Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Sugar ($SB_F ). As our members know, Sugar is having bearish sequences in the cycle from the 20.52 peak. Current view is calling for further weakness as far as 19.6 pivot holds. Recently the commodity has given us nice 3 waves bounce - B red which found sellers as we expected. In the further text we are going to explain the Elliott Wave Forecast

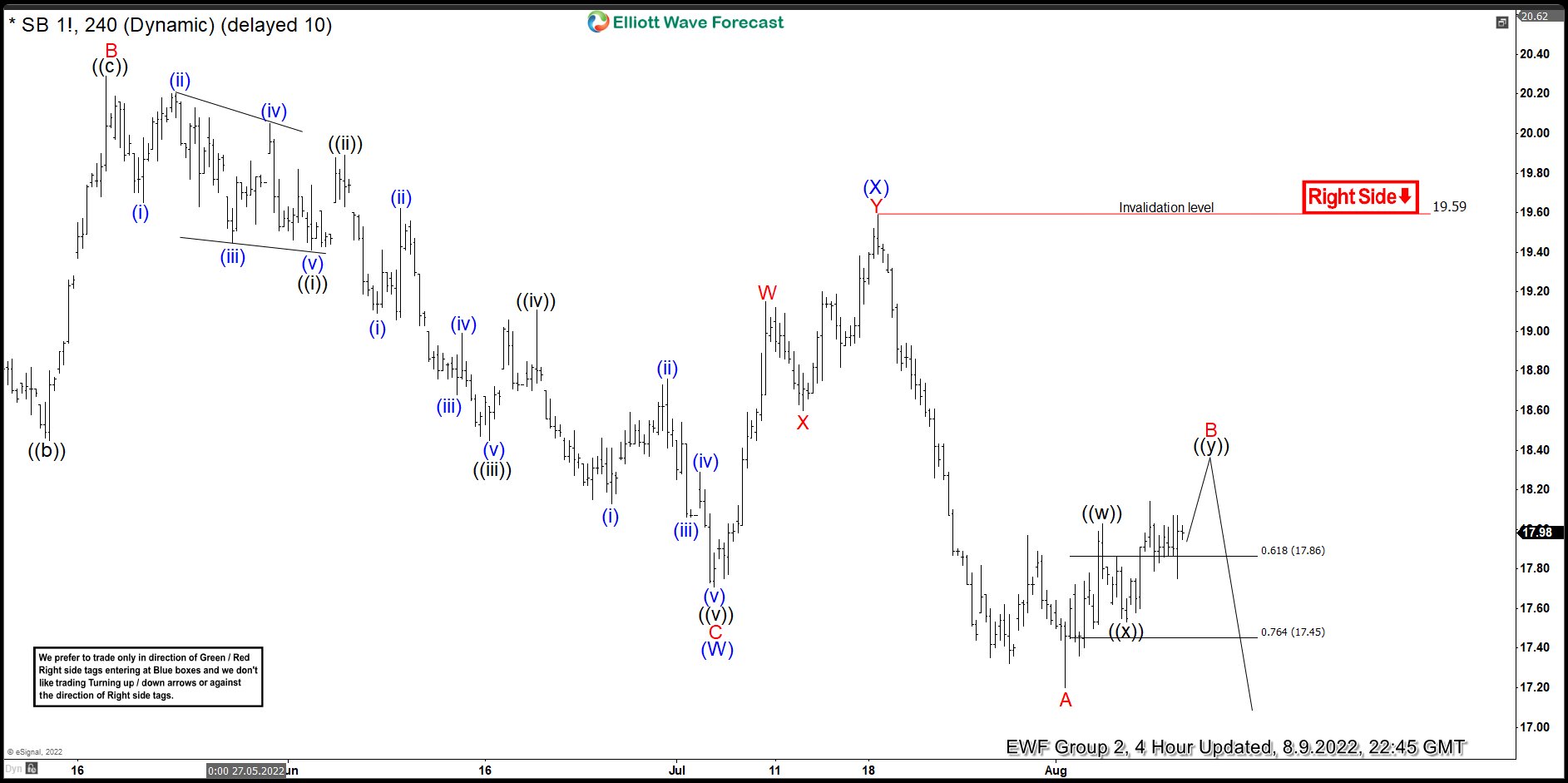

Sugar $SB_F H4 Elliott Wave Analysis 08.09.2022

Sugar is correcting the short term cycle from the 19.59 peak. Recovery is unfolding as potential Double Three Pattern and looking incomplete at the moment. The price is showing higher high from the lows, suggesting B red bounce can see more upside toward 18.35-18.86 are. Target for B red we got by measuring equal legs from the low ((w)) related to ((x)). As the commodity is currently in bearish cycle, we expect sellers to appear at the mentioned zone for further decline toward new lows or for a 3 waves pull back at least . Another marginal push up still can be seen toward mentioned area before decline takes place.

