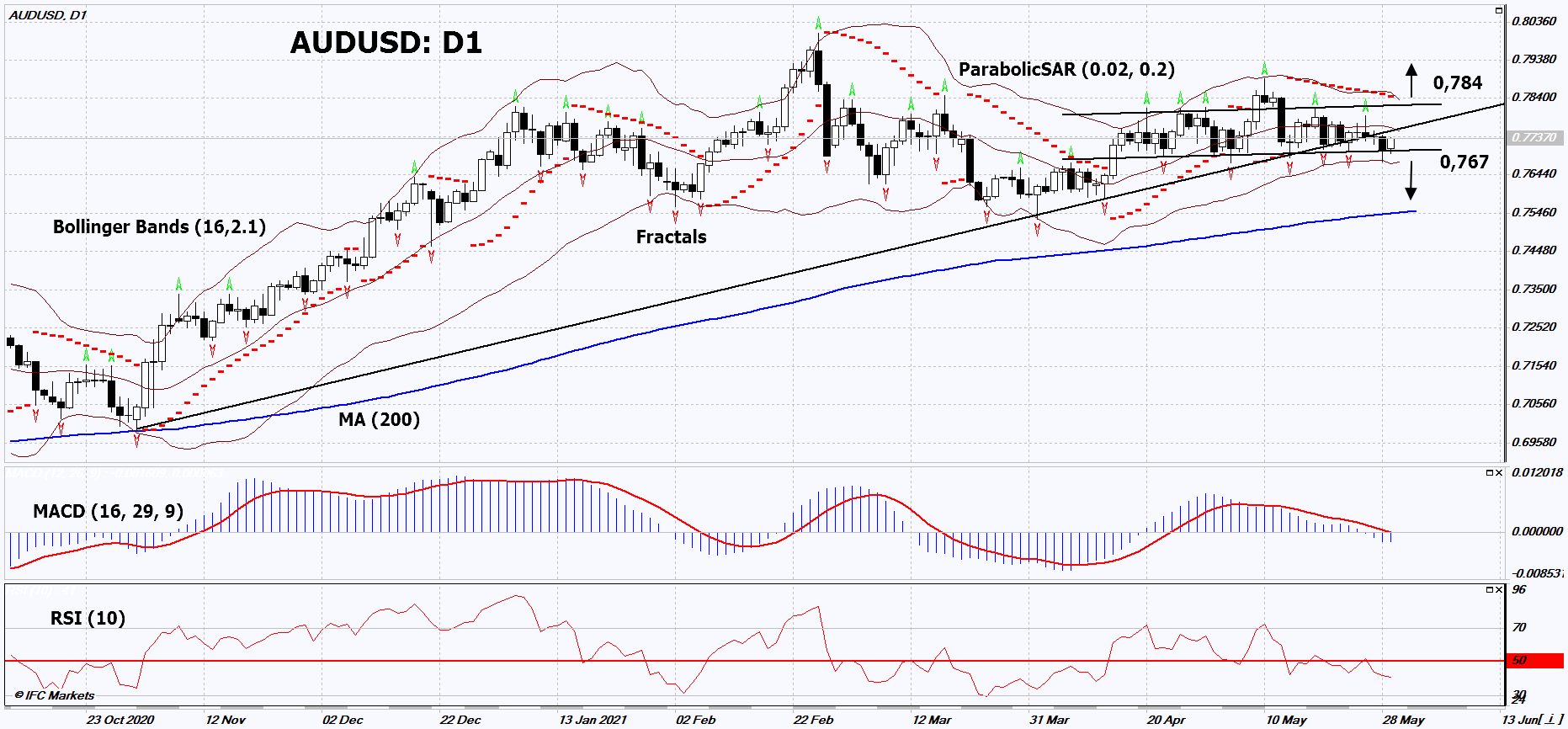

Recommendation for AUD/USD:Sell

Sell Stop : Below 0,767

Stop Loss : Above 0,784

RSI : Neutral

MACD : Sell

MA(200) : Neutral

Fractals : Neutral

Parabolic SAR : Sell

Bollinger Bands : Neutral

Chart Analysis

On the daily timeframe, AUDUSD:D1 came out of the uptrend, but so far it is trading in a neutral range. Most of the technical analysis indicators have formed signals for further decline. In our opinion, the impulse movement AUDUSD can be formed after the growth and overcoming of the last 2 upper fractals, the upper Bollinger line and the Parabolic signal: 0.784 or, in case of falling below the lower fractal and lower Bollinger line: 0.767. Let the market choose its own scenario of movement. Two or more positions can be placed symmetrically: after opening one of the orders, the second order can be deleted - the market has chosen the direction. After opening a pending order, we move the stop following the Parabolic signal every 4 hours to the next fractal maximum (short position) or minimum (long position). After the transaction, the most cautious traders can switch to a four-hour chart and set a stop-loss on it, moving it in the direction of the trend. Thus, we change the potential profit / loss ratio in our favor. If the price overcomes the stop loss without activating the order, it is recommended to delete the position: there are internal changes in the market that were not taken into account.

Fundamental Analysis

On June 1, 2021, a regular meeting of the Reserve Bank of Australia will take place. Will the AUDUSD quotes rise or fall? The Australian dollar has been trading in a narrow range for almost 2 months. Exit from the range could be the start of a noticeable price movement. No change in the Reserve Bank of Australia (RBA) rate is expected. Investors may react to the RBA’s comments on the volume of repurchases of Australian government bonds. The current program began in early November 2020, concurrently with the rate cut to the current minimum level of 0.1%. Its volume amounted to 100 billion Australian dollars for a period of 6 months. In February 2021, volume was increased by an additional $100 billion. The RBA then said the rate would not increase until 2024. If at its regular meeting on June 1, 2021, the RBA confirms the soft parameters of its current monetary policy, then the Australian dollar may weaken and the AUDUSD quotes will go down. Statements about a possible rate hike or a decrease in the volume of government bonds redemption, on the contrary, may cause an increase in AUDUSD. Recall that earlier the Bank of Canada tightened its monetary policy, and the Bank of England and the Reserve Bank of New Zealand announced plans to tighten it. This strengthened the exchange rates of all three respective currencies. Note that on June 2, there will be data on Australian GDP for the Q1 of this year, which may also affect the dynamics of the Australian dollar. The GDP forecast looks negative.