Hello Traders, in this article we will analyze our forecast for SPY ETF in the short term cycle. Since the short term peak of SPY from 05.30.2023 to end wave i of (iii) we have been expecting a pullback within wave ii to take place. Thereafter, we were expecting more upside within wave iii.

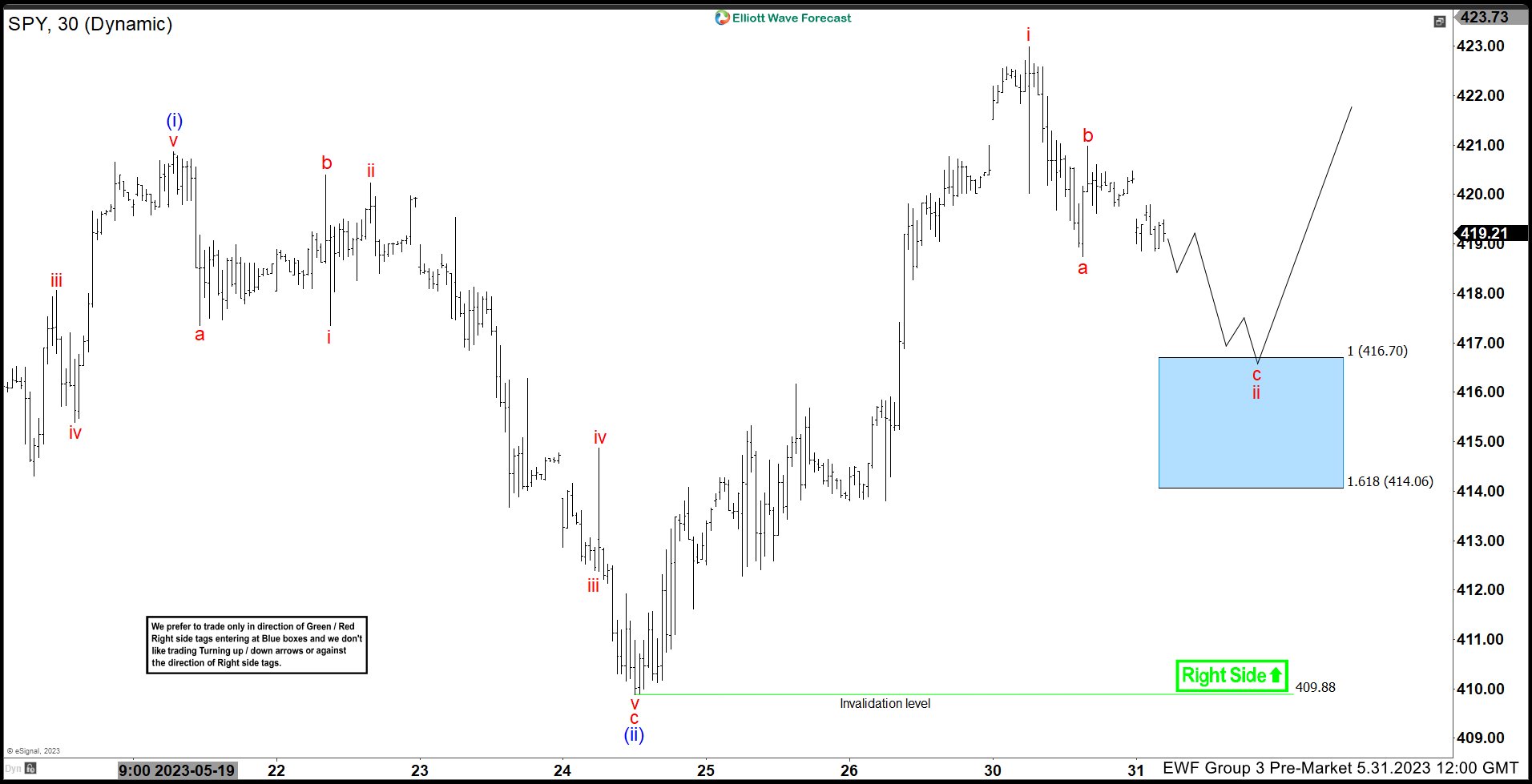

Let’s have a look now at the 30 min chart of SPY from 05.31.2023. We have been expecting more downside to reach the blue box area before turning higher.

