STATE OF THE MARKETS

Tech and banks boost stocks. US stocks closed higher on Monday after investors continue to bid undervalued tech and bank stocks after seven weeks of losing streaks. Dow (+1.98%) made the biggest gain, followed by S&P (1.86%), Nasdaq (+1.59%) and Russell (+1.10%) as the Dollar index broke below the 102 handle.

Investors were seen as bullish as haven demand retreated with yields falling lower across the board. The 10Y benchmark sits around 2.86% at writing with inversion seen in the 5Y (2.88%) and 7Y (2.90%) signaling that inflation fears remain.

In the commodities market, crude continues to be bid above $110.00/bl as demand is expected to remain robust going into Summer. Dollar weakness continued to float the metal complex higher with gold settled above $1853.30/oz and iron ore near $134/tn as New York closed.

In the FX space, sentiments turned mildly bullish for short and medium term accounts as demand for Swiss retreated while Euro advanced further. Long term investors, however, remain bearish as Yen continues to lead in demand alongside King Dollar.

On Tuesday markets will continue to watch the latest development in Russia-Ukraine war while waiting for earnings reports from Agilent Tech (A), AutoZone (AZO), Intuit (INTU), Best Buy (BBY), Ralph Lauren (RL), Nordstrom (JWN) and Abercrombie & Fitch (ANF) as well as the latest figures on US new home sales and manufacturing index. Fed chair Powell is scheduled to speak at 12:20 PM ET.

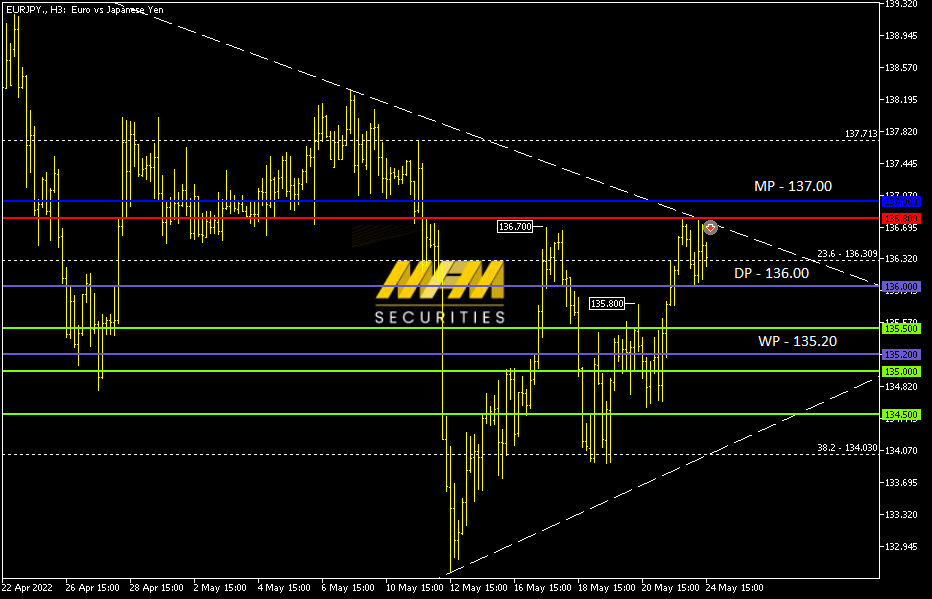

OUR PICK – EUR/JPY

Long term remains bearish. Recent talk of ECB potentially raising rates soon boosted the Euro but the long term outlook remains bearish. Technically the pair is at weekly downtrend and remains so as long as it closes below ¥136.80 on the weekly. A close above ¥137.20 is needed to reverse the trend. We favor shorts in the meantime.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.