Equities mixed despite Dow record high. Global equities were mixed Tuesday despite record high made by the US oldest index Dow Jones. While Dow up 0.20% to a new all time high of 31,522.75 points; S&P (-0.06%), FTSE UK (-0.11%) and Nikkei (-0.59%) all took a breather as the benchmark US 10Y yield hit its 11 month’s high of 1.33% as price fell. Bond futures saw more than $850 billion inflows as investors took advantage of the higher yield, hence buoyed the Greenback.

Crude saw heavy bidding with more than $800 million worth of block orders alone, as record cold winter hit US refineries and disrupted supplies. Price settled a little unchanged above the $60/bl mark. Gold fell to close below $1,800.00/oz after Dollar gained strength from the increased demand in the bond markets.

In the FX markets, that brought Dollar back to the front foot in the short -term while a few notches up in the medium and long term accounts. Markets remain bullish yet cautious as Yen are offered while Swiss are bid. Short term accounts seen more Comdolls profit taking and more bids for the Euro. Sterling remains unchanged.

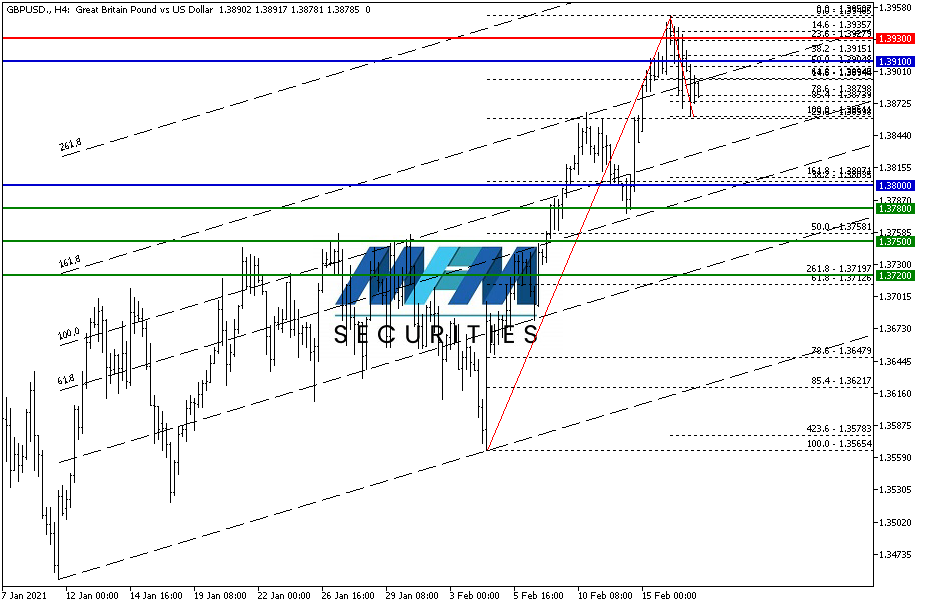

OUR PICK – GBP/USD

When Bank of England goes negative. Our RTC Team points to an interesting trade in GBP/USD shall BoE go negative on rates in August as expected by Citibank. Though at this point, BoE is hesitant, it’s not far fetched from reality as SNB and BoJ were also along the same narrative back then. In the mean time, the path of least resistance for the short term is to the downside on correction as medium term pointed to further upside. The exchange rate could fall to as low as 1.3750/20 where we might see bigger buying opportunity. Sell on rally for the short-term.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.