Southern Copper Corporation (SCCO) engages in mining, exploration, smelting & refining of Copper & other minerals in Peru, Mexico, Argentina, Ecuador & Chile. The company is based in Phoenix, Arizona, US, comes under Basic Materials Sector & trades as “SCCO” ticker at NYSE.

SCCO made all time high at $83.15 as wave I impulse started from March-2020 low of (II). Later, it finished II as flat correction at $42.42 low. Currently, it favors pullback in ((2)), while placed ((1)) at $82.05 high. It expects ((2)) to unfold in 3, 7 or 11 swings & remain supported at extreme area to resume higher in ((3)) of III.

SCCO - Elliott Wave Latest Weekly View:

It placed (I) at $58.09 high & (II) at $23.43 low in March-2020. It resumes higher in (III) & finished I at $83.15 high. It placed ((A)) of II at $54.92 low in 3 swings pullback, while ((B)) at $79.31 high. It finished ((C)) as 5 swings lower at $42.42 low to finish wave II flat correction.

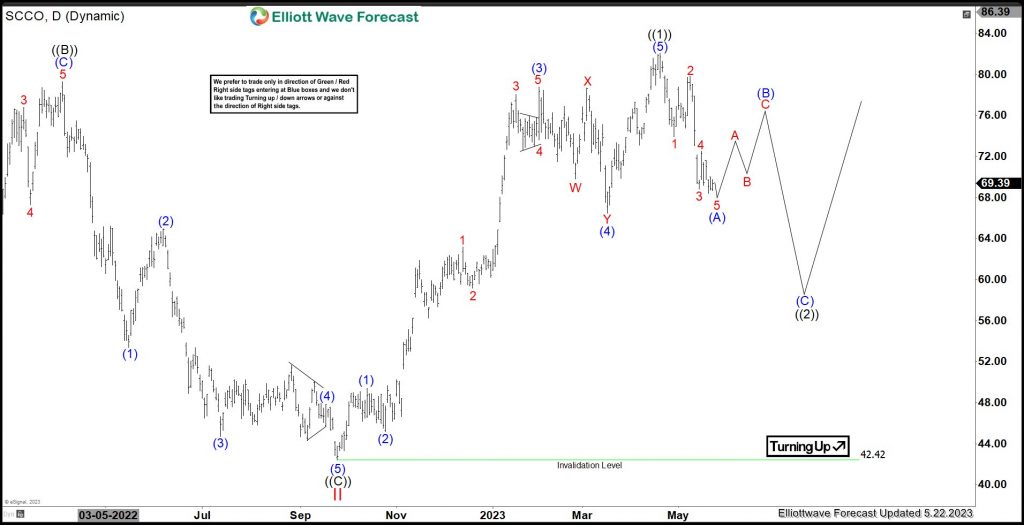

SCCO - Elliott Wave Latest Daily View:

Above II low, it placed (1) at $49.41 high & (2) at $45.17 low as 0.618 Fibonacci retracement. It finished (3) as extended wave at $78.76 high & (4) at $66.47 low as 0.382 Fibonacci retracement of (3). Finally, it ended (5) as ((1)) at $82.05 high. Currently, it favors lower in 5 of (A) & expect small downside before bounce in (B). It expects ((2)) to correct lower in 3, 7 or 11 swings against II low before upside resumes in ((3)) of III, which confirms above $83.15 high. Buyers expect to enter the market in extreme areas in ((2)).