STATE OF THE MARKETS

Stocks mixed as investors digest data. US stocks closed mixed on Monday as investors digest the employment sector data released on Friday. Dow (-0.36%) and S&P (-0.08%) edged lower, while Nasdaq (+0.49%) and Russell (+1.43%) climbed higher after NFP reports on Friday revealed that employment is below expectations. Feds may be forced to keep rates low for a while, though costs pointing north and demand an increase in yields. The US 10Y benchmark yielded lower, below 1.57%, as New York closed.

Crude futures reached $70/bl for the first time since October 2018, before pulling back to close below $69.25/bl, after reports that China oil imports fell to 12 months low last month. Gold was firmly bid and held close to the $1,900 mark after falling yields failed to revive investors interest in the Greenback.

In the FX space, it seems that short and medium term investors are preparing for further risk-off as Yen reign in demand in the short term, while the three safe havens – Swiss, Yen, Dollar – led the demand in the medium term. The trend is quite evident as Aussie and Kiwi were on offer as Yen advanced closer to the demand territories.

OUR PICK – EUR/USD

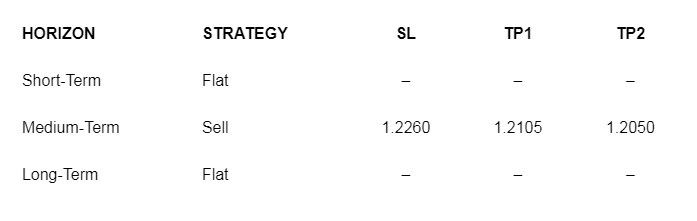

Policy divergence puts the Euro under pressure. With ECB meeting this Thursday that is expected to be a non-event as the European Central is expected to stay put and extend its easy monetary policy into 2022 and the Feds is expected to raise rates soon as inflation concerns are rising; Euro is seen to be under pressure in the medium term. We remain bearish as last week target was reached and have reduced stop to 1.2260 with first target at 1.2105

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.