STATE OF THE MARKETS

Stocks hit new high amid stronger NFP. Stronger than expected US employment figure released on Friday, kicked the markets opened by sending major indexes to a new all time high for Dow (+1.13%) and S&P500 (+1.44%), while Nasdaq (+1.67%) broke last month high. The US10Y yield edged lower, but still above 1.71%, after short sellers bought and took profit for the quarter.

Crude continued to be under selling pressure, closed below $58.80/bl, after traders were spooked with OPEC+ decision to hike production from May to July, instead of rolling over the quota. Gold was in the limbo, after some closed markets made the yellow metal finished with bearish indecision below $1,728.50/oz. A rising yields would certainly keep the metal under selling pressure and favor the Greenback.

In the FX space, King Dollar seemed to maintain its position with investors seen to seek short term safety in the safe-haven Swiss and Yen. Rebound in the high beta commodity currencies are more likely a repositioning as investors trimmed their USD shorts to the lowest in a year. The battles between Euro and Sterling continues.

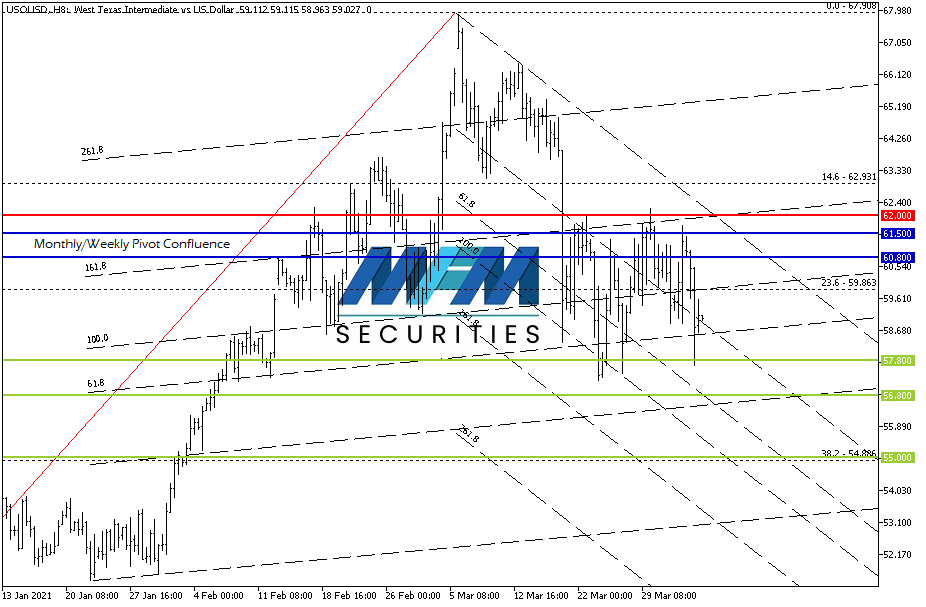

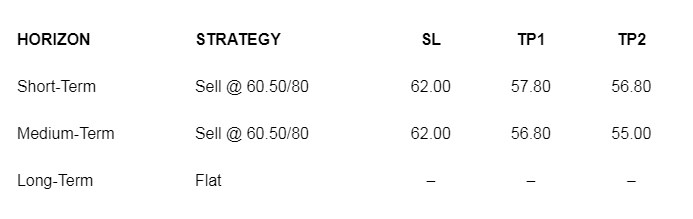

OUR PICK – Crude Oil

Under selling pressure below $62.00/bl. OPEC+ decision to hike production output from May to July, spooked investors that were already pricing a production rollover. On top of that, renewed lockdowns in Europe and South Asia are dampening demand, though faster economic recovery in the US might buoyed the commodity. Any report of rising inventories would send price lower. Dealer is currently supporting the black gold, albeit on lower bid, amid the selling pressure. We favor sell on rally with $62.00/bl stop.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.