Hey Man keep posting!!

Hey…

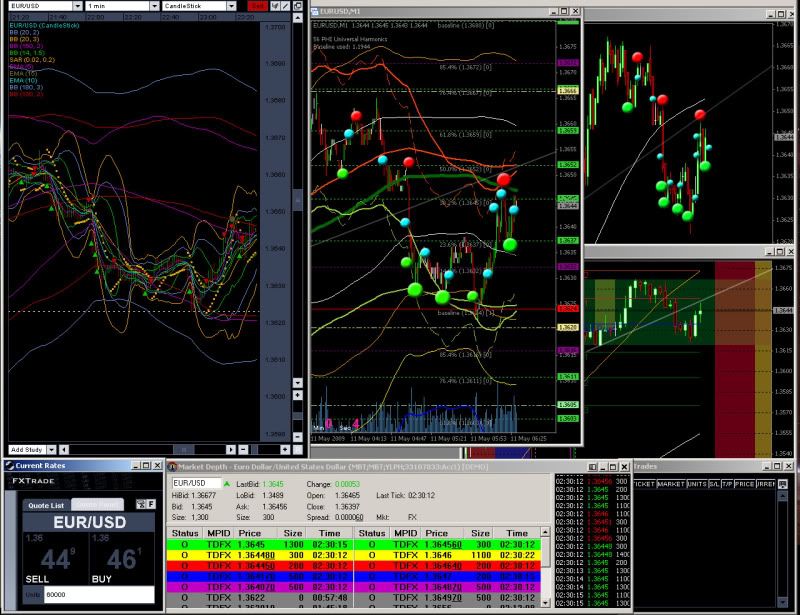

Few trades tonight.

Luckily…the very first trade of the night immediately went my way nicely…in a “big” way. At least for my style of trading anyways. Able to get more than 20 pips out of it, which is far above average for me.

Since Im mostly shooting for 1-3 pips most of the time.

So since that one trade gave me my quota for the day, the rest was bonus

I have been following this thread from the beggining and decided to jump in and give it a shot, I have traded for a few fours on Fridayand I pulled in 6.2% of my account, I was trading bare naked and only watching price action. Maybe it was just pure luck, Friday votility and nothing else but I will keep trying it a few days more and see what happens. Thanks for your great thread pip siphon

Hey Pip Siphon,

I’d be interested to see how you traded last night’s Asian action, the way that it dropped from 1.2930 to 1.2900 before retreating back up to where it started from and then just hung around.

Also, what’s the range of gearing that you use on your trades?

You’ve also mentioned that you’ve rarely missed achieving your daily goal. What is that goal? A certain percentage of equity growth?

OMG! Your style is freakin’ amazing, Pip Siphon!! Have you considered condensing your scalping method into an Expert Advisor (bot) on MT4?

I have a Eurica account with Instaforex… the spread is 0 pips but they take a fixed commission per trade. Man, how I’d love to apply your strategy and grow my account…

Sorry I took so long to reply to the posts in here.

Ive been busy packing and getting ready to move, so Ive been a little busy lately. I will get back to posting semidaily, once Im all settled in at my new place. In about a week, or two.

OMG! Your style is freakin’ amazing, Pip Siphon!! Have you considered condensing your scalping method into an Expert Advisor (bot) on MT4?

Thanks.

No, I dont think I would ever do that. For two reasons.

One…I LOVE trading. Its fun, and a challenge. Its the perfect “job” for me.

And two…

My method is VERY discretionary.

What looks like a buy technically, could turn into a sell in a few seconds of watching price action. Like for example that trade in an earlier post where someone was questioning why I sold instead of bought, at what was clearly support. And I answered by watching the price action, I was able to see that it wasnt gonna hold. Things like that, cant be programmed.

Possibly one day, neural networks and AI will be up to the task, but as we stand now…not quite yet there.

As for Colins question…

What’s the range of gearing that you use on your trades?

You’ve also mentioned that you’ve rarely missed achieving your daily goal. What is that goal? A certain percentage of equity growth?

My daily goal is 1% of equity. Though I sometimes get 3-4% or 0.5%, my average is around 1%, or 1.23% to be exact. (gotta love excel)

Ive only had 7 negative days at losses between 1%-2.5% for this year. And only 16 in my whole 2.5 year “career”.

The leverage for my trades varies from each trade. Depending on my feeling on the trade, or the technicals etc. But I never go full out, maxed out leverage. I have 50:1 at Oanda, and the most Ive used on one paticular trade, or average down, is about 15:1.

So Im not your typical scalper, going balls to the wall, trying to hit it big.

I hit it small consistently, every day.

