Southern Copper Corporation (SCCO) engages in mining, exploration, smelting & refining of Copper & other minerals in Peru, Mexico, Argentina, Ecuador & Chile. The company is based in Phoenix, Arizona, US, comes under Basic Materials Sector & trades as “SCCO” ticker at NYSE.

As discussed in previous article, SCCO favors pullback in ((2)), which ended at $64.66 low. Above there, it resumes higher in (1) of ((3)) of III as the part of impulse sequence. It already breaks above ((1)) & I high confirm the bullish sequence trading at all time high. So, it expects to find support in 3, 7 or 11 swings at extreme areas to resume higher.

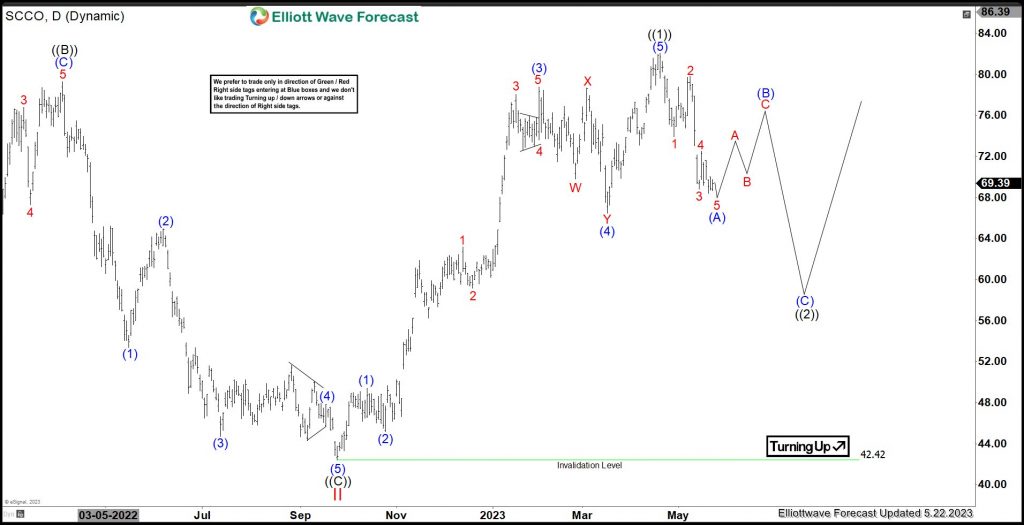

SCCO - Elliott Wave View From 5.22.2023:

It placed I at $83.15 high & II at $42.42 low as flat correction in weekly sequence. Above there, it favors higher in wave (1) of ((3)) of III. It placed (1) of ((1)) at $49.41 high & (2) at $45.17 low. It extended higher in (3), which ended at $78.76 high & placed (4) at $66.47 low as 0.32 Fibonacci retracement. Finally, it ended (5) at $82.05 high as ((1)). It corrected lower in ((2)) as zigzag correction, which ended at $64.66 low.

SCCO - Elliott Wave Latest Daily View:

Above ((2)) low, it resumes higher in (1) of ((3)) as it confirms higher high sequence. It placed 1 of (1) at $74.88 high, 2 at 67.64 low & 3 at $87.59 high. Currently, it favors pullback in 4 & expect small downside before turning higher in 5 of (1). Once it completed (1) sequence, it expects to pullback in (2) in 3, 7 or 11 swings & we like to buy the pullback at extreme areas for the next sequence up.