STATE OF THE MARKETS

Stocks rebound as earnings unfold. US stocks staged a rebound on Tuesday, with Dow (+1.62%), Nasdaq (+1.57%), and S&P (+1.52%) , including Russell (+2.99%) all up in the green as more corporate earnings topped Wall Street forecasts. Industrials (+1.84%) , financials (+1.76%) and energy (+1.72%) are the top three beneficiaries of the rebound as demand for bonds receded. The 10Y benchmark fell to as low as 1.13% before settling higher around 1.22% as New York closed.

In the commodities market, crude futures stabilized above $66.75/bl after selling pressure stopped as short sellers took profits off the table. Gold edged lower, closed below $1,810.05/oz, as yields seeking investors ran to Dollar in the last two sessions.

In the FX space, risk-off still dominates the medium to long term accounts as Yen, Dollar and Swiss led the demand while the comdolls, Euro and Sterling were offered. Demand for Dollar remained elevated in the short-term accounts, however, as US stocks suffered heavy liquidation on rally. Unemployment claims and US crude inventories will be on heavy watch as markets try to gauge the economic recovery.

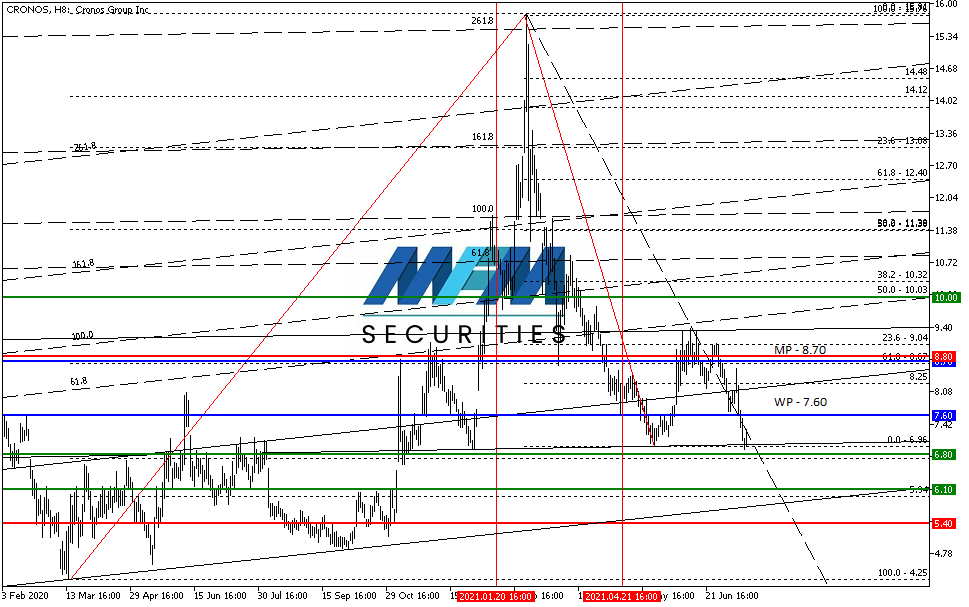

OUR PICK – Cronos Group (CRON, NASDAQ)

Long term looking bullish. The last two trades on CRON didn’t quite work as planned. In January it was only on breakeven and the buy stop in April didn’t get filled. Now the price is looking undervalued by about 20% according to S&P GMI, which put the fair value around $9.00. In the short-term, however, the risk remains for the stock to drop further to $6 on the last frontier of 13% Fibonacci retracement from 2020’s low to 2021’s high. Medium to long term is looking bullish in our view as CRON approaches the next earnings report on Aug 4th.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.