STATE OF THE MARKETS

Stocks mixed amid falling yields. Major US stocks indexes closed mixed on Wednesday, with Dow (+0.13%) and S&P (+0.12%) closed higher, while Nasdaq (-0.22%) and Russell (-1.63%) trended lower; after Feds reiterated its pledge to support the economy that will see temporary higher inflation. Feds reluctance to be firm on taper and rates, sent yields lower as investors demand more bonds. The 10Y maturity yielded down from 1.41% to 1.35% as New York closed.

In the commodities market, crude futures trended lower as of this writing, down to $72/bl as Saudi and UAE managed to work out a supply deal to balance the production and demand quota for the summer months as EIA reports showed that inventories were reduced more than expected. Gold continues to be on firm bids, past the $1,820/oz mark, as Fed’s remain supportive of current policy allowing yields to fall and inflation to rise for a while.

Falling yields sent Dollar on offers for the short and medium term accounts, while bids returned to Kiwi and Aussie. Traders and investors seemed cautious as demand for Yen and Swiss remained elevated across horizons. Euro and Sterling were all over the place as players repositioned themselves due to lack of data for the two economies.

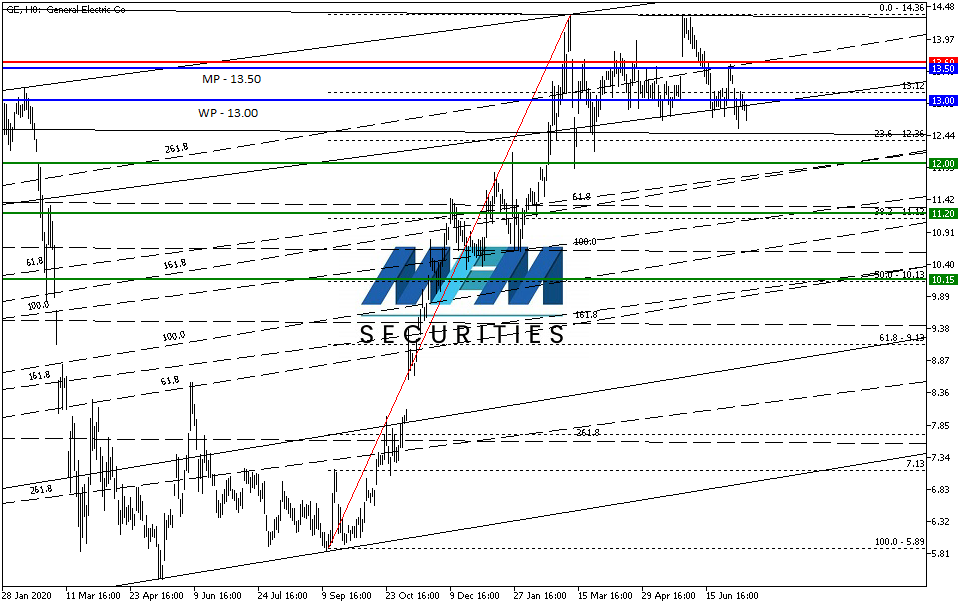

OUR PICK – General Electric (GE, NYSE)

Overvalued, technical sell. A corporate behemoth General Electric has been facing deteriorating earnings in the last few years, sending its price from the high of around $30 in 2016 to close to $5.50 early last year. Dividends cut from $0.24/share in Q3,2017 to $0.12 for three quarters of 2018 before further reduction to just a penny a share in Q4, 2018 until the last quarter. The company was highly leveraged with more than three times equity back in 2018 and the last few years saw debt being reduced as dividends being cut as the company tried to turn around. Currently 30% overvalued per S&P GMI metrics, making it fairly valued around $9.00 where we would buy again.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.