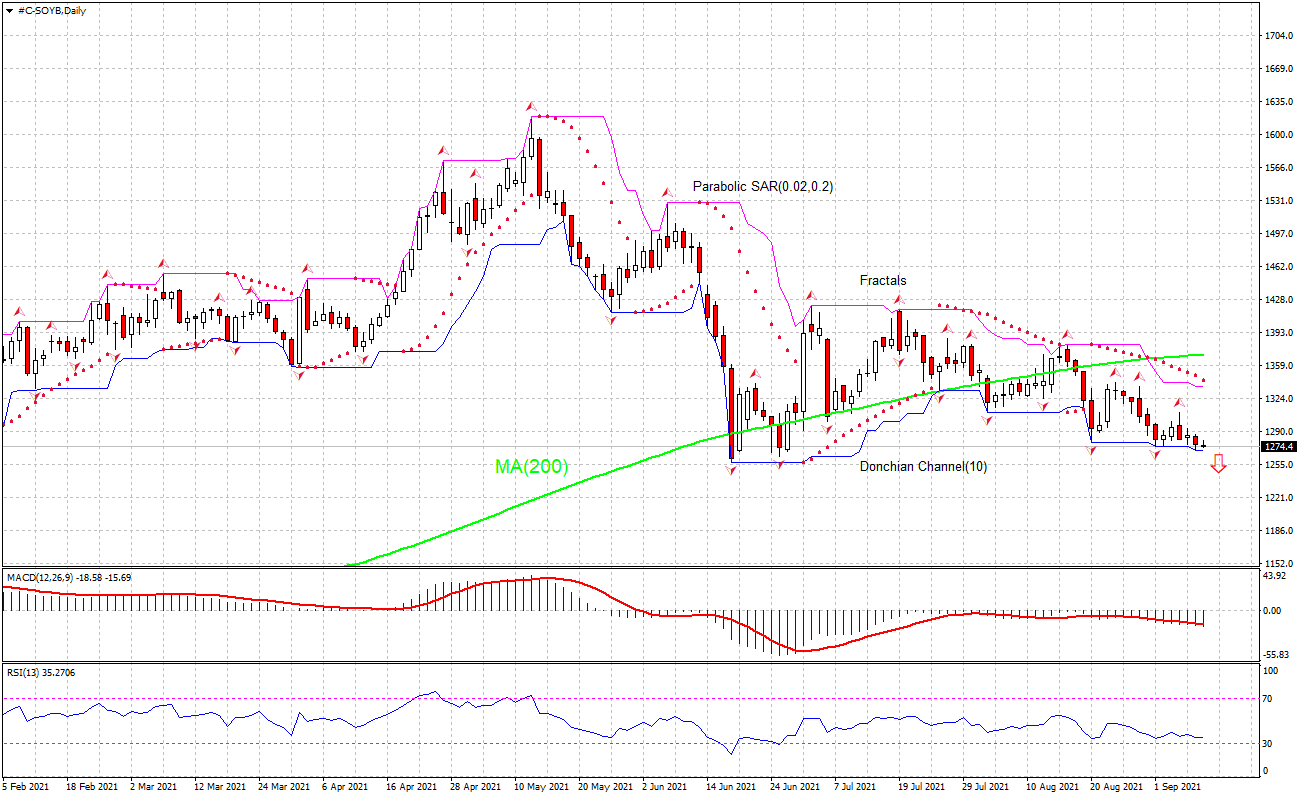

Recommendation for Soybean: Sell

Sell Stop: Below 1269.8

Stop Loss: Above 1337.2

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Neutral |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

Chart Analysis

The #C-SOYB technical analysis of the price chart on daily timeframe shows #C-SOYB,D1 is falling under the 200-day moving average MA(200), which is rising still. We believe the bearish momentum will continue as the price breaches below the lower Donchian boundary at 1269.8. A pending order to sell can be placed below that level. The stop loss can be placed above 1337.2. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis

US soybean export inspections suffered a moderate week-over-week decline. Will the SOYBEAN price continue rising?

US Department of Agriculture reported on September 2 that soybean net sales of 68,200 metric tons for 2020/2021 were down 9 percent from the previous week. However, the next day USDA said private exporters reported export sales of 130,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year. The marketing year for soybeans began September 1. The news of fresh export business to China is an upside risk for #C-SOYB. At the same time analysts note that warmer weather forecast is favorable for US crop, and the last Crop Progress Report for the week ending September 5 showed an uptick of one percentage point for domestic soybean crop in good to excellent condition: thus 57% of the soybean crop in 18 States that planted 96% of the 2020 soybean acreage nationally is rated good to excellent, up from 56% the previous week. Expectations of higher proportion of higher quality soybean crop translate into expectations of higher supply of the commodity, which is bearish for #C-SOYB.