Can someone better explain swap charges to me? For example, if my overnight swap charge is 12 points does that mean 12 percent is charged? Is that charged every night or is it a 1 time charge say if I hold a position for a week or more?

As you might know, it’s also called a rollover rate. The rollover rate in forex is the net interest return on a currency position held overnight by a trader. That is, when trading currencies, an investor borrows one currency to buy another. The interest paid, or earned, for holding the position overnight is called the rollover rate. A rollover interest fee is calculated based on the difference between the two interest rates of the traded currencies. If the rollover rate is positive, it’s a gain for the investor. If the rollover rate is negative, it’s a cost for the investor. You can find formulas in the internet actually, there is lots of description.

This is a bit in-depth I would recommend search on YouTube for a good video there is both positive and negative rollover

The swap in points should be the amount credit/lot traded, over the course of 1 night. This is charge applied to your account over every night held.

For e.g. I’ve got two currencies trading right now that have both a credit and debit:

- NZDJPY = +0.04

- EURUSD = -0.26

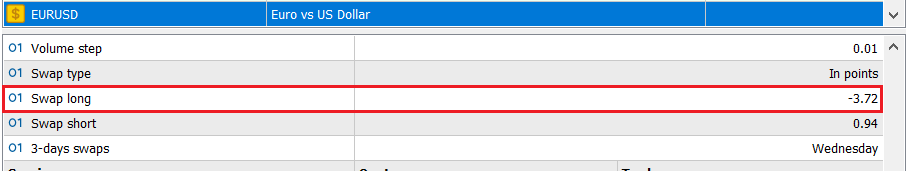

To validate this I can the check the currency contract specifications in my client (MT5) and get the following info against long swaps:

Since the points are against 1 Standard Lot when I apply a multiplier of 0.07 according to my position size the swap numbers should be near identical.

To check this out I basically tried deriving the numbers by adjusting my swap numbers to 1 lot size as folls:

![]()

The math for 1 lot is a close approximation to the contract spec.

There are different swaps for long and short positions, and swap for long position is more then short position and charged on daily basis whenever trader rollover the position.