A simple strategy I use to trade crude oil.

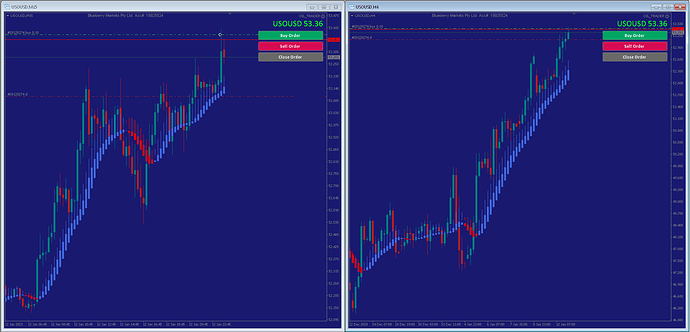

Time Frames: M15 to time entries and H4 or D1 to confirm

Indicators: (HAS) Heiken Ashi Smoothed MA1 Method 2, MA1 Period 6, MA2 Method 3, MA2 Period 5

ENTRY RULES:

Buy when HAS candle turns from red to blue on M15 if H4 or D1 HAS candle is blue. This rule also applies to add-buy-position trades.

Sell when HAS candle turns from blue to red on M15 if H4 or D1 HAS candle is red. This rule also applies to add-sell-position trades.

MONEY MANAGEMENT:

Entry Stop Loss is set at the low of the previous HAS candle for a buy, and high of the previous HAS candle for a sell.

Trailing Stop Loss is modified only if price action is completely clear of HAS candle. It is moved to the low of the previous HAS candle for buy positions, or the high of the previous HAS candle for sell positions. The trailing-stop-loss is used to close-out a trade.

Add Position Trades are allowed only if the trailing-stop-loss on an existing position is beyond breakeven. The above buy and sell rules apply.