SPY 30 min chart Pre Market Update 05.31.2023

As we can see the market was expected lower within c of ii to reach the blue box area. We recommend to always buy from the 100% extension area with a stop loss just below the 1.618 area. Fast forward, towards the latest post market update now from 06.06.2023, we will see that the market has already reacted higher and what we expect next.

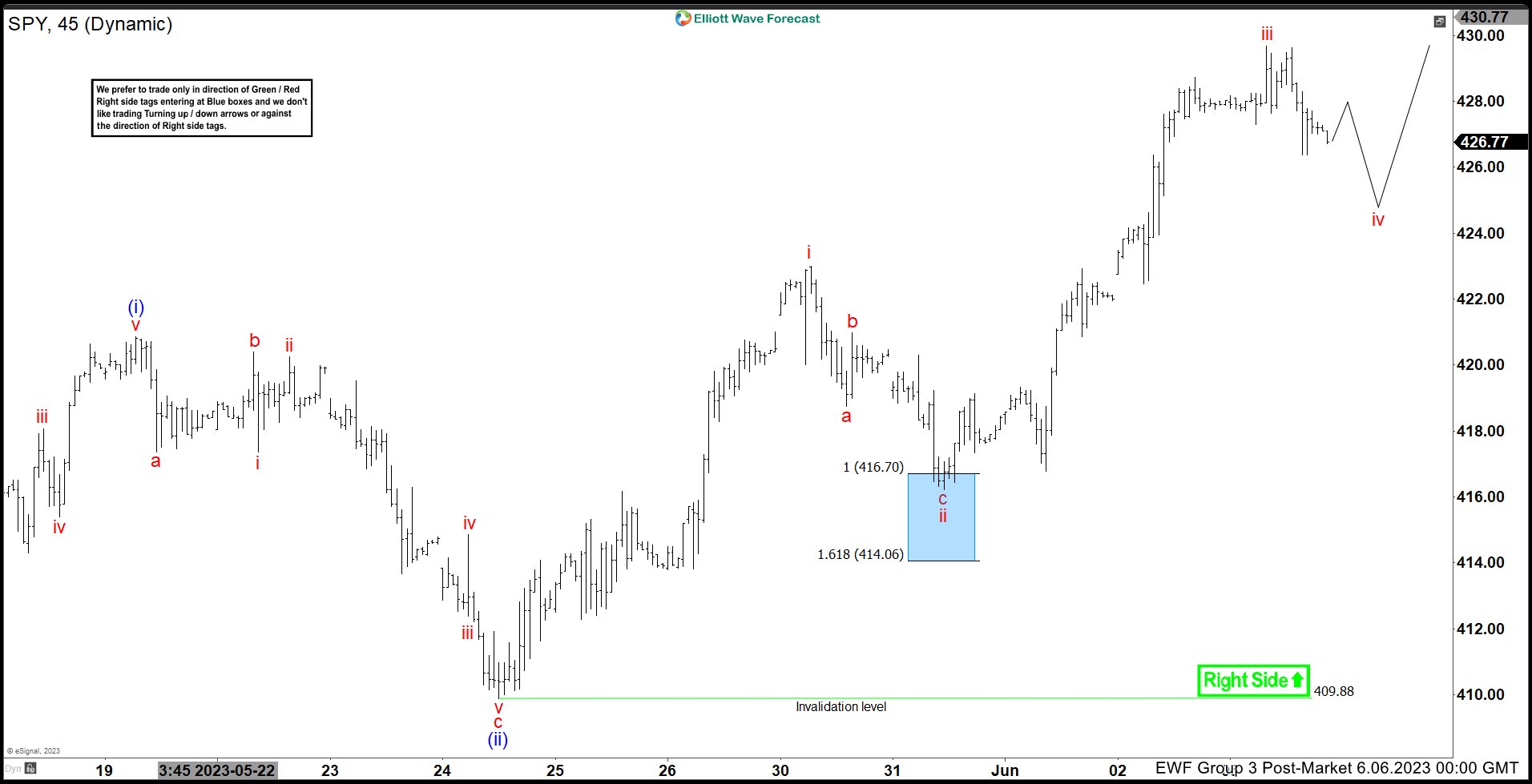

SPY 45 min chart Post Market Update 06.06.2023

A strong reaction higher took place from the blue box area. The reaction higher within wave iii of (iii). And then expecting the pullback within iv before one more high in v to end (iii).