And in that way, Ive hit it big.  1% daily has added up to quite a nice lump sum.

1% daily has added up to quite a nice lump sum.

I’d be interested to see how you traded last night’s Asian action, the way that it dropped from 1.2930 to 1.2900 before retreating back up to where it started from and then just hung around.

Unfortunately, I didnt come to this thread until yesterday, so I cant go back and see what I did on that day, as my Oanda charts wont let me view 1 minute charts that far back. So I cant see what I did anymore. :rolleyes:

But why??

Did you have particular trouble with that day?

As I think I recall, I ended up averaging down that last leg, but it was okay, cuz price bounced rapidly, and sharply. Which was nice. Then I went long, on the upmove. I think.

But maybe Im not even thinking of the same day as you…

Maybe you can post a chart of that day??..then Ill go over my records…and post an image of where I took my trades for you.

guys, I am pretty doing well using this stregady, I average about 4 - 5 % a day. If you get caught up on the wrong side it can lead to a margin call. I think I have to trade smaller sizes and aim for maybe 1 - 2 % per day.

Oh yeah…Teknomage…how is instaforex?

Do they let you scalp? Or hit you with requotes?

And what is their commision structure for 0 pip spread?

Does it almost equal spread anyways?

Is it based on lot size? Or fixed?

I like Oanda, and its pretty fast execution, and “mostly” low spread.

But soon I’ll be moving to an ECN platform. As soon as I hit the $150,000 mark, Im moving $100,000 to an ECN broker, like currenex or hotspotfx. And leaving $50,000 in Oanda.

Oandas getting a little too laggy for my liking now. So Im just gonna position trade with that account.

Pip-siphon,

first of all, thank you for posting, i really feel that it has helped out my trading. however I’m still having a little trouble setting up my chart. could you please either post your template or give the exact name of the fibobollinger indicator that you use.

also when you set up your trendlines do you only draw them for the TF of that particular chart or do you also draw up Tls from higher TFs?

thanks again.

-madison

Hey Madison,

The “fibobollinger” is nothing but a bunch of regular bollinger bands, at different intervals to create dynamic “fib” levels.

I just call them fibobollinger because on the VTtrader platform there is an indicator called that, which looks similar. (more like Sigma bands though)

Anyway…

I use 4 200 period bollinger bands.

Settings…

200, 1.618

200, 2.618

200, 3

200, 4

Then I use 20,2 and 20,3.

I also use envelopes. (30) (which havent been pictured on my charts, but I use them quite a bit as confirmation for heavier weighted entries at strong confluence)

I start each session with a fifteen minute chart. I draw the major trendlines for that time frame, then I drop down to 5, and draw the rest.

Then I go to the 1 minute, and start trading.

Depending on the action, I may draw more trendlines in this time frame, but if theres alot of movement, I just stick the with 15min and 5min trendlines.

Usually when I start drawing trendlines in the 1M I just end up with a gigantic matrix of lines that becomes confusing after a while…but its really up to you.

It really actually depends on the day, and the action I guess.

Are you having success with this method??

Have you tried it out? Or just using some of the general ideas?

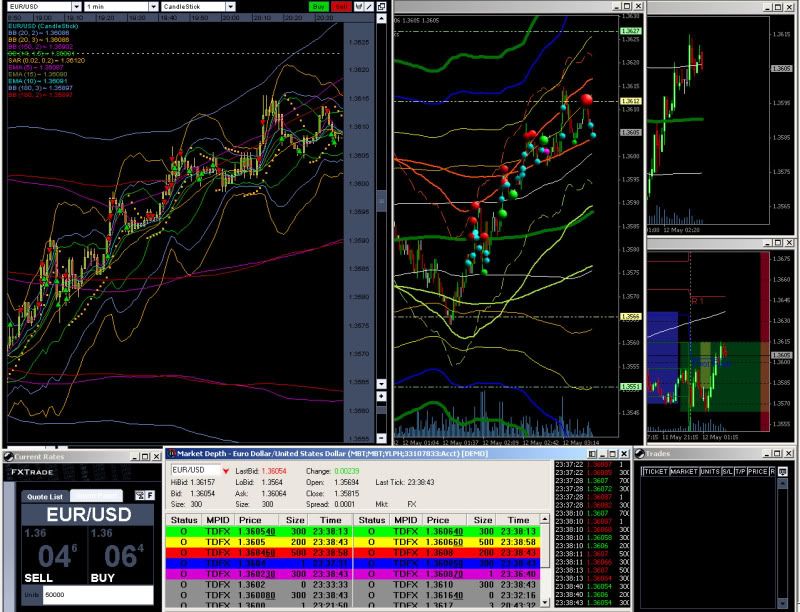

Hey all…

Some awesome trading tonight.

