In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of SPY. In which, the rally from 24 May 2023 low unfolded as an impulse structure. And showed a higher high sequence favored more upside extension to take place. We will explain the structure & forecast below:

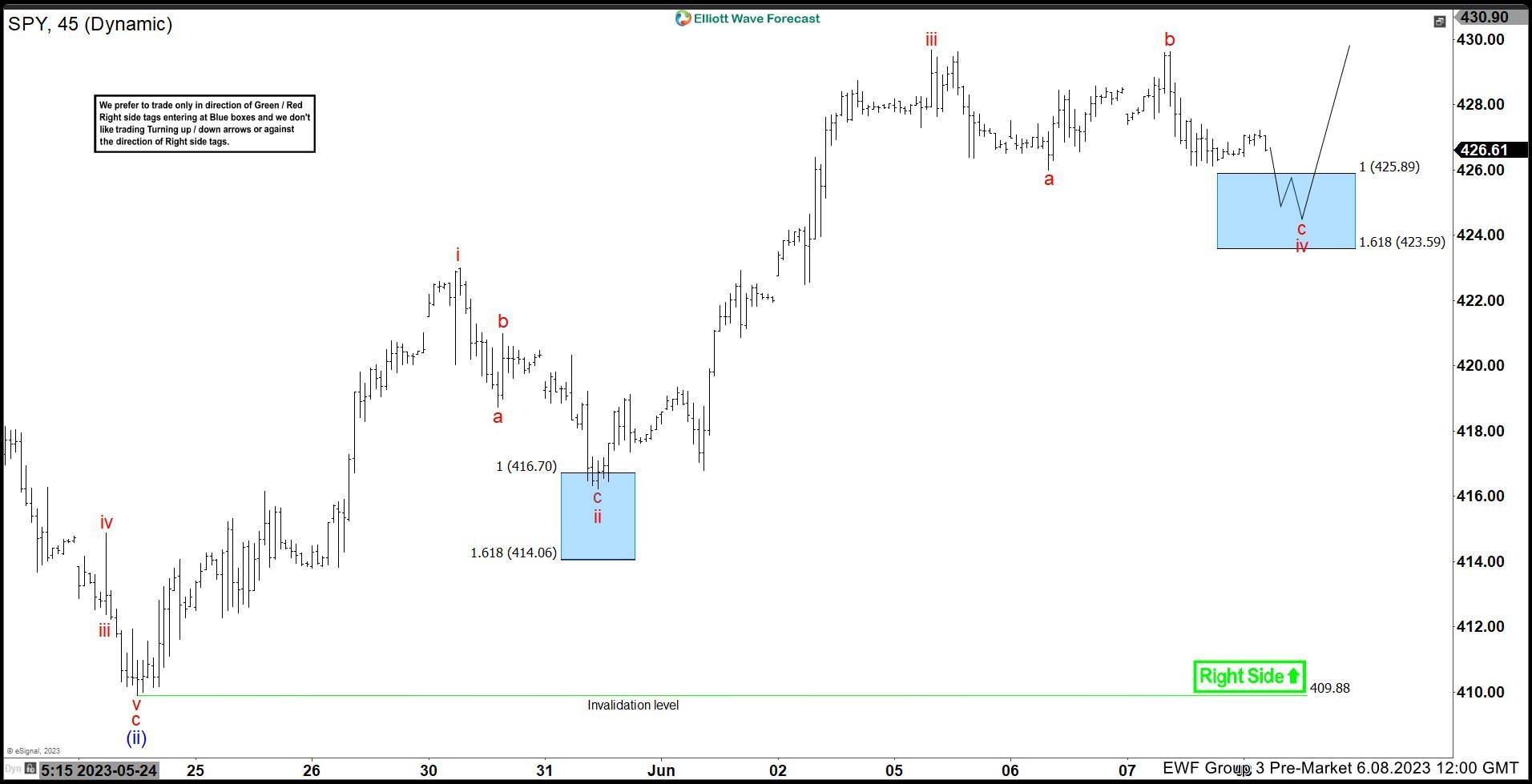

SPY 1-Hour Elliott Wave Chart From 6.08.2023

Here’s the 1hr Elliott wave chart from the 6/08/2023 Pre-Market update. In which, the cycle from the 5/31/2023 low ended in wave iii as an impulse structure at $429.62 high. Down from there, the ETF made a pullback in wave iv to correct that cycle. The internals of that pullback unfolded as Elliott wave flat structure where lesser degree wave a ended at $425.99 low. Lesser degree wave b ended at $429.62 high and lesser degree wave c managed to reach the blue box area at $425.89- $423.59 area. From there, buyers were expected to appear looking for the next leg higher or for a 3 wave bounce minimum.

