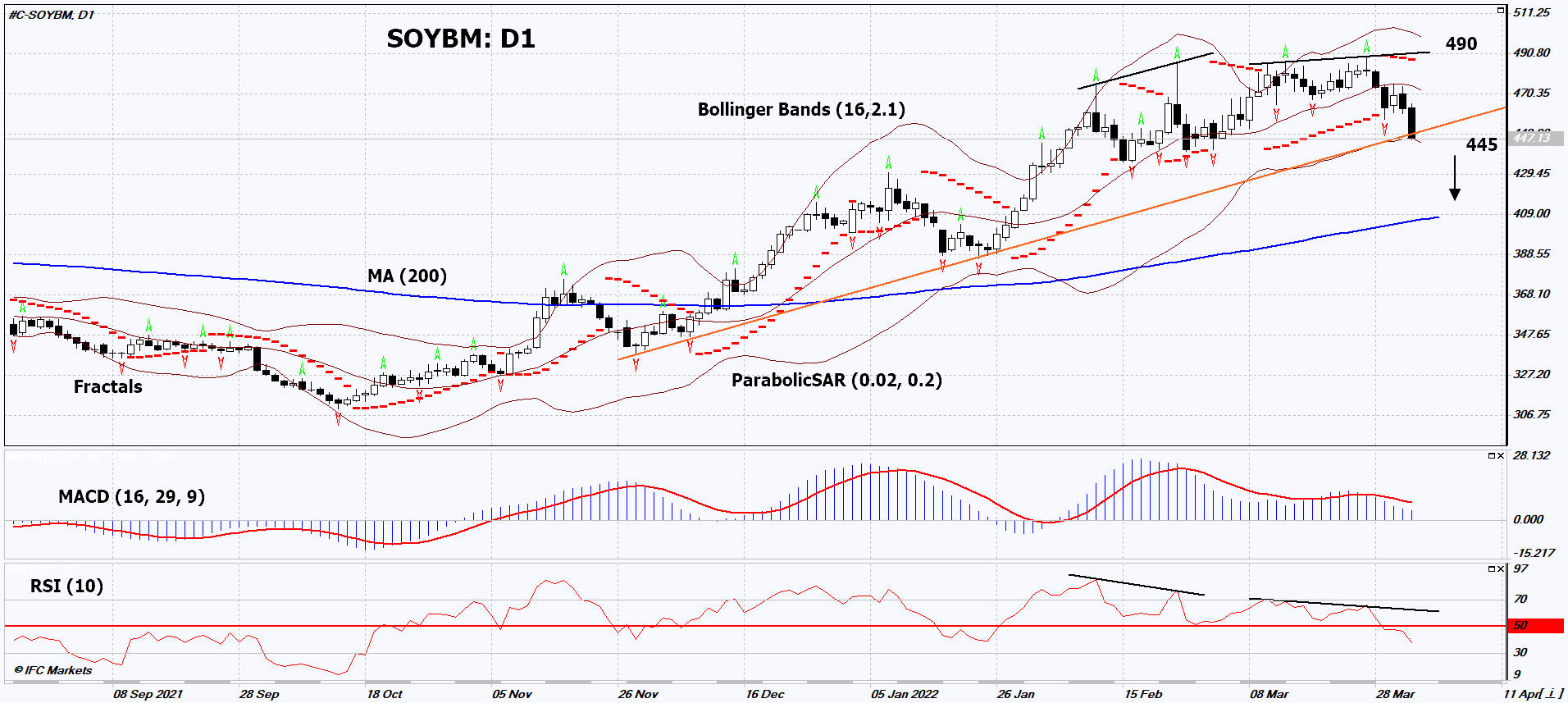

Soybean Meal Technical Analysis Summary

Sell Stop։ Below 445

Stop Loss: Above 490

| Indicator | Signal |

|---|---|

| RSI | Sell |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Sell |

| Parabolic SAR | Sell |

| Bollinger Bands | Sell |

Soybean Meal Chart Analysis

Soybean Meal Technical Analysis

On the daily timeframe, SOYBM: D1 broke down the support line of the uptrend. A number of technical analysis indicators formed signals for further decline. We don’t rule out a bearish movement if SOYBM: D1 drops below the lower Bollinger band: 445. This level can be used as an entry point. The initial risk limit may be higher than the high since June 2014, the last up fractal and the Parabolic signal: 490. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal high. Thus, we are changing the potential profit/loss ratio in our favor. The most cautious traders after making a trade can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (490) without activating the order (445), it is recommended to delete the order: the market is experiencing internal changes that were not taken into account.

Fundamental Analysis of Commodities - Soybean Meal

The US Department of Agriculture (USDA) reported an increase in the area under soybean crops and its stocks. Will the decline in the SOYBM quotes continue?

In 2022, US soybean plantings increased by 4% compared to 2021 to 91 million acres. As of April 1, 2022, soybean stocks in the United States amounted to 1.93 billion bushels. This is a 24% increase compared to soybean stocks at the same date in 2021. Another negative factor for quotations of soybeans may be data on its active sale in China from state reserves. It is possible that this was required due to the disruption of food supplies to regions where a lockdown was introduced amid the outbreak of Covid-19. As soybean imports continue, this situation carries the risk of a glut of soybeans in China. Quotes of semi-finished soybeans (soymeal) on Friday, April 1, on the Dalian Commodity Exchange, collapsed by 6%. This is the highest daily drop in 10 years.