This is were consistency and risk management comes into play.

Good job man

Thank you.

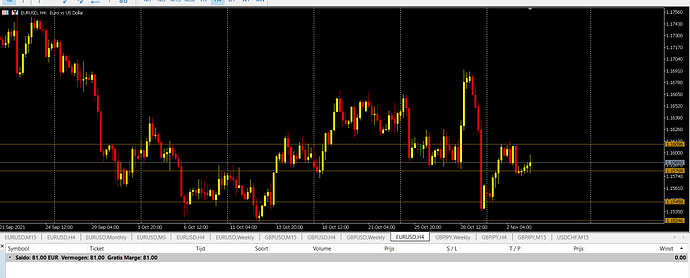

Wednesday and today were loss days. The past two days I had less time, so here is a quick summary of what happened:

- My bias with FOMC was correct, however I timed it wrong.

- Today in London I expected a retracement in GBPUSD, which did not happen.

Account status: €52,27.

Thanks 4 the update.

Welcome

This is gold!!! Keep up the good work!!!

Thank you!

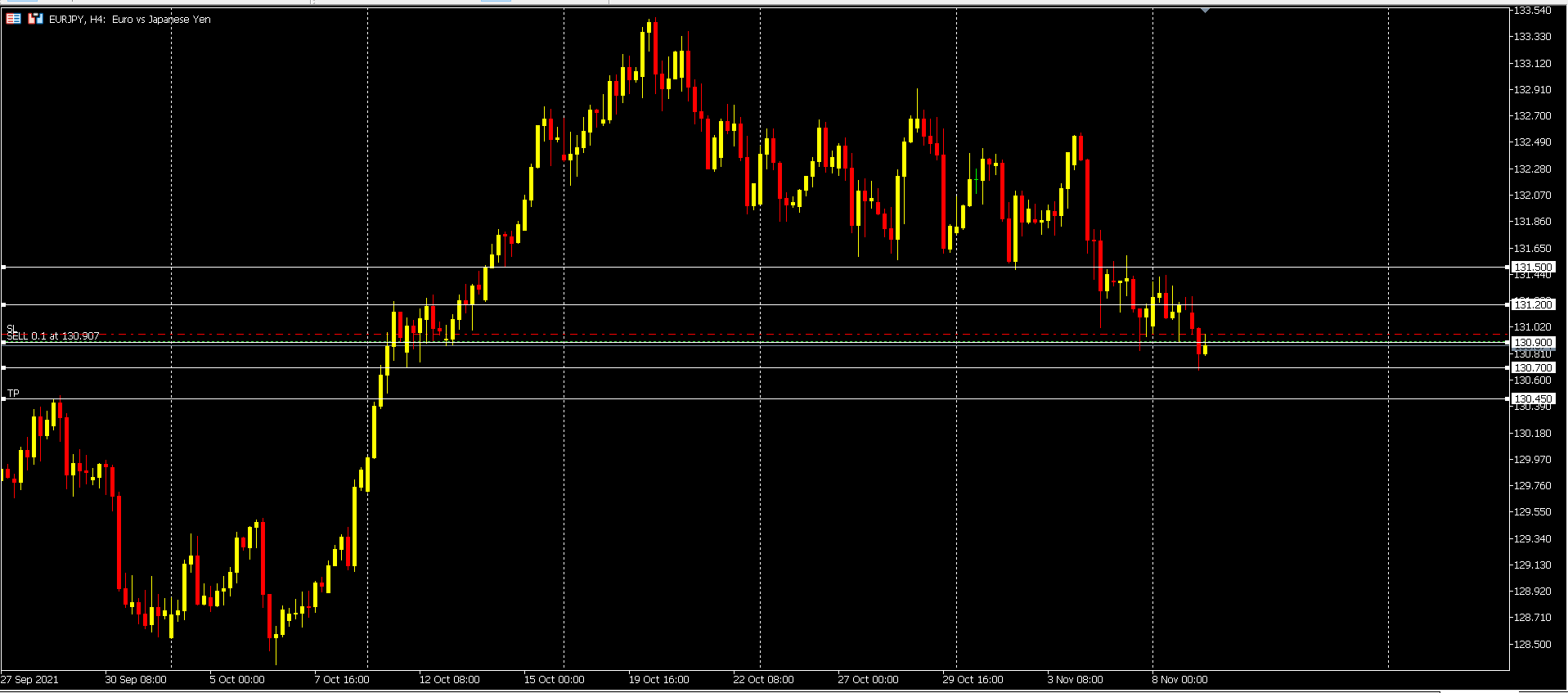

EURJPY - sell from resistance to support. Price might fall very hard to balance out the upmove of the previous uptrend.

Update EURJPY - sell

Put on BE.

EURJPY Hit BE.

Hit your BE level or you moved your SL to BE, then got stopped out at BE?

Do you have a preference for TF? Mostly H4? Ever dip below H1?

I got stopped out BE here, as I moved my stop to BE. I could have grabbed a 1:2 rr, but I expected a harsher drop.

MN/W1/D1/H4/H1/M30/M15/M5

All those timeframes XD

Top down analysis

Ok. Gotcha. But what TF do you spend the most time?

I saw a few H4 charts. Is that where you usually end up placing your trades?

Me, I’ll check M1, W1, and D1. But my trades are placed while looking at the D1.

Most of my entries are actually done on M15 and M5. I can not share my specific setups as it is unfair to my students who paid for it. However I can share the levels! If there is a resistance level, you can try out which ‘‘lower timeframe bearish setup’’ works for you. If there is a support level, you can try out which ‘‘lower timeframe bullish setup’’ works for you. Feel free to backtest using the levels I draw in my charts

Identifying the levels = key! Know the levels and you will know, where you can expect a reaction. This reaction does not have to be big. As long as it can give you enough pips for a living, that is all it takes. This is what I used to pass my FTMO account ( proprietary firm ).