STATE OF THE MARKETS

Stocks jumped as the Dollar retreated . US stocks jumped more than 2% across the board on Monday after Fed’s President Williams commented that he expected inflation to fall sharply in 2023 and regressed to Fed’s 2% target in 2024. The blue chip Dow (+2.66) jumped the most, followed by the small-cap Russell (+2.65%), S&P (+2.59%) and Nasdaq (+2.27%) as the Dollar continued to fall below the 111.50 minor handle. Demand for bond safety, however, remained elevated, sending yields lower as prices increased. The 10Y benchmark dropped more than 20 basis points to settle around 3.62% as New York closed.

In the commodity markets, crude continues to climb past $84.20/bl after OPEC+ decided to cut production of more than 1 million barrels per day in a move to sustain higher oil prices amid global economic slowdown. Dollar weakness and the North Korea tension continue to buoy gold above the $1,700/oz handle while iron ore continues to drift lower on global recession fears. The commodity settled around $94.20/tn, $4 lower than last week, as New York closed.

In the FX space, news of the UK tax cut reversal sent Sterling to the helm of demand in the short and medium term alongside Kiwi, Euro and Loonie. Sentiments seemed bullish as Swiss and Yen pulled back more to offers across all horizons. King Dollar was sold alongside Yen, Aussie and Swiss in the short and medium term, though reigned in demand in the long term accounts.

On Tuesday, markets expect more follow through from the bulls on the hope of slowing inflation and rate hikes. However, trimmed earnings estimates may cap further rally in equities. Earnings reports to watch for include Acuity Brands (AYI), Smart Global (SGH) and Novagold Resources (NG) as well as the latest numbers on US vehicle sales, factory orders and job openings.

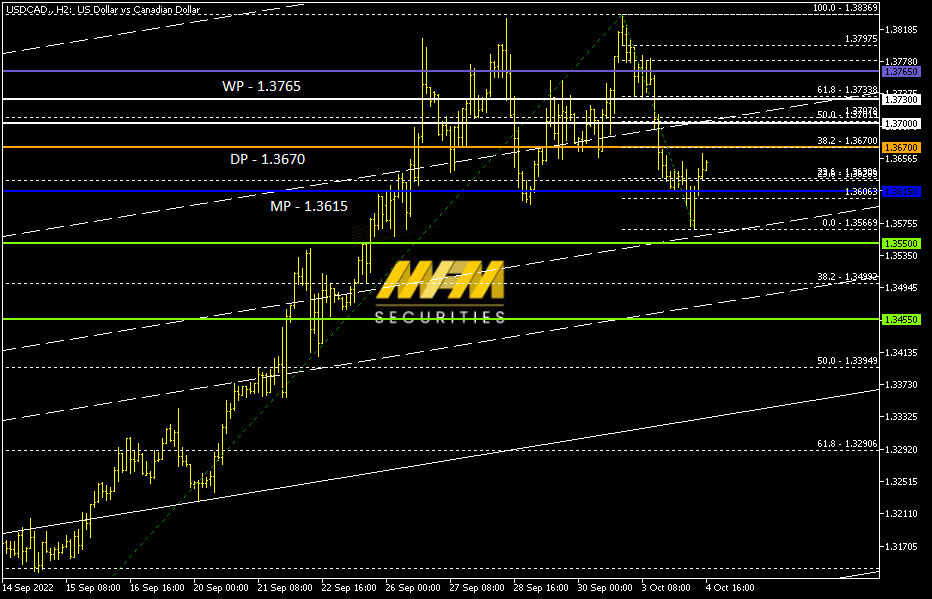

OUR PICK – USD/CAD

Weaker NFP may pull the Dollar lower. We see weaker than expected NFP this Friday (250k vs 315k) may continue to pull the Dollar lower in the short to medium term. Fed’s sentiments is currently Dollar bearish as comment on easing inflation may slow rate hikes. CAD may also benefit from higher oil prices.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer: This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.