Which commodity ?

Which Local Currency ?

Mate, you know what… i don’t trade Soyabean

but this is a perfect example to answer both your questions

let me show you how I FIGURED THIS OUT when i was a newbie 7 years ago approx.

and this works for any instrument.

-

Open the Chart of whatever you want. DO THIS ONLY ON DEMO

-

put down a trade 1.0 Lot to BUY

-

now put your TAKE PROFIT down and a Stop loss

now you said the price was 9.600 right

well, put a TAKE PROFIT AT 9.601

And put a STOP LOSS at 9.599

then see how much money you win or lose, whichever way it goes

-

if that doesn’t work, try this

Entry = 9.600

Take profit 9.610

Stop loss 9.590

and if that doesn’t help

Entry = 9.600

Take profit 9.700

Stop Loss 9.500

see what i’m doing

TEST IT

then ensure that it moved EXACTLY 1 place of whichever place value you were looking at

and DIVIDED IT UP BY THE AMOUNT THAT YOU WON

this will tell you definitely how much money you will move for how many pips

now try to use this as a guide

1.0 Lot = $10 per pip

0.1 Lots = $1 per pip

0.01 Lots = 10 cents per pip

so here is an example

EUR USD vs US2000 (Russell US200 Index)

if i put down a trade of 1.0 Lot on EUR USD it’s worth $10 per pip

if i put down 1 lot on US2000 it’s worth $1 per pip

you can find all this in the Contract Specifications as well

but testing is the best way to go

now beyond that, you can google it as well and see and compare your results

AND NO OFFENSE… some common sense would not go astray either

and if you have it, it will serve you well in trading

LET ME EXPLAIN THIS LIKE THIS…

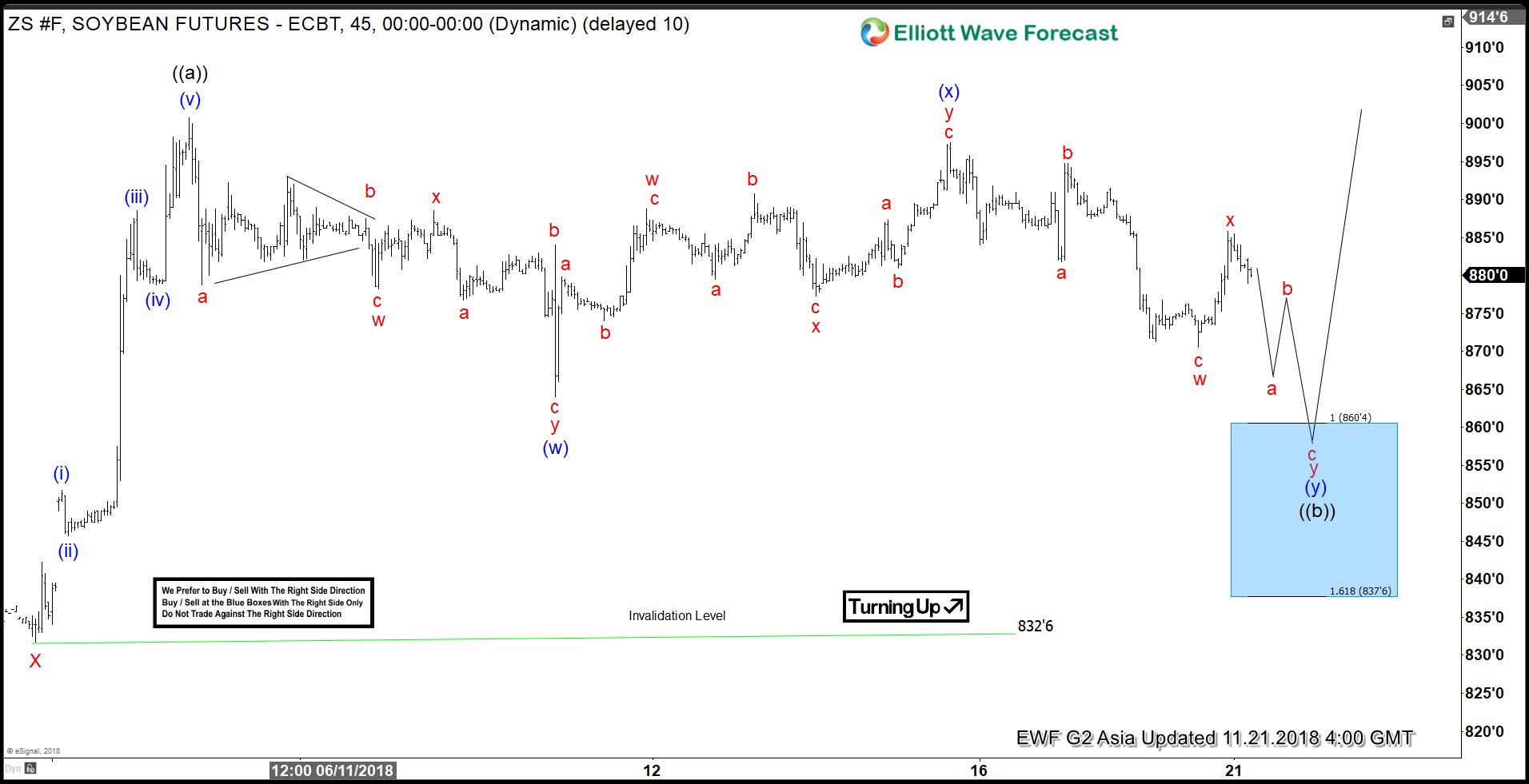

i googled “SOYBNUSD FORECAST”

one of the results was from TradingView… ok

i’m not interested in price accuracy… just price

so we have this… on this site…

not the writing at the bottom and the prices

ok so

9.620

9.644

9.546

and let’s compare this to your

9.600

9.800

so so far we can conclude the following

THE NUMBER OF DECIMAL PLACES IS CORRECT AS BEING 3 PLACES

but we still don’t know which one is the point and which is the pip

ok

now look at this

Read the line that states…

“CLOSES ABOVE 9.65”

now this has to tell you the following

-

this person is a regular trader or Soy vs USD

-

this person is used to quoting in pips , short hand

just like i would quote US2000 as 1502 when it’s 1502.6

because on US2000 the pip is from 1502.0 to 1503.0 and the point is after the decimal place

so clearly he is saying that 9.65 is actually 9.650

so IT WOULD BE REASONABLE TO ASSUME THAT 9.650 - 9.660 = 1 pip

and 9.650 - 9.651 = 1 point

so your question

9.600 - 9.800 = 200 points = 20 pips

a bit of research goes a long way mate

this took me around 1 - 2 mins to figure out

and even though i’m an experienced trader

I HAVE NEVER TRADED SOYABEAN and haven’t a clue as to the price… ok

but yet, i figured it out in around 2mins

when you are in a situation like this again, TRY NOT TO ASK

Try to research for yourself and figure it out

so even if it’s not CLEARLY STATED as this is a pip… this is a point

WORK IT OUT

Look at the contract specification by going to the Market Watch… RIGHT CLICK click SPECIFICATION

have a read

UNDERSTAND IT

if you don’t

ask your broker

simple

does that help