STATE OF THE MARKETS

Markets cautious amid safe haven flows. US markets traded with caution on Tuesday as more safe haven flows were seen as London closed. Dow (-0.46%), S&P500 (-0.81%) and Nasdaq (-1.69%) finished lower with all sectors in the red, except Materials that saw modest bidding. US treasuries were mixed with the benchmark 10Y US bonds yielded lower around 1.398% as New York closed.

Crude futures continued to fall for the third day as traders expect production ramp-up post OPEC+ meeting this week. The black gold closed around $59.75 as New York closed, with more than $110 million worth of block orders seen ready to bid around $56.80/bl. Gold stabilized after bidders emerged ahead of the $1,700/oz mark to settle the yellow metal higher around $1,738.10 amid easing yields.

In the FX space, Dollar took a breather in the short-term while holding ground in the medium to long term accounts. Order flows suggested a more cautious markets as high beta Aussie and Kiwi were sent to the back seat in the medium term, along with Sterling. Euro saw stronger demand, replacing Loonie, as European lawmakers tried to force Euro clearing out of London to Frankfurt. Overall risk sentiments are relatively unchanged as demand for Swiss and Yen remain stable.

OUR PICK – Crude Oil

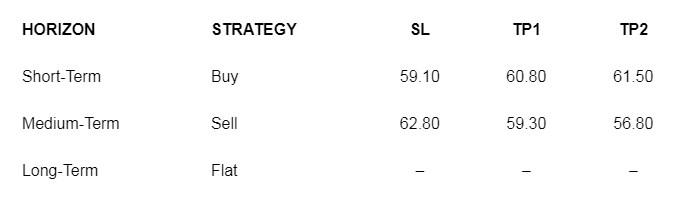

Less bidders, more offers sent price lower. Confirmed block orders of more than $110 million placed at $56.80, while market priced at $60.50/bl, suggested that not many bidders are left to bid the black gold higher. Indeed the three black crows formed on the daily with clear motive wave on 1H, is a signal for a lower crude. As players expect OPEC+ to agree on output increase after the meeting, in view that markets can absorb extra barrels; more profit taking will be seen among speculators, hence lower bid from dealers. Sell on rally is our preferred strategy, targeting block orders level for the medium term. Short-term risk is on the upside to as high as 61.80 to 62.20 in extension.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.