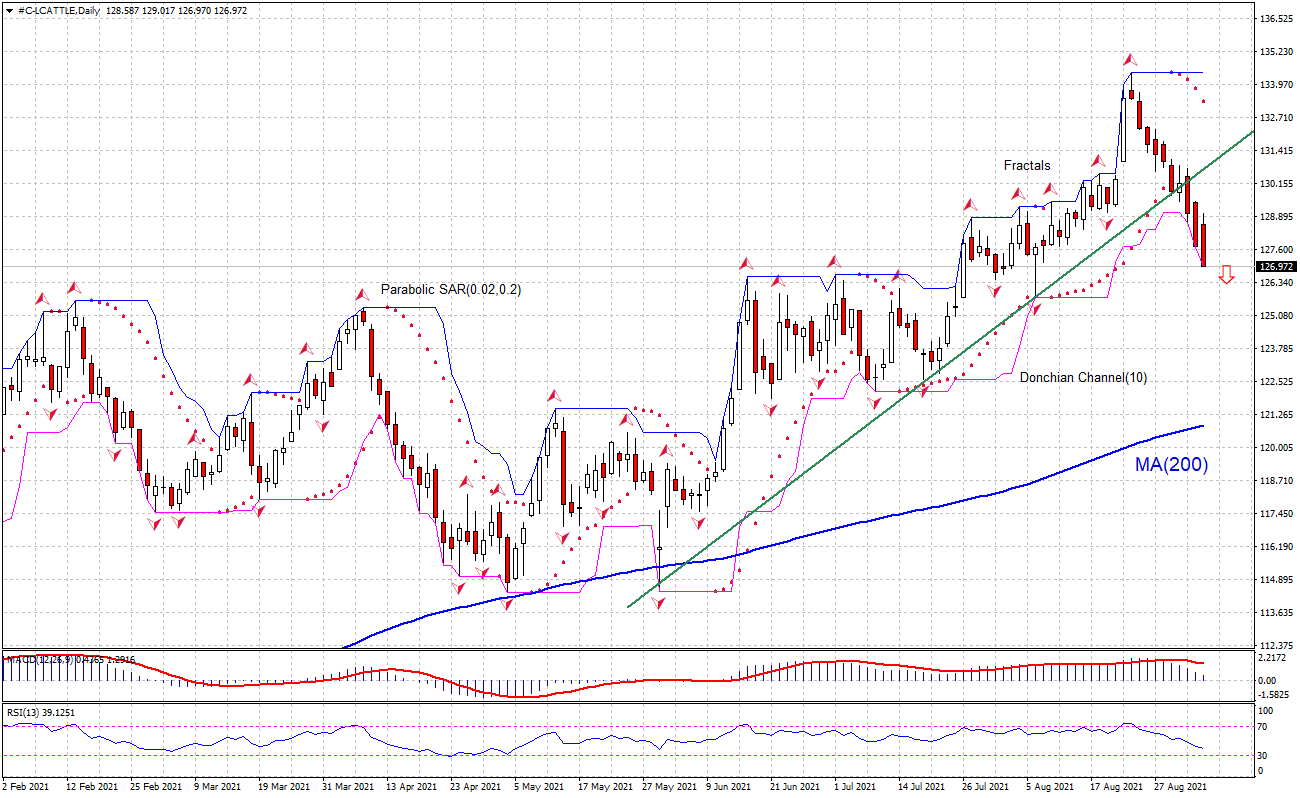

Recommendation for Live Cattle: Sell

Sell Stop: Below 126.97

Stop Loss: Above 131.27

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Neutral |

| Parabolic SAR | Sell |

Chart Analysis

The #C-LCATTLE technical analysis of the price chart in daily timeframe shows #C-LCATTLE,Daily has breached below the support line above the 200-day moving average MA(200), which is rising still. We believe the bearish momentum will continue as the price breaches below 126.97. A pending order to sell can be placed below that level. The stop loss can be placed above 131.27. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis

US cattle slaughter volume fell last week. Will the LCATTLE continue falling?

Last week ending Saturday September 4 the US cattle slaughter volume fell to 624,000 heads from 651,000 the previous week. Lower slaughter volumes mean lower supply, which is bullish for live cattle price. However current technical setup is bearish for LCATTLE. At the same time, a number of news sources reported over the weekend that Brazil had suspended its beef exports to China following confirmaton of two cases of atypical BSE (bovine spongiform encephalopathy) in the country. The news is important to the US market as it involves the biggest beef supplier in the world and the world’s biggest buyer. In case the suspension lasts more than a couple of weeks China will need a replacement for missing shipments form Brazil. China has become more active in the US market and it is expected to remain active in the coming years. through the first seven months of the year, US shipments to China were 282.8 million pounds compared to 119.1 million for all of last year. Higher Chinese purchases of US beef are an upside risk for LCATTLE.