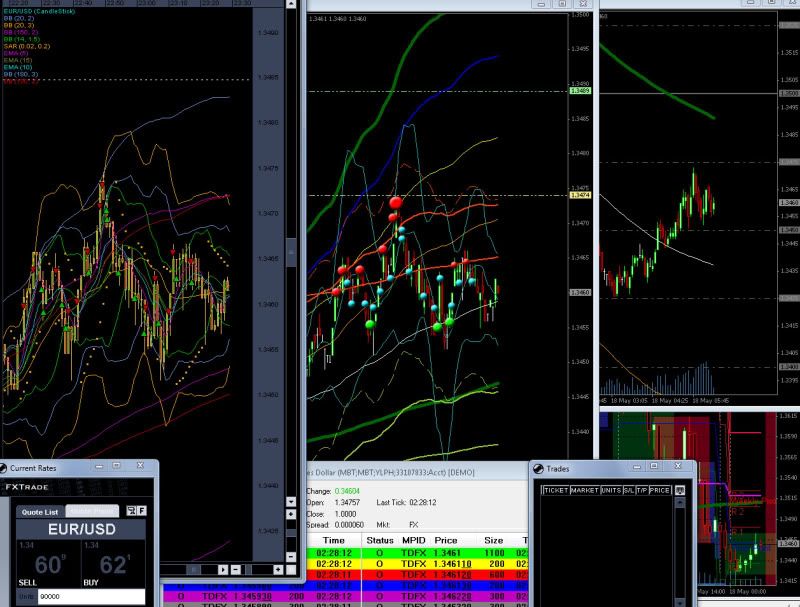

Thanks Pipsiphon - I tried it out last evening, did real well at first but struggled with the averaging, I felt I would ahve been better of taking the loss when it was just a little negative, but instead it went to -17, I was short, then entered again with bigger position size but clutzed trying to get out of it, my plan was for every pip the 2nd position went positive i took an extra 100units off the losing trade, it got to eeks peeksy where i wasn’t losing anything or gaining, but i miscalculated the position size and ended up in a buy when i was supposed to be out at break even - so in first minute i was up 10 pips, then got a few more but due to my mistake i only ended up overall about 3pips, maybe more, i started out with a really low positon size, and after about 6 positive trades i had grossed under a $ - so upped it, naturally just in time to take a loss of -5 and balls up the averaging.

I took 13 trades, with only one loss, plus my human error so all in all worked out well - the range was about 30 pips.

I found it difficult to concentrate with the speed of it all, open position, get next ticket ready, open close box…Plus not being familair with the one minute chart every pip felt like 10 speed wise, there would mega red/greeen candle (to my eyes at least) and i’d close out only to find I had about 3 pips! Think the gauge was too big…

I enjoyed it though, found my concentration waned after about an hour and that’s when i began to make errors. I used the S&R and fibs from higher time frame to guesstimate entry and exit rather than your indicators for now as hadn’t a clue how to read them as yet.

Couldn’t believe how much movement there was from minute to minute, and how when it stalled it became a sign that it could retrace and be ready…

thanks a lot, every little helps and all, and glad your trades worked even with your mishap.