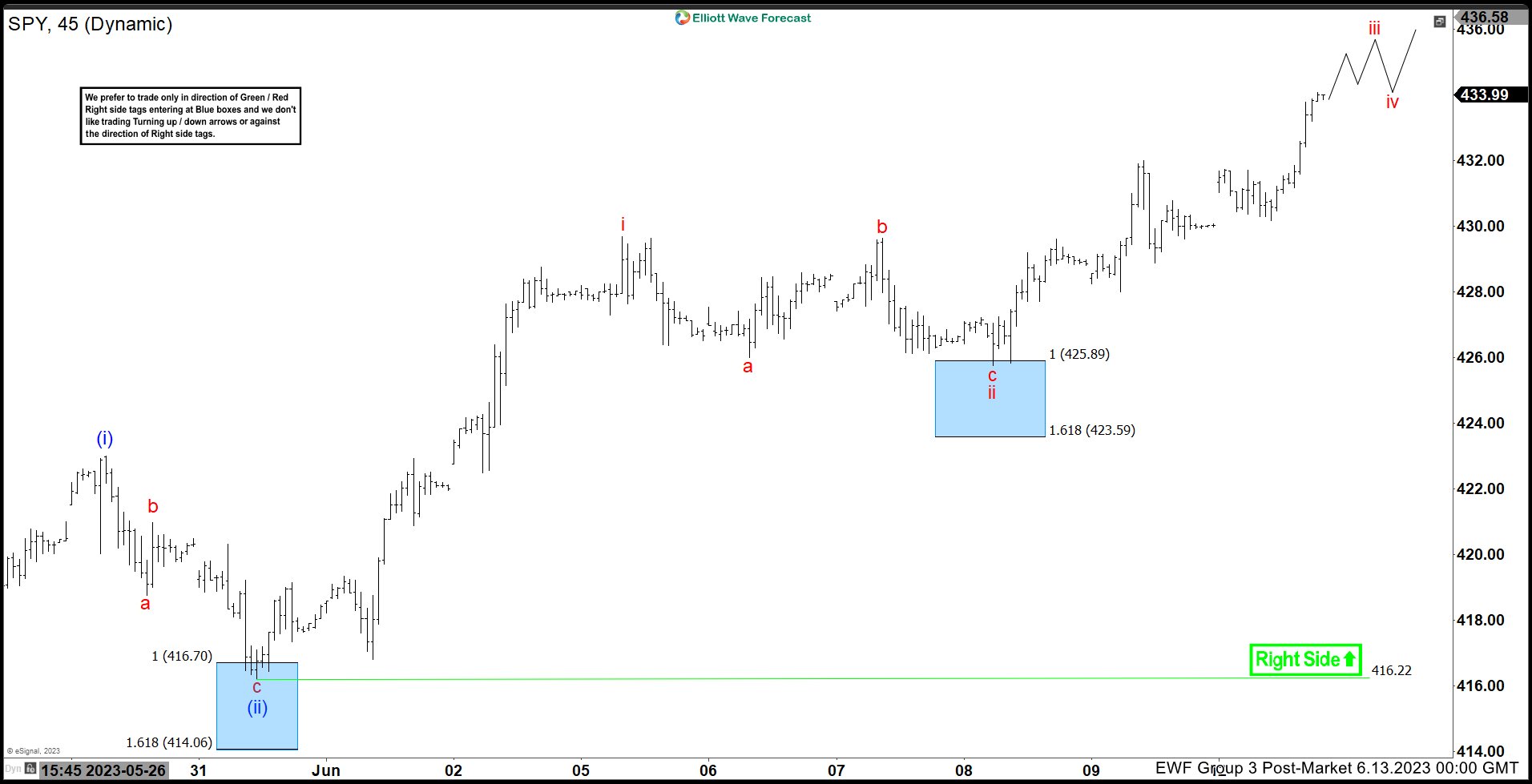

SPY Latest 1-Hour Elliott Wave Chart From 6.13.2023

This is the latest 1hr Elliott wave Chart from the 6/13/2023 Post-Market update. In which the ETF is showing a strong reaction higher taking place, right after ending the flat correction within the blue box area. Since it hits the blue box area the ETF has erased divergence suggesting that it’s still trading in wave iii of (iii) & should be looking for more upside.