EURO made a nice move up.

Was able to grab lots of pips on the way up, and on the pullbacks.

Most other charts Ive shown, were ranging days, but this was a nice move, and Im sure many would be interested to see how I traded it, since it was a strong trend, and I would most likely be going counter to the trend.

So heres how I traded it.

As you can see, even though its an upmove, Ive got many more sells there, than buys.

Dangerous, for some…but if you play it right. Its like taking candy from a baby.

siphon,

thanks for clarifying which indis you use. i traded a bit this morning and it went really well. i was able to meet my 1% quota in about 30 minutes. my favorite thing about this style of trading is the minimal expose. i was trading with a ridiculously small (for scalping that is) lot size, e.g a 100 pip drop would have only put a 5% dent in my total roll, and yet i was still able to make a decent amount in a very short period of time.

attached is a 10 sec chart showing all the trades i made this morning. in the time i traded the market ranged a total of 33 pips while i was able to extract 45! i had to average in on a couple of the trades but hey what can you do…

thanks again for sharing your tips and strat.

-madison

Nice trading there, madison.

May 10, 2009

9 trades tonight.

2 pip spread for sunday.

Despite that, I made decent gains today.

A favorite pattern of mine happened tonight, where price breaks a trendline, then reaches some support, and moves back up towards it to touch it. Gotta love it, when its steep, and when you get in right at the support and get out right at the line.

A nice twenty pip trade was had on that trade (7th trade on chart)

I could feel this one was gonna move to the trendline like a magnet, so I let it ride there. Usually I take profits pretty quickly, but this one was a no brainer to let ride…and it payed off.

Made a weeks worth of quota today. 5.7%

So its the start of a good week.

Thanks for the thread pipsiphon, a successful scalper - great stuff and I’d like to try it out too. From what I’ve gathered the key is discipline and cutting losses ASAP - but I’m a bit confused with the averaging thing. If your average loss is 4-5pips. Why do you average with a bigger lot size, I tried to work it out from your chart examples and think I’ve picked up something wrong. Say you have 3 open trades, all losing, then as price nears the top/bottom of the range you’re anticipating that the level will hold and take a bigger position to even out the other 3 open trades - but wouldn’t the other open trades be a fair bit more than 4-5 in the negative then?

I got the bit about killing the bigger position in a flash if the level didn’t hold, just can’t get the bit above - Do you mean average loss is 4-5 pips if it comes back to that from being more in the negative or are these your average losses based on your discretion outwith the averaging thing.

Sorry to bug u - and I will reread thread again to see if I can understand more clearly. thanks

Hey happydays,

My average of 5 pips loss is my all time average figured out by my spreadsheet over my sample size of 33,000 or so trades. Or 2 years worth of trading. So its just a general average.

but wouldn’t the other open trades be a fair bit more than 4-5 in the negative then?

Yes, but thats drawdown. Not realized loss.

When I say my average loss is 4-5 pips. I mean, actual, realized loss.

Not floating/potential loss/drawdown.

Still though…my drawdown rarely ever exceeds 5-10% of equity though.

Do you mean average loss is 4-5 pips if it comes back to that from being more in the negative

Exactly. So the drawdown is bigger than the actual taken loss…if taken.

Most of my averages/scales, end up in a net profit though.

So Im able to get out of all or some postions with a profit.

And the “losers” will be relatively small. Between 3-7pips.

But the “winners” outgained the “losers”, hence a net profit.

Also…I rarely average/scale into a move more than 3 times.

The sizing of the average/scale…also depends on the situation.

If the price is DRIFTING lower, and Im in a long, Ill probably only average in with equal position sizes at support. Or even just exit the position with a loss.

But if Im long…and it makes a FAST, sharp move down towards support…I’ll usually average in with a little larger amount than the original entry, so as to make up on the pullback.

When I reach the “breakeven” point…I exit the averaged position. And let the other one ride. If it continues, Im able to exit both with a profit.

If not…I exit the first entry with a small loss. Usually less than the profit I made on the scaled trade. So a net profit is usually made overall.

Hopefully that clears stuff up for you.

Sorry if I repeated myself there…lol

PS

Heres my stats if youre interested.

The “PIP” stats, are accurate…

But since my position sizing fluctuates quite a bit, the “$” stats are a little more “meaningless”.

I find keeping these stats is the one thing that keeps me striving to become better.

I constantly run monte carlo simulations just to be sure that going bust is a far away possibility/probability.

