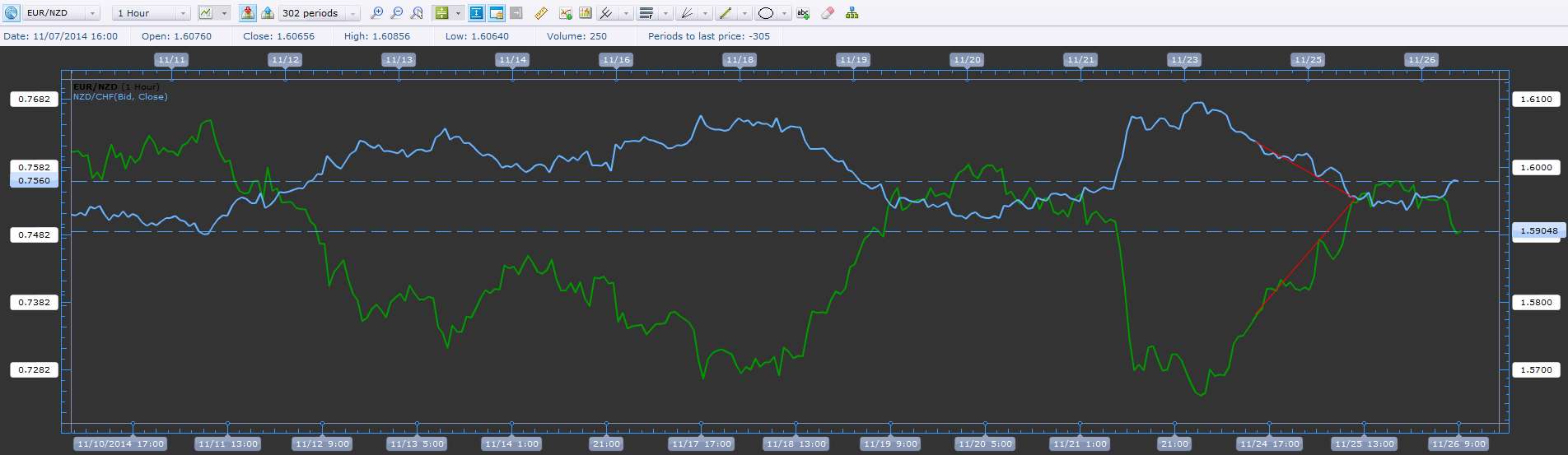

Before I start this post, let me please set the standard on what I’m hoping to accomplish. Theory aside, I’m trying to figure out a mathematical algorithm that accomplishes the same base function as the system Kelton originated here:

Let me share with you what I’ve found trading this system.

First, I designed an EA that accurately takes trades when the currency pairs are 20, 40, 60, 80 and 100 pips apart. The max I risk (as a function of my entire account balance) is 2.5%. Meaning when the drawdown for all my trades is at 2.5% of my account, I shut everything down.

I tart trailing prices with stoplosses when the currencies show a separation of less than 3 pips. I also start trailing the orders by 5 pips as soon as there is a 1% gain. I do not Scale Fix the currencies.

This past week was the first week the EA went into production on two demo accounts. One lost nearly half its balance due to a unique problem that I’ll describe below. The other is still trading at a modest profit after I did a work around for the problem.

Kelton’s original model (though brilliant) had one significant issue:

Repainting of the currency pairs every 15 - 30 minutes causes older deviations to dramatically change on the M1 charts. In other words if two currency pairs were 40 pips apart at time T1, at Time T1+60, the values at T1 are repainted as having crossed over and showing a 2 pip separation. This is what caused a massive loss in one of the demo accounts above

This means that trades that were started at let’s 01/26 00:00 that showed a 20 pip separation where you were selling one pair and buying another pair and then 4 hours later show that same data point was repainted and now shows that the pair you’re buying, was supposed to be sold and vice versa.

This creates a HUGE issue but one I think that can be overcome with the correct algorithm for what’s really going on. Right now I have a crafty work around but I’m not so confident that I’m about to put real money in.