STATE OF THE MARKETS

Stocks mixed amid rising yields. US stocks closed mixed on Tuesday, with Dow (+0.55%) and S&P (+0.17%) rebounded higher while the tech-laden Nasdaq (-0.50%) continued to slide lower as markets prepared for a bigger taper and earlier rate hike. That in itself sent yields higher as bond demand eased, with the 10Y benchmark climbing towards 170 basis points and Dollar (DXY) stalled at 96.50 mark.

In the commodities market, crude rebounded further to settle around $78.50/bl as New York closed after consumer nations were reported ready to release strategic reserves. Gold tumbled further close to $1,780/oz as the Dollar continued to strengthen further while iron ore stalled at $93.40/tn.

In the FX space, King Dollar continued to reign across all horizons as Euro flipped to demand in the short term. Long term investors turned less bearish as Aussie and Loonie received more bids than Sterling, while medium term accounts were little changed. On Wednesday, markets look for earnings reports from Deere & Co (DE), Futu Holdings (FUTU) and Viomi Technology (VIOT) as well as the latest numbers on jobless claims, home sales and personal consumption to gauge the health of the US economy. Petroleum reserves from EIA will be in the spotlight for oil traders.

OUR PICK – AT&T

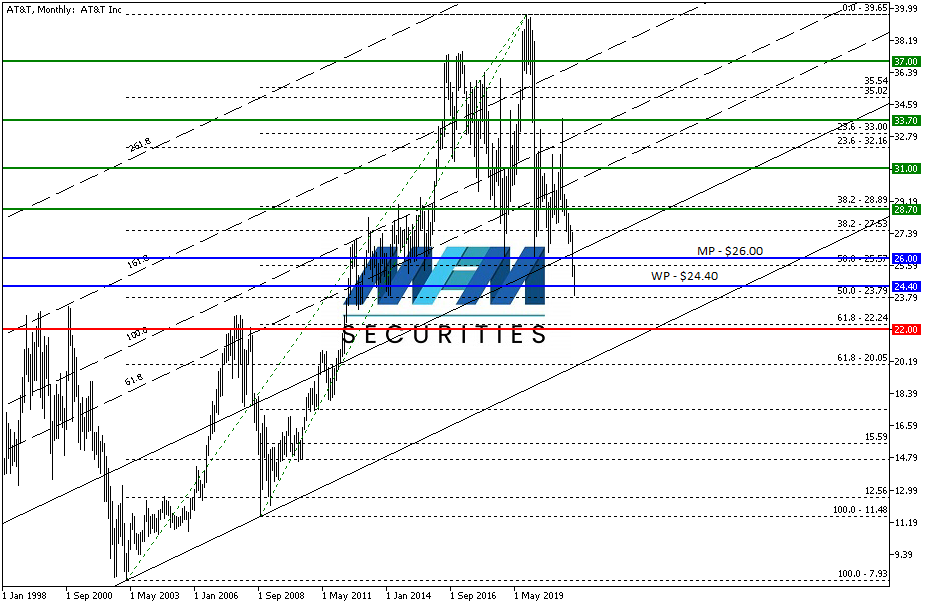

Re-entry and average down. Our re-entry in early June didn’t quite work out as planned and we have stuck with AT&T since then. Nevertheless, AT&T has been paying regular dividends for the past three quarters and at current price, annualized yields of 8.4% is not that bad in our opinion. Though, AT&T definitely could have done better if they had stuck to their core business, we see light at the end of the tunnel. Recent partnership with Ericsson (ERIC) to expand its 5G network, we believe, will put AT&T back on track.

Currently rated hold, with a high price target of $37, low of $22.50 and mean around $31, plus technically approaching long term uptrend line; we wouldn’t be surprised if large block orders surge in as price approaches $20/share. In fact, earlier this month, Director Stephen Luczo was reported to have acquired 100k shares at $25.04.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.