STATE OF THE MARKETS

Optimism retreats further and safe-havens in demand . Equities took another dip as investors cashed out at the height of the markets, with Dow fell more than 300 points (-1.16%) followed by Nasdaq at 97 points (-0.82%) and S&P for 41 points (-1.16%). Energy, utilities and real estates suffers as rising covid cases prompts local governments to reimpose lockdowns. Nevertheless, vaccine news calm the jitters with Pfizer reassuring delivery before Christmas.

IT and consumers continue to thrive under current climate with crude closed higher around $41.70. Gold inched lower to close below $1,880/oz and the 10Y benchmark inched higher around 0.87%, which saw more than $394m and $138b flows into the precious metal and US treasury futures respectively on the falling prices.

The greenback continued to be bought on the short-term while firmly supported by the CAD and CHF on the medium and long term. Sterling took a dip as early investors took profit but remained supported in the medium and long term on the prospect of a resolved Brexit next week.

OUR PICK – KraftHeinz (KHC, Nasdaq)

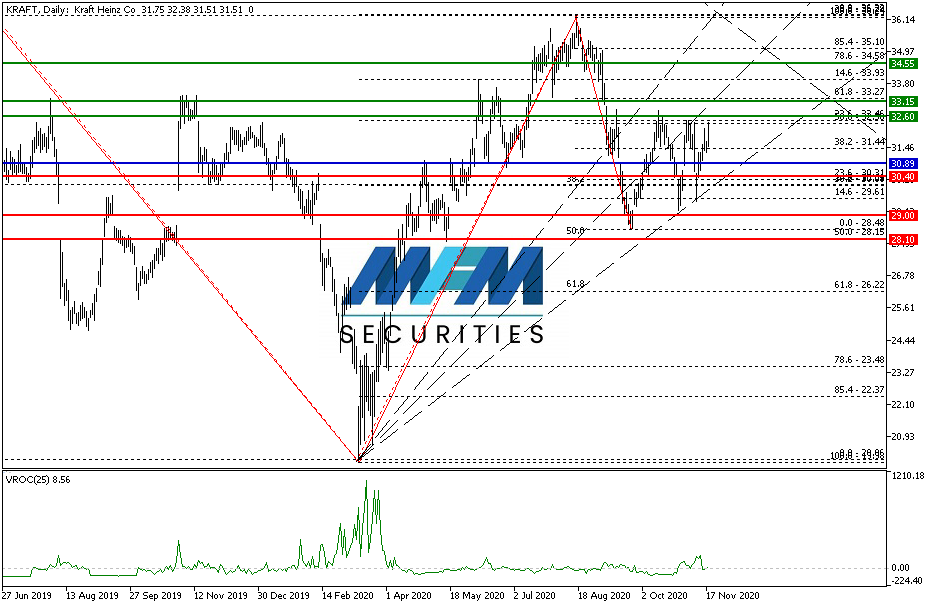

It’s time to load on defensive stocks. With market storms brewing in uncertainties, it’s time to rotate to defensive undervalued stocks and we picked KraftHeinz on the merit of dividend payout, PEG and institutional interests. With dividend yield around 5%, it’s quite a steal compared to market median of 2.8% and at $31.63 as of yesterday close, it’s 40% below its enterprise value if a white knight were to take over. Technically, as long as $30.89 remains pivot, we are looking for an upside to $32.60 and $33.15 but shall price remain suppressed below $32.60, there is a chance for a dip to $29.00 and $28.10. As of last quarter, Bank of Nova Scotia, DZ Bank and GoldmanSachs were seen to divest their holdings while hedge funds Bridgewater, Renaissance Tech and Natixis bank have increased their holdings.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.