Reminder: You can learn about Elliott Wave Rules and Patterns at our Free Elliott Wave Educational Web Page.

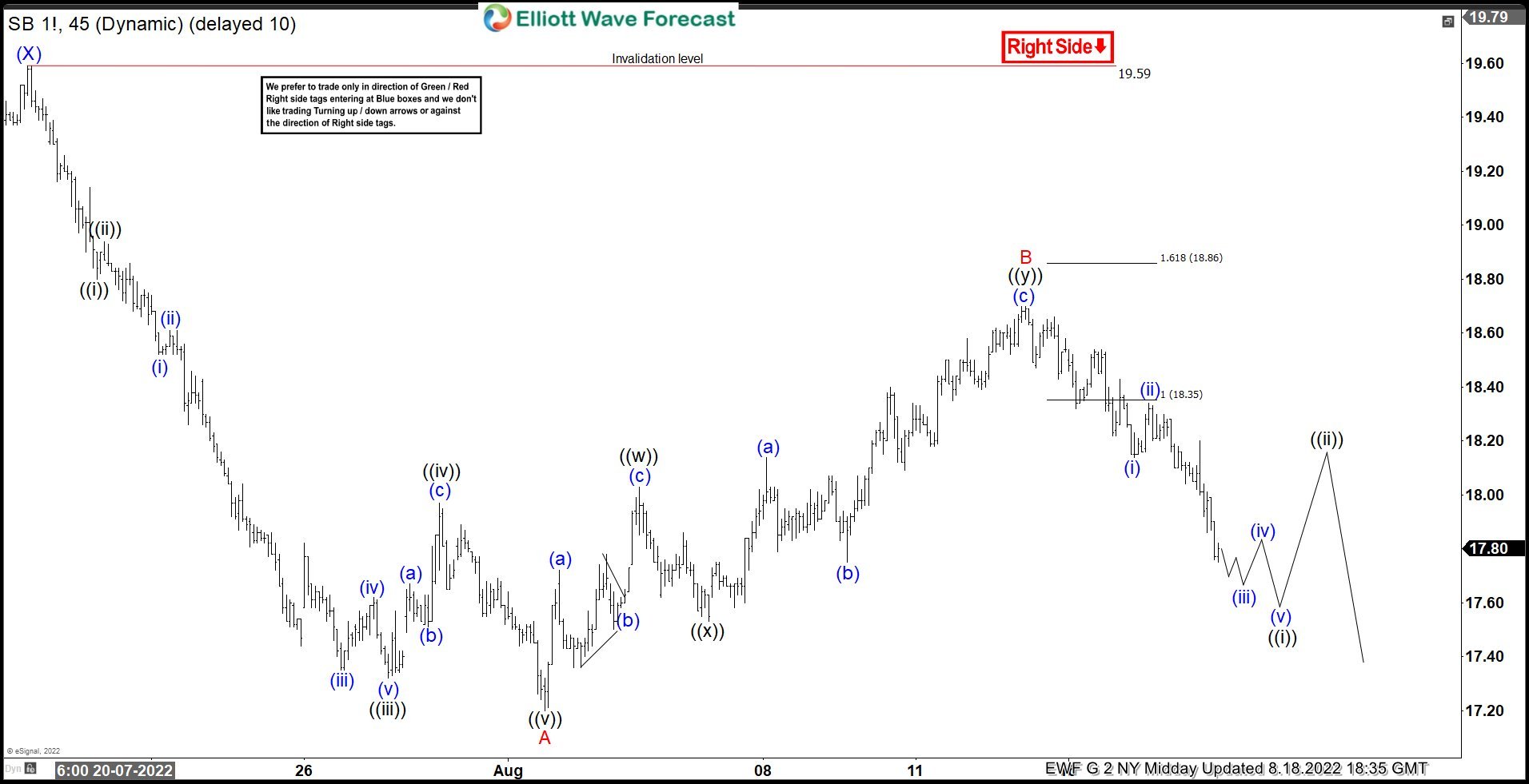

Sugar $SB_F H1 Elliott Wave Analysis 08.18.2022

The commodity made rally toward target area and found sellers as expected. Sugar made nice reaction from the equal legs zone. At this stage we count wave B red recovery completed at 18.7 high as Double Three pattern. As far as the price stays below 18.7 high we expect further decline in the price of commodity. Once we get break of A red low -08/01 ,we will get confirmation that next leg down is in progress.

Keep in mind market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences.We put them in Sequence Report and best among them are shown in the Live Trading Room.