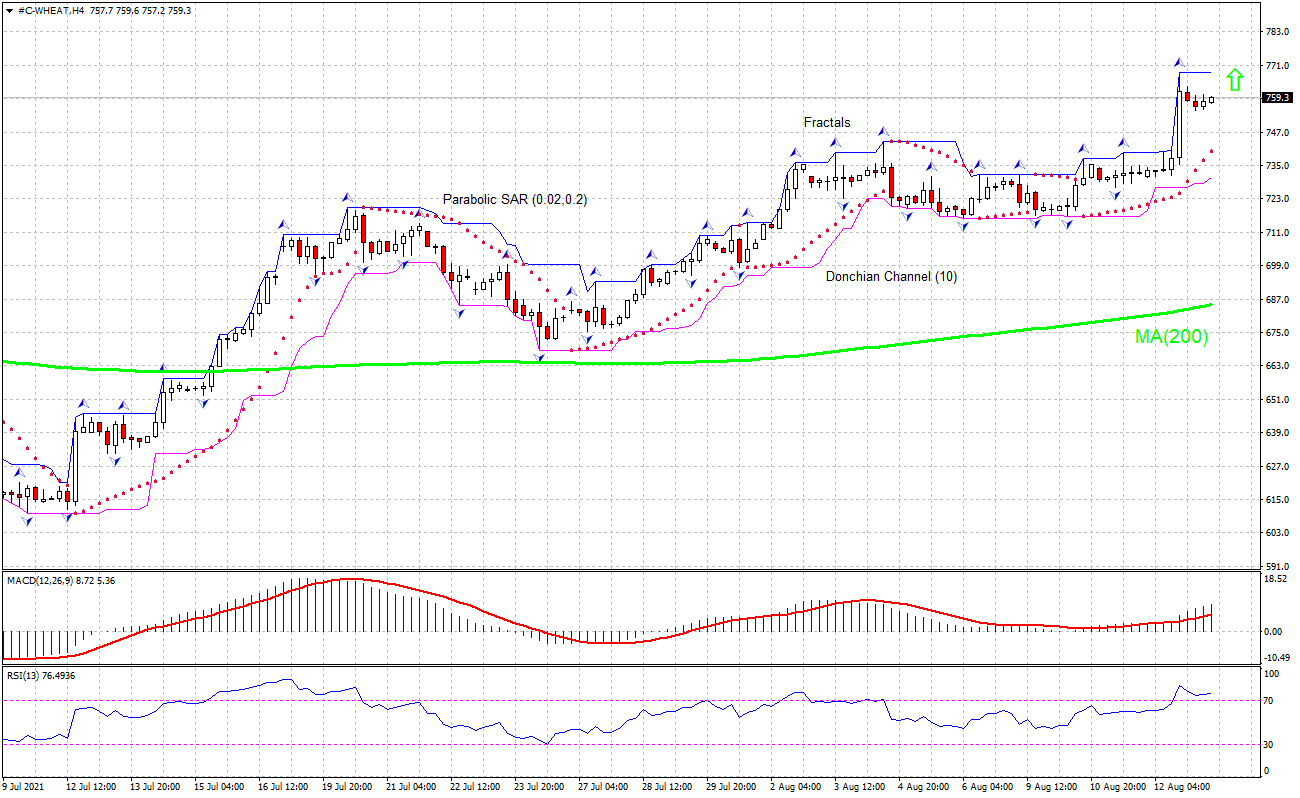

The #C-Wheat technical analysis of the price chart on 4-hour timeframe shows #C-Wheat,H4 is retracing higher above the 200-period moving average MA(200) which is rising still. We believe the bullish momentum will continue as the price breaches above the upper Donchian boundary at 768.3. A pending order to buy can be placed above that level. The stop loss can be placed below 730.5. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis

Higher shipping costs in Argentina due to lower water level of transport river make Argentina’s wheat exports more expensive. Will the wheat price continue rebounding?

A once-in-a-century drought has lowered the water level of Argentina’s main grain transport river. The Paraná River basin has received only 50% to 75% of the normal rainfall in the last 12 months. This has lowered the water level in the center of the Argentine ports of Rosario in Santa Fe Province, where about 80% of the country’s agricultural export load occurs. Ships sailing off Rosario are loading 18% to 25% less cargo than normal due to the shallow waters. Southern Brazil, the source of the Paraná River, has been in the grip of drought for three years. As a result, Argentina’s logistics costs have risen and agricultural exports fallen in a trend that meteorologists have said is likely to continue next year. Argentina is the seventh top exporter of wheat in the world. Lower supply of less expensive wheat is bullish for #C-Wheat.