Anyway…

[B]33,546[/B] Total Trades [B]79.5%[/B] Winners [B]20.5%[/B] Losers

In Pips

26669 Winners - Avg Gain - [B]2.6[/B] Pips Largest Gain - 32 Pips

6876 Losers - Avg Loss - [B]-4.8[/B] Pips Largest Loss - -24 Pips

In $

26669 Winners - Avg Gain - $9.2 Largest Gain - $191 Pips

6876 Losers - Avg Loss - $-16.8 Largest Loss - $-148 Pips

Net Pips - 35089Pips

(positive expectancy of about 1.045 Pips per trade, after spread)

Just think…without spread…these amounts would be substantially higher. Since spread eats away up to around 50% of us scalpers profit. :eek:

Since spreads eat up so much profit, its critical that one selects the best broker possible. Enjoying the thread so far, especially any information about scaled positions, keep up the good work.

Yeah, thats why I intend to go ECN as soon as possible.

Dunno if it will really make that much of a difference though, with commisions and such…and Oanda already being quite low.

But we’ll see…

Anyway…

Heres tonights trades…

A little messy, but easily made the quota…

10 trades in total.

2 scaled trades…and one trade where I took a loss…but only on 1/3 of the position (purple dot), the rest I rode to profit.

Then I did a heavy short at the top. Nice payoff.

That one was one of those ones I mentioned…where I would exit straight away if I was wrong. No scaling. Since I decided to enter at my “max” position size. (which is only still 1/4 of my leverage available)

Weeks Results

Sunday - 5.7%

Monday - 1.8%

thanks for the detailed reply Pipsiphon I’m much clearer on the averaging thing now - not sure if I’d have the ‘cojones’ to do it right enough, think as you know your system so well you know the nuances thus have instinct as when to cut and bail or when to average - I’m bit of a numpty with instinct when it comes to forex, but I’m going to give it a bash on demo - witness the negative side for myself and see how i get on.

I used to scalp, but just once a day was the rule and I couldn’t get the balance between what was a loss and what was breathing space thus ended up with one bad trade wiping out the weeks hard earned gains - so started trying out different things, with little success. And am now all over the shop-

i like the idea of get in/get out/switch of platform rather than being in front of computer all day.

are there nights when you switch on to trade and then don’t becuase you don’t like the price action? Or do usually test it anyway?

Thanks again

are there nights when you switch on to trade and then don’t becuase you don’t like the price action? Or do usually test it anyway?

I usually trade anyways. I pretty much trade everyday.

Except Holidays.

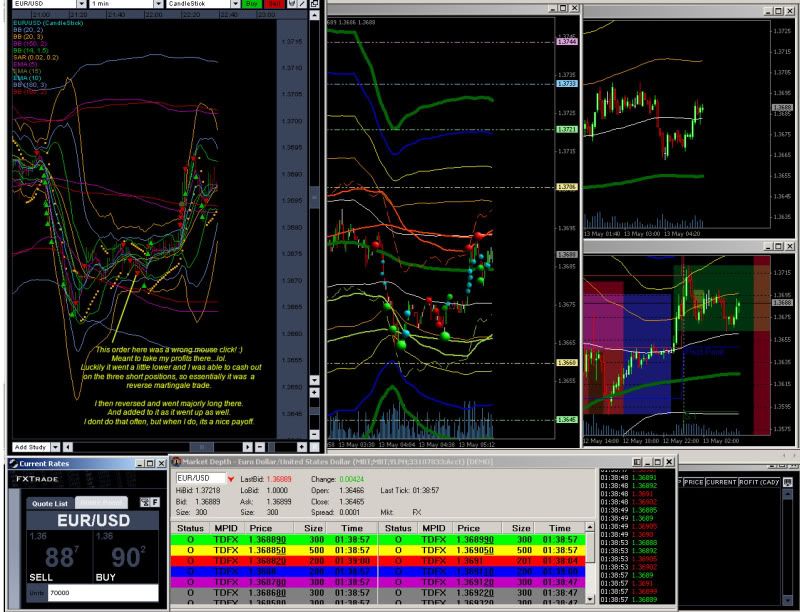

Heres tonights trades…

I accidently clicked the wrong button tonight, for the first time in over 7 months!!! lol

It was pretty nerve racking…because the trade was supposed to close out my orders…so I ended up doubling my position.

Right where I meant to exit. :eek:

Anyway…the price went further a little bit allowing me to exit with a profit, and then reversed to a long. Whew… :o

I wonder if every single trader in the world has done this…at least once.

This week…

Sunday - 5.7%

Monday - 1.8%

Tuesday - 2.4%