STATE OF THE MARKETS

Stocks dented as inflation rose. Major US stocks indexes pared earlier gains on Tuesday, with Dow (-0.31%), S&P (-0.35%), and Nasdaq (-0.38%) fell lower, after inflation YoY was reported (5.4%) higher than expectation (4.9%). The 0.9% monthly increase was the highest since June 2008. Subsequently, bonds were sold off sending yields higher, with the 10Y benchmark closed above 1.41%, benefitting the Greenback.

In the commodities market, crude futures remained above the $75.20/bl mark as New York closed, ahead of the EIA report on Wednesday that was expected to point to tighter supplies. Dollar strength failed to close gold below $1,800/oz, as dealers bid the precious metal up ahead of Feds testimony that may see Feds tangled with inflation, taper and rates.

In the FX space, long term accounts seemed settled on risk as Swiss was sent to offers while Sterling, Kiwi, Yen and Dollars were on bids. Short and medium term accounts remain cautious as the safe-haven trio lead the demand territories while the comdolls and Euro mainly on offers. Markets look forward to seeing a lower PPI (0.6% vs 0.8%) on Wednesday and lesser unemployment claims (360k vs 373k) on Thursday to decide the fate of King Dollar.

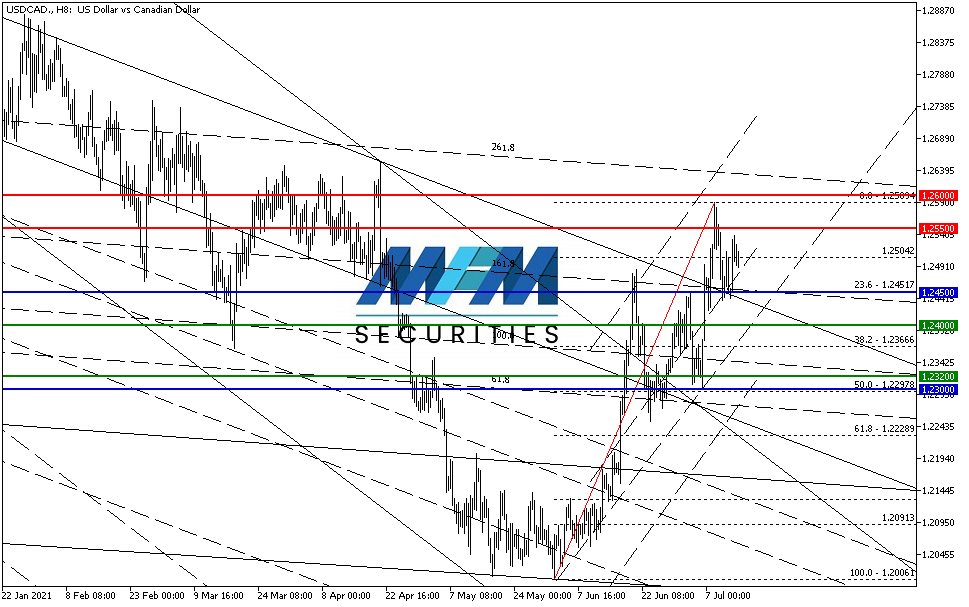

OUR PICK – USD/CAD

Riding on block orders and yields. About $380 million worth of block orders of CAD

were noted on the futures exchange that we would like to ride with on Tuesday. Though this idea is against our FX sentiments index, bond yields of up to 5 years remain favorable to the Loonie. We see short term snap demand for CAD in that respect while investors await the next Feds narrative about taper and rates. Cut loss if daily closed above 1.2550.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.