STATE OF THE MARKETS

Another vaccine news from Moderna continue to buoy optimism . Major indexes returned to rally after being indecisive last Friday, when Moderna hit the wires with 94% effectiveness of its vaccine trial. Spooked with optimism, bond yields rallied, with US10Y hit 0.93% before closing lower around 0.91%. The optimism was shared across the board as major commodities surged higher on the news.

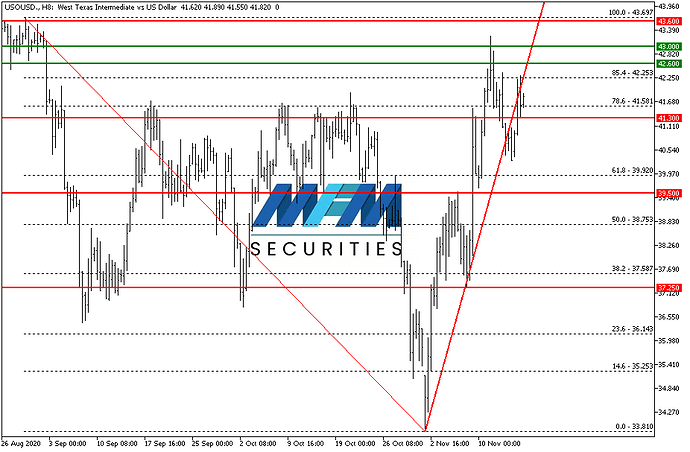

Crude closed higher than Friday, around $41.60, but remain below last week high. Contrarian were seen to increase their exposure on market reversal as the optimism is more likely to be short-lived. This was expressed in the strong offers absorption in gold that closed higher than $1,880/oz.

This view is also shared in the medium term FX space as Yen returned to bid while Dollar and Swiss were offered. Long and short term accounts, however, are pretty much aligned in letting the safe-havens running on the back foot. Sterling remained supported as Brexit is expected to be resolved soon.

OUR PICK – Crude Oil

Order flows point to medium term weakness. Our previous [crude oil shorts] boded well and we believe though current risk sentiments support further upside, the rally is most likely short lived as order flows point to medium term weakness. Crude oil demand depends on economic activities and continued lockdown plus restricted movements are not going to help bolster demand. The vaccine is good news but it will be a while before it would become publicly available. Our estimate is next summer and that is more than 6 months away.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.