STATE OF THE MARKETS

Stocks mixed amid heavy sell-off. US stocks closed mixed on Monday after a heavy sell-off in the morning. Dow (-0.45%) and S&P (-0.14%) managed to rebound, while Nasdaq (+0.05%) eked small gains as investors scooped up valued tech stocks. Flights to safety were noted as yields surged but backed down on higher demands. The 10Y benchmark hit 180 basis points before settling at 177 as the Dollar (DXY) stalled at the 96 handle.

In the commodities market, profit taking sent crude lower to $78/bl while inflation concerns continue to press gold back above the $1,800 mark. Elsewhere, iron ore continues to receive bids above $126.20/tn signifying stronger demands.

In the FX space, overall sentiments are mixed as the safe havens Yen, Swiss and Dollar are all over the places. Short and medium term traders are more bullish, however, as Swiss was sent to the back burner while Loonie remains in demand. With the earnings season just started, markets look forward to seeing the latest earnings report from Albertsons Companies (ACI) and TD Synnex (SNX) as well as the small business optimism index to gauge the economy.

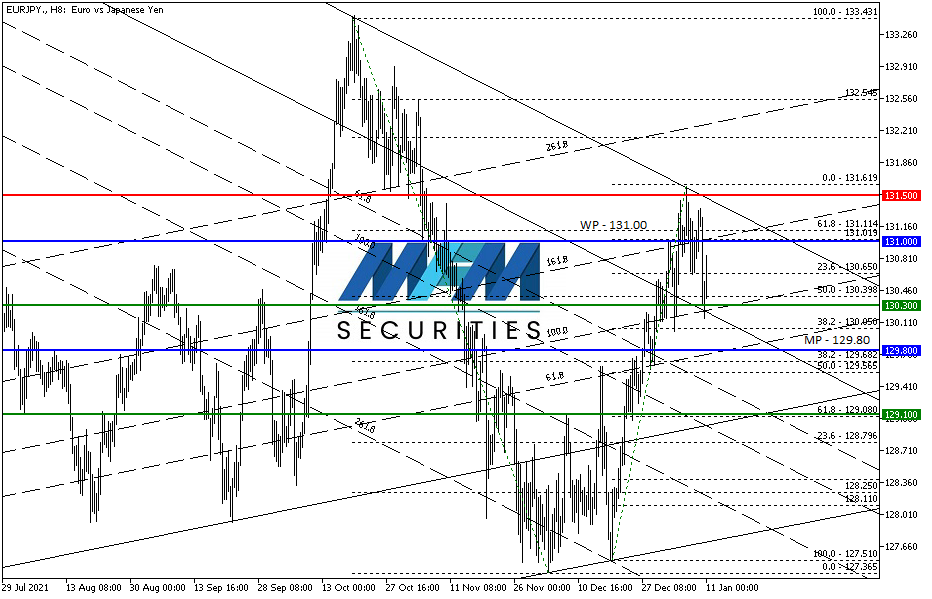

OUR PICK – EUR/JPY

Riding on block orders. A block order of about $24 million was noted in the region of 131.20s that we intend to ride on. With Japanese tax seasons coming soon, we expect Yen to gain strength in the weeks to come. May use open TP on partial orders to maximize gains.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.