hints at a swing high on the S&P 500 heading into the weekend. And that puts traders on high alert for next week’s inflation report, not to mention the threat of a government shutdown if the debt ceiling is not raised by Friday.

The week that was:

- Wall Street rallied in the first half of the week with an 8-day winning streak (its best streak in two years) despite hawkish comments from some Fed members

- Yet a hawkish speech from Jerome Powell snapped the winning streak, seeing the S&P 500, Nasdaq 100 and Dow Jones formed bearish engulfing days on Thursday

- Powell warned that the Fed are not yet confident policy is tight enough and that they will not hesitate to hike again if need be

- Bond yields recouped some of last week’s losses, with the 2-year nearly recouping all by Thursday’s close (the 2-year is more sensitive to monetary policy expectations)

- The RBA Hiked their cash rate by 25bp to 4.35%, yet traders positioned for a hawkish hike were disappointed without a firm commitment to further hikes in the statement

- Oil prices continued to unwind with TWI crude oil falling to a 3-month low amid concerns over demand from the US and China

- China’s consumer prices slipped back into deflation at -0.2% y/y and -0.1% m/m, to show the level if stimulus to revive the economy remains inadequate

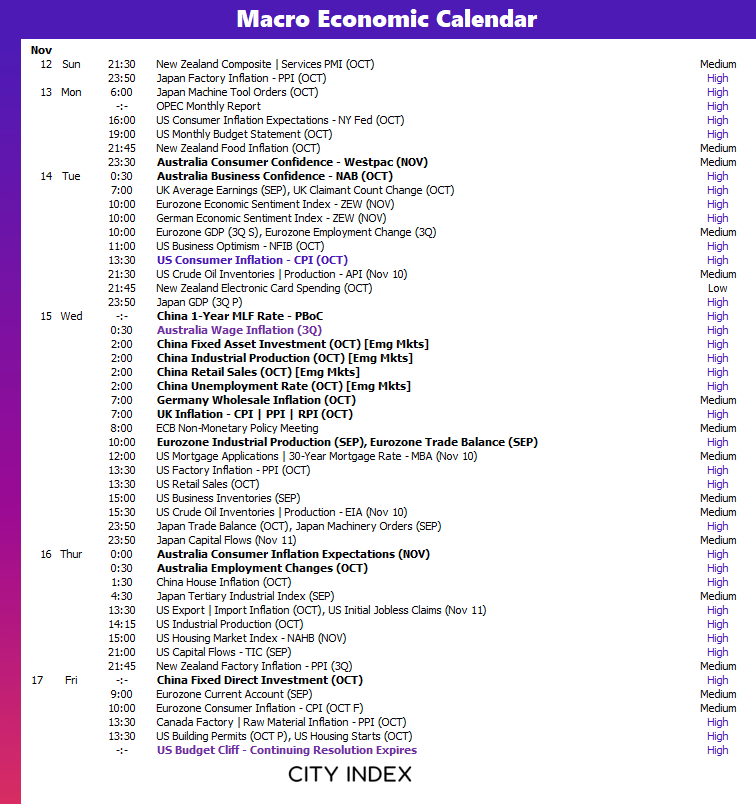

The week ahead (calendar):

This content will only appear on City Index websites!

Earnings This Week

Look at the corporate calendar and find out what stocks will be reporting results in Earnings This Week.

The week ahead (key events and themes):

The week ahead (key themes and events):

- US government shutdown

- US inflation

- Australian wage inflation employment data

- China data

US government shutdown

This topic keeps on resurfacing, and it certainly seems it is popping up with an increased frequency. But once again the US government is approaching a shutdown unless a resolution can be found ahead of November 17th, when the government is expected to run out of money. Mike Johnson, the new Republican house speaker, is expected to reveal his plans of how to avoid the catastrophe over the next coupe of days. But if history is anything to go by, talks will run to the final hour and could weigh on risk appetite, before the debt ceiling is inevitably raised once more to potentially see risk bounce.

Market to watch: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

S&P 500 technical analysis (daily chart)

The S&P 500 rallied just over 7% from the October 26 low to the daily high ahead of Powell’s speech, in a relatively straight line with a couple of bullish gaps along the way. Then Jerome Powell delivered his hawkish speech, traders took note, forcing bulls out and bears to reinitiate and close the day with a prominent bearish engulfing day.

This places a potential swing high around a cluster of technical levels including gap resistance, October highs, 4400 handle and a bearish trendline. As we head into the weekend, we might see the S&P 500 try and close the bullish gap around 4320, a break beneath which brings the 200-day EMA and lower bullish gap into focus.

US inflation

With markets still absorbing hawkish comments from Jerome Powell, next week’s inflation report becomes the more important because any signs of rising price pressures could see markets reprice the potential for another hike. With core CPI rising 0.3% m/m for the past two months and the annual rate still at 4.1%, it is difficult for the Fed not to maintain a hawkish narrative. And that could keep a lid on appetite for risk unless we’re treated to a refreshingly soft set of inflation numbers next week.

