Why did you go short at what looked very clearly to me to be support? I went long exactly where you went short. I thought it was support, you knew it was, what, resistance? That can’t be. How did you know to go short at that congestion area that looked so much like support to me?

Boing787,

Heres my reasons for those trades…

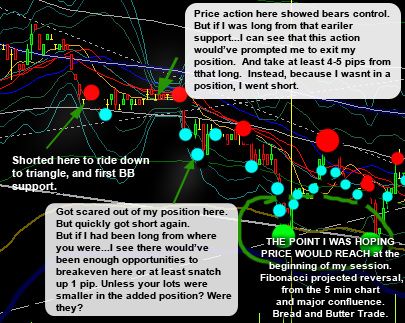

Hopefully the picture says it all, so you dont have to read the long ass post below.  I figured a picture would be more helpful.

I figured a picture would be more helpful.

The first short was showing a nice space between where price was and the true first support was. So I capitalized and took a quick 2 pips.

Then the price congestion started happening, which tipped me off a little bit. It became pretty clear…that the bears had the bulls beat, by watching the price action. And tick chart.

The price tried to push up and hold a couple times, only to be slammed down. And the longer it went on, the more sure I was that it was gonna drop instead. I went short, but with a smaller trade. Because I wan`t 100% sure…It was a familiar pattern though, that I see all the time. Horizontal congestion, ends with a continuation move about 75% of the time…and if it was strong support it wouldve bounced immediately like the previous two times.

Now still, even if you did play it as support, right when it hit it…you wouldve been able to grab at least 5 pips into the congestion.

But if you went long exactly where I shorted, than yeah, you woulda had to average it down.

If I had went long there…I see that I wouldve been able to break even or claim some pips right at the next 300Bollinger support (green)

I woulda added my next average at that line…and cuz price was jumpy around there, there were 3 opportunities to take some profits.

But the next short after that was a no brainer. Bumping up right on what was recently support, and a small trendline confluence above,with no more major support below besides that major trendline confluence point about 20 pips away.

And a classic 3 leg move looking like its busy forming.

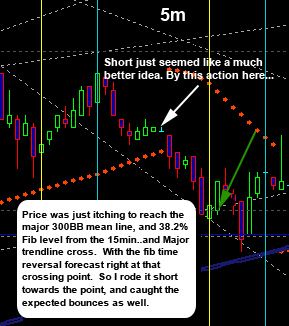

On the 5 minute…it was clear that it was gonna go towards the major point. (38fib, 300BB, and major trendlines)

They were like a magnet for the price, and I rode that sucker down.

But the long was the easiest trade for me, as it was major major confluence, with a fibonacci reversal time projection as well!

From the 5 minute.

I went HUGE on that one. Fully maxed to my allowable BIGposition.

This is one of those ones where if it didt do what I want. I would exit straight away…not average. Too risky.

Hopefully this helps you in some way…