Sugar Technical Analysis Summary

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

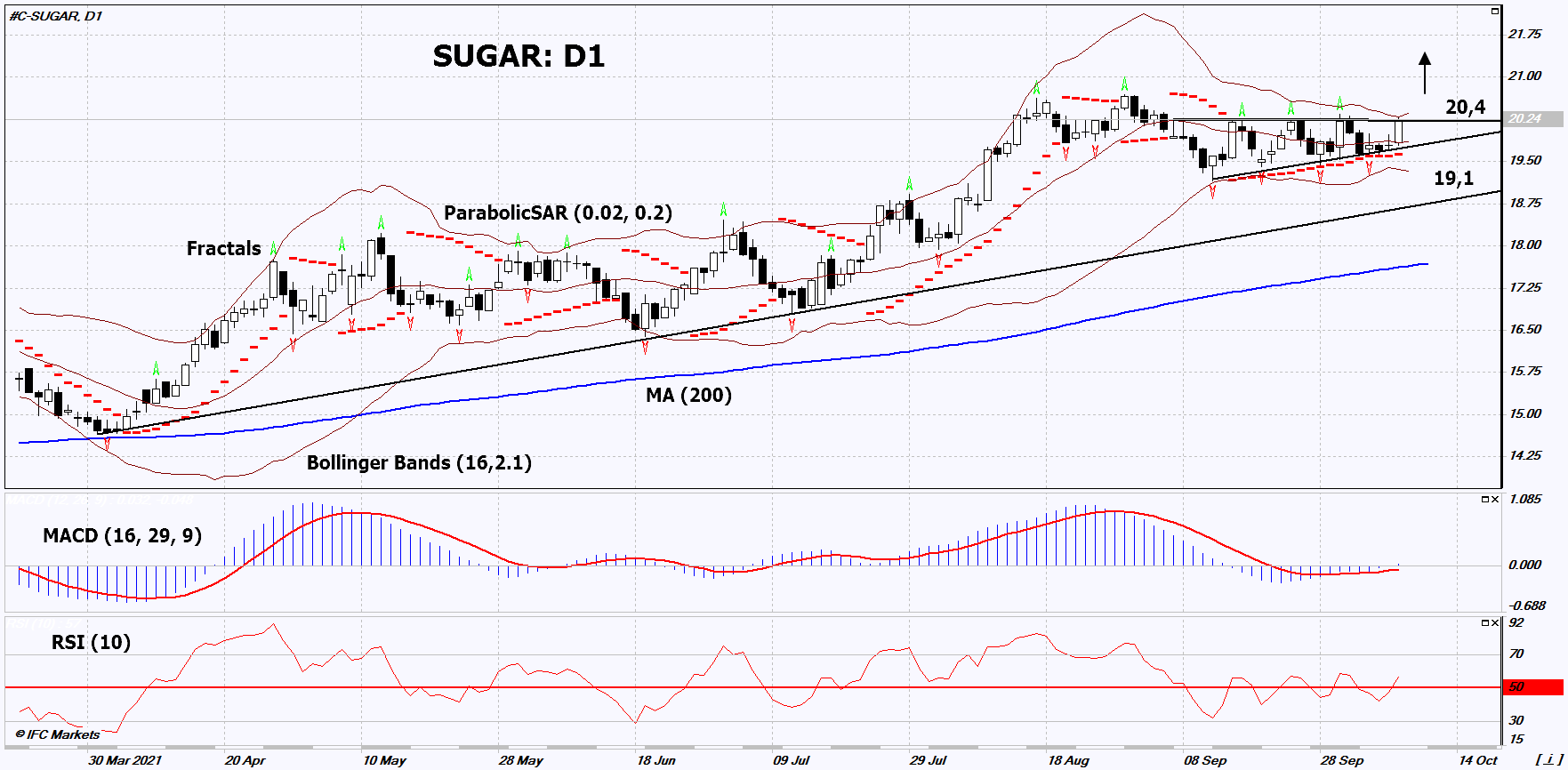

Buy Stop: Above 20.4

Stop Loss: Below 19.1

Sugar Chart Analysis

Sugar Technical Analysis

On the daily timeframe, SUGAR: D1 is in a triangle. He must go up from it before opening a position. A number of technical analysis indicators have formed signals for further growth. We do not exclude a bullish movement if SUGAR rises above the last upper fractal and upper Bollinger band: 20.4. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal, 4 lower fractals and the lower Bollinger line: 19.1. After opening a pending order, move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit / loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (19.1) without activating the order (20.4), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Commodities - Sugar

High world oil prices are driving the demand for biofuels. Will the SUGAR quotes continue to rise?

Brent oil quotes are now near a 3-year high, while WTI is near a 7-year high. For 12 months, they have risen in price by about 2 times. This could increase the demand for sugarcane used in the production of ethanol, a fuel for cars. According to agricultural agency Unica, in the first half of September, the share of sugar cane used for ethanol production in Brazil increased to 55.1% from 53.8% in the same period last year. Against this background, in the 2021/2022 season, sugar production in the southern and central parts of the country is expected to decrease by 20.5% to 2.55 million tons. In addition to increased demand for ethanol, deteriorating weather conditions in Brazil may contribute to this. The International Sugar Organization raised its forecast for the global sugar deficit in the 2021/2022 season to -3.83 million tons from its July estimate of a deficit of -2.65 million tons.