STATE OF THE MARKETS

Profit taking marks that holiday and hedging are coming . Major indexes are lowered Thursday as investors continue to take profits in preparation for the coming holiday. On top of that, talks of a second lockdown to curb the pandemic, bolster demand for safe-havens as investors optimism waned. Treasury yields slid lower as more than $300b was flowing into the US Treasury as it open after the Veterans’ Day.

Crude closed lower to $41.09 on demand concerns as major economies continue talking about a second lockdown that would hammer economic activities. Gold firmed above $1,870 and futures point to higher demand as investors hedge their positions against any catastrophic backdrop during the holiday. This was evident as Yen, Swiss and the Greenback were in demand on the short-term while flows on the medium and long terms suggest EUR and GBP repatriation to prepare for end of year consolidation.

OUR PICK – Gold

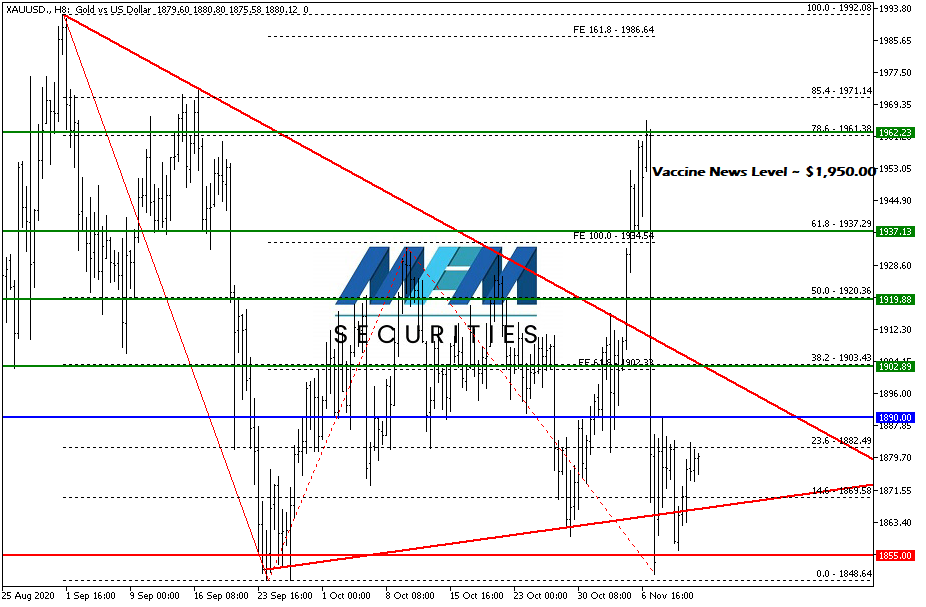

Gold is in the accumulation process, vaccine news level to be tested. Our previous gold trade worked well for the short term but medium term suffered a setback as US election election results set in. Vaccine news sent the metal price lower but in the short to medium term; as investors prepare to hedge for the holiday and potential second lockdown; plus another round of stimulus post US election, we believe it’s being accumulated and the metal would grind higher especially after it passed monthly pivot circa $1,890.00 and vaccine news level at $1,950 will be tested.