Market to watch: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

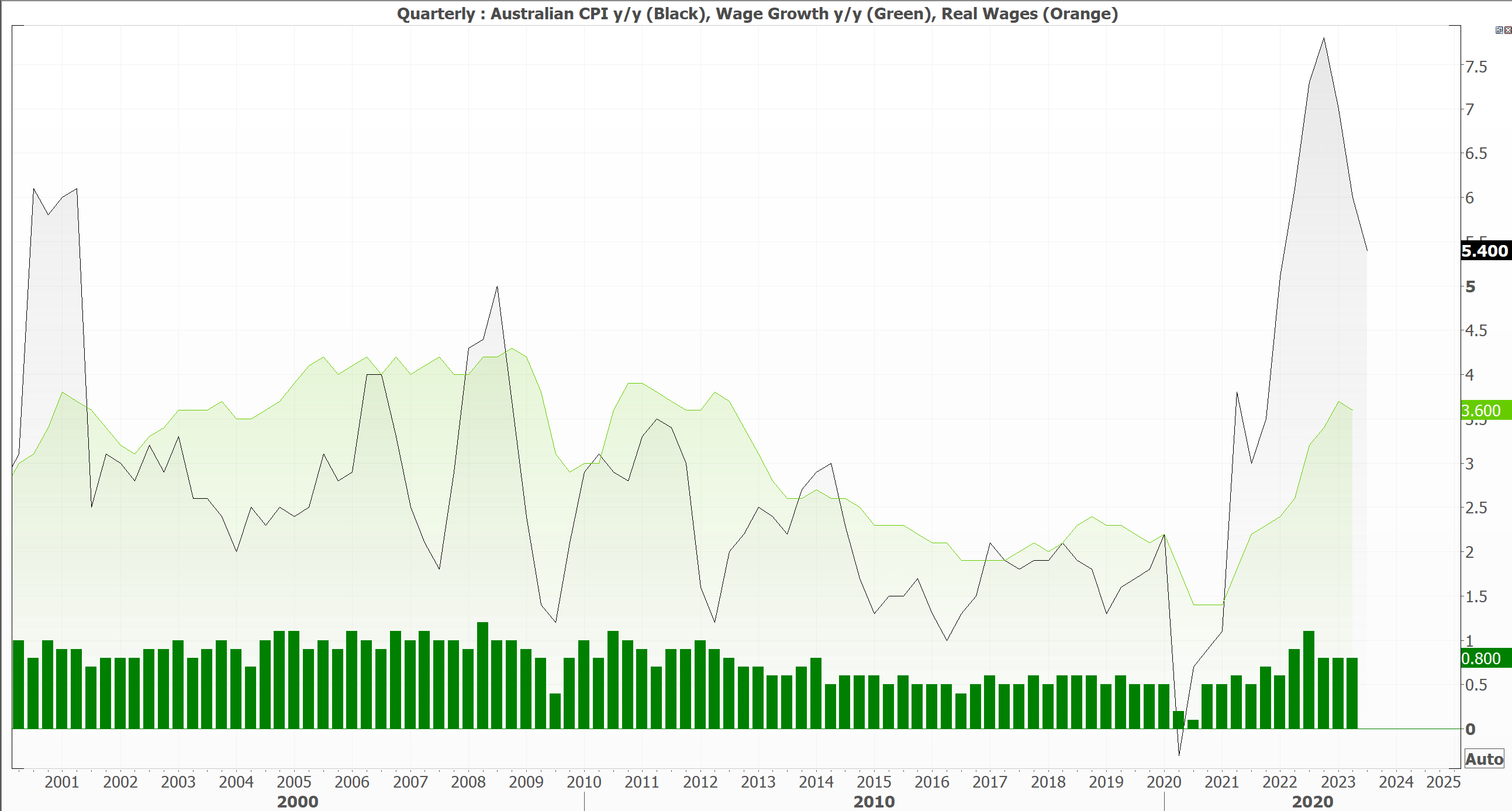

Australian wage inflation employment data

Despite a new governor at the helm, the RBA’s approach to hiking seems very familiar; do it as little as possible. When inflation data was broadly higher than expected, producer price and retail sales also beat, many economists upgraded their forecasts for two more hikes this year. So when they RBA delivered the 25bp hike alongside a slightly tweaked statement to suggest incoming data will decide if more hikes are to follow, some AUD/USD bulls were caught on guard. But now we know that the RBA remain very much in a data-dependent mode, that clearly makes incoming data the more important.

For the hawks calling for another hike or two, a hotter wage price index alongside okay or better employment data could be the key.

Market to watch: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

Data from China and Japan

Japan’s GDP is expected to contract by -0.1% in Q3 and post a trade deficit in October due to the weaker yen, according to ING. A slew of data from China is also in focus, including industrial production, investment and retail sales. Whilst retail sales are expected to rise, it’s likely down to a basing effect as last year’s lockdowns drop out of the annual figure. And with inflation and PMIs coming in softer, there’s now an expectation for industrial production and investment to follow suit. Whilst this is deflationary for the rest of the world, it also points to slower global growth.

Market to watch: USD/CNH, USD/JPY, S&P 500, Nasdaq 100, Dow Jones, VIX, AUD/JPY

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.