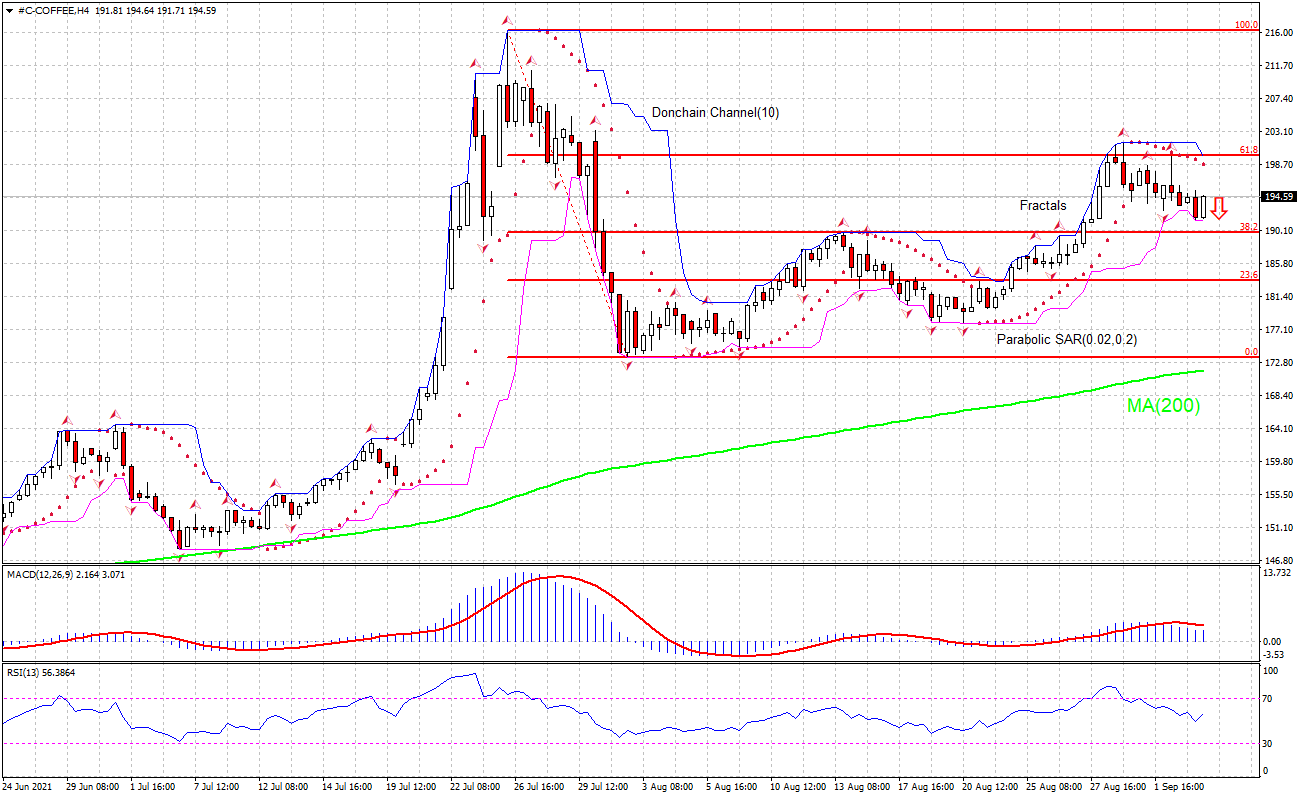

Recommendation for COFFEE:Sell

Sell Stop: Below 189.8

Stop Loss: Above 198.8

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Sell |

Chart Analysis

The #C-COFFEE technical analysis of the price chart in 4-hour timeframe shows #C-COFFEE,H4 is retracing down toward the 200-period moving average MA(200) and is close to testing the Fibonacci 38.2 support level. We believe the bearish momentum will continue as the price breaches below the Fibonacci 38.2 support level at 189.8. A pending order to sell can be placed below that level. The stop loss can be placed above the last fractal high at 198.8. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (198.8) without reaching the order (189.8), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis

Global coffee exports rose in the ten-month period ending in September 2021. Will the COFFEE price reverse its retreating?

The global coffee exports for the month of July were 1.34% higher than the same month in the previous year, at a total of 10.61 million bags, according to the International Coffee Organization (ICO) reports. Aa a result the cumulative global coffee exports for the first ten months of the October 2020 to September 2021 coffee year have been 2.15% higher than the same period in the previous year, at a total of 108.92 million bags. Brazil drove the cumulative increase in exports over the ten-month period, contributing 34.18% of the total exports to consumer markets. Higher exports indicate higher global demand for coffee which is bullish for price. However, the current technical setup is bearish for #C-COFFEE.